Posted May 12, 2024

By Sean Ring

RIP, Jim Simons

It’s perfectly understandable if you were wondering what all the fuss was about over James Simons’ death. He didn’t court attention like Buffett and Soros. He just performed. There may be ten interviews you can find of Simons on the internet. Simons just wasn’t interested in promoting himself.

But his is one of those names you need to know if you’re investing in the financial markets. That’s because Jim Simons didn't just invest, he revolutionized the very concept of investing with his groundbreaking quantitative approach.

Simons was a man of many talents and achievements. He was a mathematician, code breaker, professor, hedge fund manager, and philanthropist. His diverse career showcased his exceptional intellect and his ability to excel in multiple fields.

He didn’t do it Wall Street’s way, either. Simons only hired the most intelligent people he could - Renaissance Technologies, his firm employs over 100 PhDs - to unravel the mysteries of the markets. And we’re talking hard math, physics, and engineering PhDs, not economists.

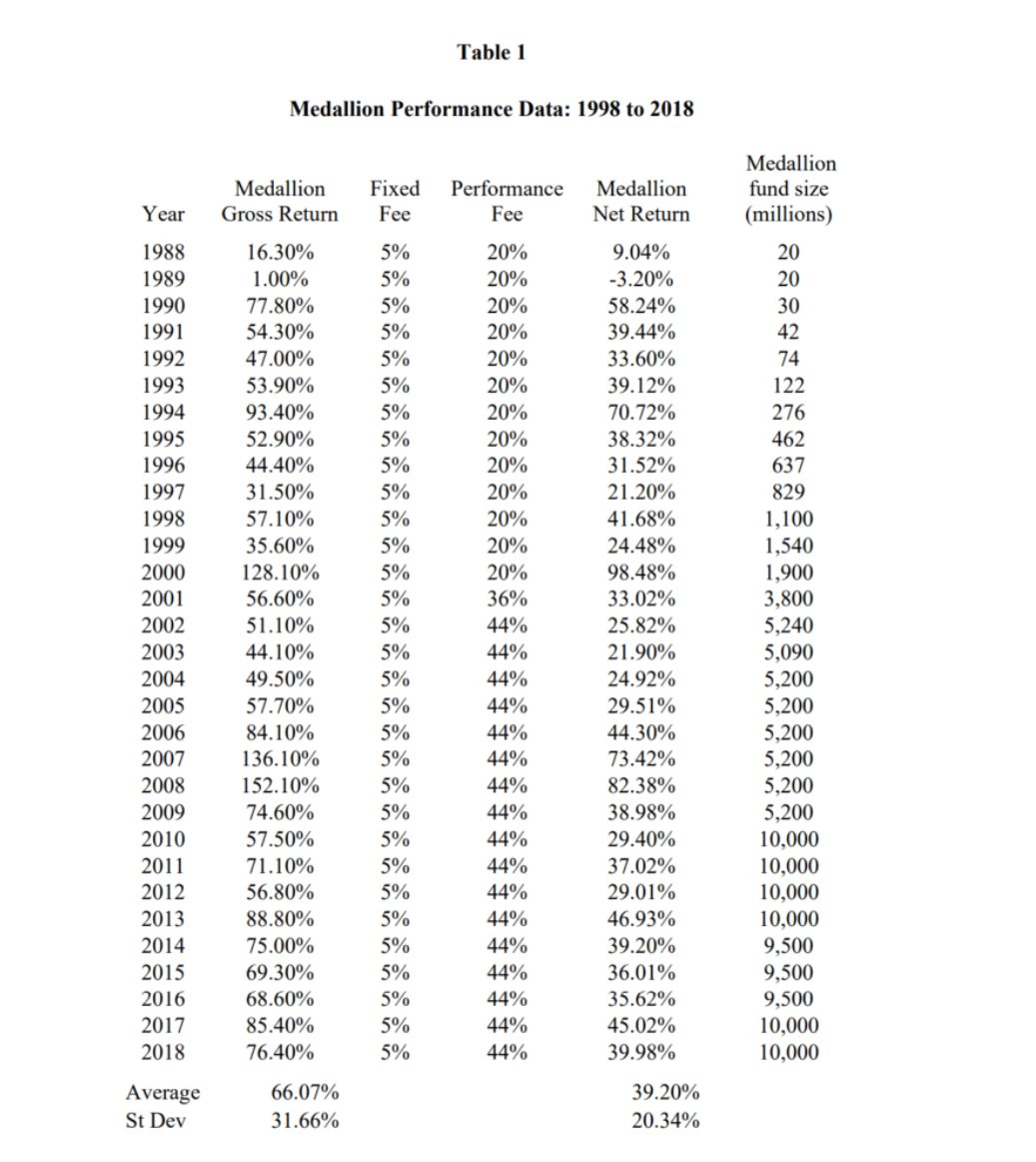

Simons’ Medallion Fund returned on average 39.2% annually for 30 years after fees. And it’s not like he didn’t charge people. Medallion’s fees were 5% for end-of-year assets under management (AUM) and a 44% performance fee. Most hedge funds charge 2% and 20%. It’s a fabulous record.

Credit: @scalptrading

Credit: @scalptrading

What Happened?

James Harris Simons, the visionary mathematician and investor who revolutionized the world of finance with his groundbreaking quantitative approach, passed away on May 10, 2024, at the age of 86. Simons' remarkable journey, marked by his exceptional intellect, innovative spirit, and commitment to philanthropy, left an indelible mark on the financial landscape.

The Start

Born April 25, 1938, in Brookline, Massachusetts, Simons demonstrated an early affinity for mathematics. He was the son of a shoe factory owner and a homemaker and grew up in a middle-class family. He pursued his passion at the Massachusetts Institute of Technology (MIT), where he earned a bachelor's degree in mathematics in 1958. His academic excellence continued at the University of California, Berkeley, where he received his PhD in mathematics in 1961 under the supervision of celebrated mathematician Bertram Kostant.

Codebreaker

During the Vietnam War, Simons worked as a codebreaker for the National Security Agency (NSA), utilizing his mathematical prowess to contribute to the war effort. However, his opposition to the war led him to resign from his position at the Institute for Defense Analyses in 1968. This period showcased Simons' technical expertise and highlighted his strong moral convictions.

Academics

Simons' academic career was marked by his professorship at MIT, Harvard University, and Stony Brook University, where he chaired the mathematics department. His teaching tenure was interspersed with research stints, including his work at the Institute for Defense Analyses. During this time, Simons developed the Chern-Simons form, a significant contribution to the field of mathematics that combined geometry and topology with quantum field theory. He also made significant advancements in number theory, particularly in the area of prime numbers, which have had a profound impact on cryptography and computer science.

Fund Management

In 1978, Simons founded Monemetrics, a hedge fund that laid the groundwork for his future endeavors. He soon realized that pattern recognition, a concept he had studied extensively, could be applied to trading in financial markets. This epiphany led him to develop a system based on quantitative models, which would become the hallmark of his investment strategy. In 1982, Simons founded Renaissance Technologies, a hedge fund that would become one of the most successful in history.

Renaissance Technologies' flagship Medallion Fund, known for its “black box” strategy, was only open to the firm's owners and employees. This secretive approach, which relied entirely on quantitative analysis and algorithmic investment strategies, earned Simons the moniker' Quant King.' The 'black box' strategy refers to the fund's use of complex mathematical models and algorithms to make trading decisions, with the specific details of these models kept confidential. Under his leadership, Renaissance Technologies managed an impressive $55 billion in assets as of 2022, with the Medallion Fund alone worth $10 billion.

Philanthropy

His philanthropic endeavors matched Simon's success in the financial world. In 1994, he co-founded the Simons Foundation with his wife, Marilyn, to support research in mathematics and fundamental sciences. The foundation has been a significant benefactor to Stony Brook University, MIT, and the University of California, Berkeley, funding numerous research projects and academic initiatives.

It has also contributed significantly to autism research and education initiatives, supporting the development of innovative treatments and educational programs. In 2023, the Simons Foundation donated $500 million to Stony Brook University, the second-largest gift to a public university in American history, furthering its mission to advance scientific research and education.

Simons' commitment to education and mathematics was further demonstrated by his founding of Math for America in 2004, an organization encouraging mathematics and science teachers to remain in their roles and advance their teaching abilities. His philanthropic efforts have profoundly impacted the academic community, fostering a culture of innovation and discovery.

Awards

Throughout his life, Simons received numerous accolades for his contributions to mathematics and finance. In 1976, he was awarded the Oswald Veblen Prize, a prestigious honor in the field of mathematics that recognizes outstanding research, for his work on geometric topology.

In 2016, the International Astronomical Union named an asteroid, 6618 Jimsimons, in his honor, a testament to his significant contributions to both mathematics and finance. At the time of his passing, Simons' net worth was estimated to be $31.4 billion, making him the 51st-richest person in the world.

Wrap Up

Jim Simons' legacy extends far beyond his financial success. His quantitative approach revolutionized the investment industry, inspiring a new generation of investors and mathematicians. His philanthropic efforts have supported groundbreaking research and education initiatives, leaving a lasting impact on the world of mathematics and beyond. As the financial community mourns the loss of this visionary, his contributions will continue to inspire and influence the world of finance and mathematics for generations to come.

And now you know what all the fuss is about.

Have a great week ahead!

King: “It Can’t Happen Here”? Hey, It Just Happened Here!

Posted July 25, 2024

By Byron King

Nothing is Biden’s Fault

Posted July 24, 2024

By Sean Ring

The Democrats’ Dilemma

Posted July 23, 2024

By Sean Ring

Harris/Obama 2024?

Posted July 22, 2024

By Sean Ring