Posted January 23, 2024

By Sean Ring

Run, Russell, Run!

As I was reading about Nikki Haley's alleged extramarital affairs, I thought, “Ewwww! Let's write about the stock market today instead!”

Luckily, a trade in one of the indexes may interest you, especially if you prefer to keep your money in index funds.

Let me explain.

The Russell 2000 index's charts look pretty unremarkable at the moment. But I'll show you a strong argument for why it may be about to break out.

But before I do, let's define the Russell 2000 and why you'd want to invest in an index like this.

What is the Russell 2000?

The Russell 2000 index tracks 2,000 small-cap companies in the United States. It's part of the broader Russell 3000 Index, which covers around 98% of the U.S. equity market, making the Russell 2000 a significant chunk.

Investors consider the Russell 2000 for a few key reasons:

- Diversity in Small Caps: It offers exposure to small companies across various sectors. These companies are often more agile and potentially faster-growing than larger, more established firms.

- Domestic Focus: Many small-cap companies are more domestically focused than larger multinational corporations. This means they can offer investors different market exposure, which is especially useful when global markets are volatile or facing unique challenges.

- Growth Potential: Small-cap stocks have the potential for high growth. They are often in their early growth stages and can offer higher returns (though with higher risk).

- Portfolio Diversification: Including small-cap stocks like those in the Russell 2000 can help diversify an investment portfolio, which can reduce risk.

- Economic Indicator: The Russell 2000 is often seen as a bellwether for the domestic economy. Since it's made up of smaller domestic companies, it can be a good indicator of the overall U.S. economy's performance.

But remember, investing in small caps can be riskier than investing in larger, more stable companies. They can be more volatile and sensitive to market changes.

So, it's always good to consider how this fits into your overall investment strategy and risk tolerance. Only you know that for sure.

The Russell's Charts

We'll use IWM, the tradeable Russell 2000 ETF, for the charts. You can easily buy IWM through whichever broker-dealer you use to trade your portfolio.

The daily chart is unremarkable, except that the price trend is bullish, the 50-day moving average is above the 200-day moving average, and both moving averages point upward.

As we zoom out to the weekly chart, the picture gets muddier, not clearer.

For the last two years, we've been in a sideways range between $160 and $200.

Currently, we're in the top end of that range at $196.54.

Again, from this point of view, nothing is screaming to me, “BUY NOW!”

The Trade

That's why it's good to follow analysts who love to pick apart numbers.

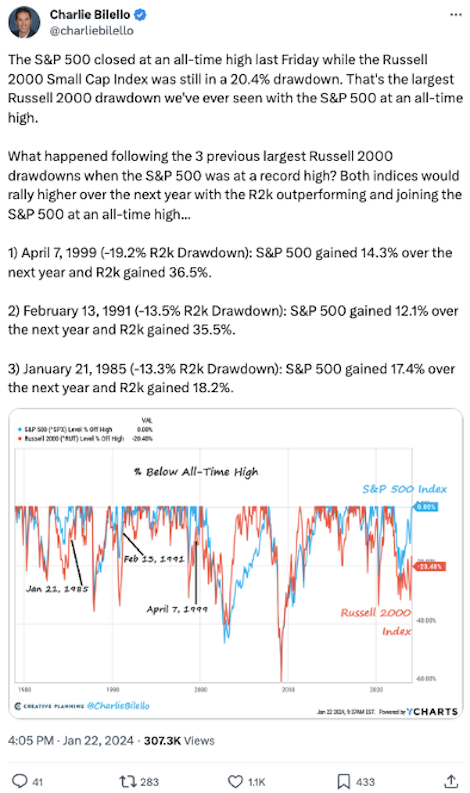

Charlie Bilello, a noted chart analyst with over 580,000 X followers, posted on X that the Russell is around 20% away from its all-time high while the S&P 500 just made a new all-time high.

The last three times that happened, the Russell rallied hard on each occasion.

Here's the post. (Note: R2k = Russell 2000).

If I were a betting man, I'd suggest that this situation will resolve like the one in 1999, when the Russell rallied 36.5%.

I cross-referenced this with the IWM's point & figure chart. Its current price target is $277, a 40.9% gain from the current level of $196.54.

To be sure, there's no guarantee the IWM will hit $277. But even if it falls short, you'd have made a hefty gain.

Besides the charts, there's another reason I love this trade.

Trump is Good For the Russell 2000

Donald Trump loves Small Business. And Small Business loves Donald Trump.

One of the most significant incentives for voting for Trump is his treatment of small businesses. Running a small business is hard enough. Running a small business when your government is actively trying to castrate you is another matter entirely.

So, I expect every small business owner (except vegan smoothie shop owners, perhaps) to vote for The Donald.

And there's historical precedence for this, as well.

When Trump became the front-runner in 2016, the Russell surged. It dipped momentarily when he was elected but then soared nearly 50%.

Then, Jerome Powell started to hike rates, only to reverse course a few months later.

The Covid crash crushed the index before a full recovery upon leaving office.

The Russell is up roughly 25% under Biden. A Trump election strengthens the chances of the trend continuing.

Wrap Up

Small caps are a great way to diversify your portfolio while leaving you with significant upside.

IWM is a diversified small-cap ETF straight off the shelf, ready for you. Its fees are minuscule while giving you the upside. And the small-cap upside can be substantial, especially in this case.

But it's up to you. Do your homework and see if this is right for you. Full disclosure: currently, I don't own IWM, so I have no conflict of interest.

I own a few small-cap companies and won't buy it soon. But if you have no small-cap exposure, this is worth considering.

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring