Posted March 19, 2025

By Byron King

“Remade in America” -- A Trump Tariff Tale

You’ve probably followed some of the roller coaster tariff talks from the Trump administration. Tariffs are up, delayed, down, and back in place. Routinely, we learn about new tariffs on this country or that country, as well as counter-tariffs against the U.S.

We must admit that it’s not easy to keep a tariff scorecard because everything changes so fast. Will prices increase for metals, machinery, automobiles, lumber, food, clothes, and other innumerable items? Or will tariffs cause prices somehow to moderate? Will the U.S. enjoy an economic boom as companies reshore capacity and build new factories and facilities?

Or will tariffs blow back, blast a hole in the economy, and increase inflation? Where is all of this headed? What do Donald Trump’s tariffs mean to you as an investor?

Let’s dive in and shine some light on the issues here.

The Tariff President

During his presidential campaign last fall, Trump said, “The word ‘tariff’ is one of the most beautiful words in the dictionary.” He spoke admiringly of America’s 25th president, William McKinley (in office 1897 – 1901), who advocated tariffs to protect U.S. industry.

William McKinley campaign poster, 1896. Courtesy Library of Congress.

William McKinley campaign poster, 1896. Courtesy Library of Congress.

Similarly, President Trump has made tariffs a key element of his presidency's economic and international agenda. Early on, he announced that he’d slap 10% tariffs on Chinese goods, but now the number is up around 20%. In return, the Chinese posted new tariffs on inbound U.S. goods and warned major U.S. buyers like Walmart that Chinese suppliers wouldn’t absorb price cuts or discounts to compensate for any new American imposts.

On the transatlantic side, Trump imposed new tariffs on products from the European Union, which in turn added additional tariffs on U.S. goods on top of other anti-U.S. tariffs long in place.

Closer to home, Trump imposed a 25% tariff on Canadian steel and aluminum, which he doubled when Ontario Premier Doug Ford raised the price of electricity that his province exports to the U.S. However, at least some of these actions are currently on hold while diplomats from both sides discuss them. And so it goes, day after day.

In general, tariffs create a distinct bias in economic activity. Indeed, the idea is to tilt the playing field to favor one nation’s industries and businesses at the expense of another country. The problem is that business managers must plan months and years ahead for supply chains and future products, and rapid swings in tariff rates compound the difficulty.

Trump’s tariff policies have disrupted the status quo of global investment and trade. The 47th president is definitely upsetting many an applecart, so to speak. His tariff changes have occurred so quickly that the issue has become personal and emotional, now reflected on a broad sociological scale. Consider how Canadian hockey fans have booed the U.S. national anthem.

“Nobody Is Safe.”

At a higher level than hockey, in a recent speech in Ottawa, Canadian Foreign Minister Mélanie Joly criticized Trump for leveling “unjustifiable” tariffs against Canada and attempting to “annex our country through economic coercion.”

According to Joly, “If the US can do this to us, their closest friend, then nobody is safe,” she warned. “The excuse for the first round (of tariffs) was exaggerated claims about our border. We addressed all the concerns raised by the US. … The latest excuse is national security despite the fact that Canada's steel and aluminum add to America's security.”

According to Joly, the “only constant” in Trump’s tariffs is a wish to annex Canada “through economic coercion.”

In fact, Trump recently said that the U.S.-Canada border is an “artificial line” that appears like it was “drawn with a ruler. … When you take away that, and you look at that beautiful formation of Canada and the United States, there's no place anywhere in the world that looks like that.”

In reply to Trump’s geographical musings, Joly said, “Yesterday, he called our border a fictional line and repeated his disrespectful 51st state rhetoric. … Well, Canadians have made it very clear that we will not back down, and we will not give in to this coercion.”

Clearly, we’re a long way from the good old days of the 1980s, when then-President Reagan got along swimmingly with Canada’s then-Prime Minister Brian Mulroney.

The halcyon 1980s: President Ronald Reagan and Prime Minister Brian Mulroney. Courtesy Journal de Quebec.

The halcyon 1980s: President Ronald Reagan and Prime Minister Brian Mulroney. Courtesy Journal de Quebec.

Long ago, during the late stage of the Cold War, Reagan and Mulroney forged remarkably close political and economic relations. That solid relationship paved the way for what evolved between them through the 1990s, 2000s, and the present day.

In a long-term historical sense, those Cold War and post-Cold War U.S.-Canada connections were in addition to the traditional strong ties between the two nations that developed during the 20th Century, especially during the two World Wars. Going back further, the countries had amicable relations throughout the 19th Century, at least in the aftermath of the unpleasantness of the War of 1812.

And then came Donald Trump. So, what changed?

“Free Trade” With a Can of Spray Paint

I don’t work for the president or his administration, and I’m not privy to Mr. Trump's thoughts. But let me digress and relate a story about something I witnessed fifteen years ago in the Port of Vancouver, British Columbia.

It was mid-July, and the old Agora Financial Group (predecessor to Paradigm Press) was holding its annual investment symposium at the beautiful Vancouver Fairmont Hotel. I was a speaker, along with about 30 others, and we hosted perhaps a thousand guests.

During a break, an attendee walked up and began what turned out to be a very nice conversation. He was a local resident who worked in the shipping business. He asked if I’d be interested in driving to the Port of Vancouver to watch cargo ships unload and see various other port activities. Always looking for a field trip, I said sure thing.

Cargo cranes at Port of Vancouver. Credit: I-stock photo

Cargo cranes at Port of Vancouver. Credit: I-stock photo

Late one afternoon, after our conference proceedings, we headed to the port area. We drove close to the piers, exited the car, and watched giant cranes move containers onto trucks that hauled them away. Frankly, the scale and precision of movement were fascinating. We witnessed a complex logistics system, and our discussion focused on trade, cargo vessels, containers, cranes, the economics of shipping, marine bunker fuel, finding crews, and much else. It was all very informative.

Then, we drove to a different area where ships docked that were not hauling containers. There, a Chinese-flagged ship was tied to a pier. Ashore, a big dockside crane system, unloaded coils of rolled steel directly from the vessel's hold onto a series of parked, flatbed trucks.

The crane operator was skilled and comfortable with his work. He maneuvered the boom and dropped the hook to where people inside the ship attached it to a big steel coil. Then, the crane man hoisted the steel up and swung the boom out into position over a truck. Then, he carefully lowered the steel onto the flatbed with perfect balance and alignment.

This happened repeatedly, and the crane operator placed three large steel coils on each of the numerous flatbeds. Then, something…… very interesting occurred.

Two men appeared, climbed onto the flatbeds, and began spraying paint from cans onto the steel, which had Chinese characters stenciled on it. That is, they covered the Chinese characters with Canadian paint.

I asked my host what was going on. Sheepishly, he looked at me and said, “That’s what we call ‘adding Canadian content.’” In other words, this was a game people played with the trade rules of the former North American Free Trade Agreement (NAFTA), which dated from the mid-1990s.

In this instance, a Chinese ship full of low-cost Chinese steel—dumped at distress-level prices—sailed to Vancouver. A Canadian crane operator was paid to unload it there, and a couple of Canadian workers were paid to spray paint over the Chinese markings. And voila! Thus, this foreign metal magically qualified, via the unloading process and new paint job, as so-called “Canadian content” for duty-free export to the U.S.

I never investigated how proper or improper this was under NAFTA. Despite the evident shadiness, it may have been all nice and legal. Or I may have witnessed a crime, a violation of NAFTA rules. I don’t know, but I always suspected this was not an isolated, one-off incident.

Spray-painted Chinese steel illustrates a troublesome trade issue between the U.S. and Canada, if not much of the world, which ships goods to sell in America. For many decades, foreign interests have chiseled on U.S. import controls and thus undermined the pricing power of U.S. industry. There’s a big whack of your so-called “free trade” right there via cans of spray paint.

Sure, buyers in, say, the states of Washington or Oregon bought low-cost Chinese steel shipped from the port of Vancouver and received a sweet price—a bargain even. Cheap steel, yay!

This means that a U.S. mill or plant failed to make a sale. The U.S. business may have lost money, closed down, or laid off workers. This is how, mill by mill, plant by plant, and factory by factory, the U.S. has deindustrialized over the past 40 years.

This prompts me to restate what I mentioned above: “And then came Donald Trump.”

Reindustrialize America

Again, I don’t work for President Trump, and he doesn’t call me to discuss policy. But I can think of two key drivers for his focus on tariffs.

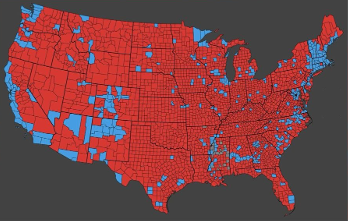

First, look at the 2024 presidential electoral map, especially by county. Trump won the American heartland, big time.

2024 presidential electoral map by county. Courtesy Washington Post.

2024 presidential electoral map by county. Courtesy Washington Post.

Note that what put Trump over the top was a solid set of wins across the industrial Midwest, from Western Pennsylvania through Ohio and Michigan over to Wisconsin. And while Trump lost overall in states like Illinois and Minnesota, based on the urban vote, look at the rest of those jurisdictions. In suburban and rural areas where many current (and former) mills and factories are located, voters cast ballots for the Orange Man.

You can see where the working-class vote came out for Trump. People voted for jobs, jobs, and jobs, and that point was central to Trump’s message. So, when Trump talks about tariffs, he reflects the message of his voter base.

Another angle on Trump’s tariffs dates back to 2020, in the early days of the pandemic. At that time, policymakers quickly realized that the U.S. no longer manufactures most of its medical products and supplies. Then (and even now), America imported massive quantities of items from overseas, especially China.

In other words, many realized that the country’s medical supply chain relied on third-party, foreign players. From antibiotics to pacemakers, blood thinners to bandages, and much more, most U.S. medical products originated from abroad (e.g., China and India) and still do in many instances. Or there’s the issue that the items may be manufactured domestically but with precursor chemicals from abroad. Right away, this is a national security issue.

Meanwhile, we’re now in the third year of the Russia-Ukraine conflict, and one glaring takeaway is that the U.S. lacks a sufficient industrial base to supply and resupply its military. Examples are legion and range from the inability to mass-produce ammunition like artillery shells and missiles to the glacial pace of output for aircraft, ships, submarines, and more.

Arguably, the U.S. is a superpower only in a legacy sense. The war reserve warehouses are filled with equipment and ammunition produced long ago in factories that are no longer there or have limited capacity.

Looking ahead, what if the U.S. had to fight a real war? Well, America is no longer that so-called “Arsenal of Democracy” you read about in history books. We have a strategic-level problem that Washington policymakers do not care to publicize and overly highlight. But the national security issue is real and absolutely concrete.

Military power is the first derivative of industrial power, and it sure looks like Trump wants to rebuild U.S. industry to reenable military strength. Of course, people write long books about these topics, and this is but a newsletter article. Still, in a nutshell, here’s a framework or lens through which to understand what we see with Trump, trade, and tariffs.

What Does It All Mean to You?

What should you do as an investor? The short answer is to invest in American companies that will benefit from reshoring. And own hard assets like energy and resources, plus, of course, precious metals.

Shares in steelmaker Cleveland Cliffs (CLF), an American play, are currently down but offer upside if Trump’s metal tariffs remain in place for the longer term. Or look at a copper player like Freeport McMoRan (FCX), which has domestic and overseas production of red metal, along with a precious metals stream, extracting gold and silver from copper mining.

On the energy side, ExxonMobil (XOM) remains a solid play based on its domestic energy production and impressive future growth from its overseas operations, especially its giant discoveries offshore Guyana in South America.

With precious metals in the strict sense, we’ll keep Barrick Gold (GOLD) and Newmont Mining (NEM) on the table as strong plays that will only improve in a rising gold market. And Kinross Gold (KGC) (NB: as Sean mentioned in yesterday’s Rude, he already owns this stock) also offers an excellent upside opportunity as gold prices rise.

Please note that although I monitor them, these names are not official recommendations from the Rude Awakening.

In the weeks and months ahead, we’ll have to wait and see what evolves with President Trump’s tariffs. It’s all history in the making as Trump channels his inner McKinley. And with that, I’ll sign off. Thank you for subscribing and reading.

A National Security Sh*tshow

Posted March 25, 2025

By Sean Ring

DOGE Alert: The Top 10 Dumbest Things YOU Paid For

Posted March 24, 2025

By Sean Ring

Silver Manipulation 101

Posted March 21, 2025

By Sean Ring

Seanie’s Gold: 10 Miners I Personally Own

Posted March 18, 2025

By Sean Ring

Keeping The Green in Ireland

Posted March 17, 2025

By Sean Ring