Posted October 20, 2025

By Sean Ring

Red Screens, but a Clear Mind

Adam Sharp’s Daily Reckoning is a must-read for me every day, as I’m sure it is for you. His latest piece, titled “Keep Calm and Hold Gold and Silver Miners,” was just the salve I needed after my miner positions were down a depression-inducing 6.98% (VZLA) to a sphincter-tightening 11.23% (SBSW) on Friday.

I’ll get back to Adam in a minute.

As my positions finished down blood red to a man on Friday, I was reminded of Mark Antony’s speech in HBO’s Rome after losing the Battle of Actium to Octavian:

I was far away... All my life...I've been fearful of defeat. But now that it has come... It's not near as terrible as I'd expected. The sun still shines. Water still tastes good. Glory is... All well and good, but... Life is enough, nay?

Warren Buffett echoed those sentiments after the Crash of 1987:

When the stock market crashed in 1987, I went outside and looked around. Everything was the same—there were no clouds, no lightning bolts, just the same old world. That’s when I realized the markets may panic, but the businesses are still there.

For his part, Adam wisely wrote (bolds mine):

Miners are falling along with the underlying precious metals. Gold is down about 2%, while silver is down 4.2%. Miners should act as a leveraged play on the metals they mine, so this move makes sense.

And believe it or not, this correction is a good thing for long-term holders. Parabolic spikes like the one we’ve been experiencing are thrilling, but not sustainable for long periods.

A 15% or even 20% pullback in miners wouldn’t be the worst thing in the world. It’s hard to say how long the correction will go on. If you’re only in precious metals for a quick trade, it might be time to exit stage left.

But if you’re looking to buy, now’s the time to prepare.

Now that’s the spirit! Looking to buy, not to bail. That’s the proper attitude.

But if you’re not convinced and are feeling a bit down, let me share a little about myself that may make you feel better.

Personality Perks and Quirks

When I was living in Hong Kong as an expectant father, I read a book titled The Mental Edge in Trading, written by Jason Williams, a Johns Hopkins PhD in Psychology, and his father, Larry Williams, the famous futures trader.

The book left a lasting impression on me, as I couldn’t trade to save my soul at the time. Believe it or not, many former bank traders and brokers have a difficult time without a trillion-dollar balance sheet backing them up.

I wrote Jason to ask if he’d give me the Big 5 Personality test so I can pinpoint what was wrong with me. The Big Five personality traits are openness, conscientiousness, extraversion, agreeableness, and neuroticism. He politely wrote back, saying that because he was inundated with requests, he stopped offering the tests.

Luckily for me, a new psychologist was red hot on the internet and created a multiple-choice exam I could take online to determine my Big 5 Personality score. His name was Jordan Peterson. The test, Understand Myself, helped me immensely.

I won’t go through all my results, but two of the five trait scores were immediately applicable to my issues.

The first was my extraversion score. To absolutely no one’s surprise, my extraversion score was off the charts (almost literally). But in psychology terms, extraversion doesn’t mean loud and gregarious, though I’ve been described as such. It means getting overly excited when good things happen. How does that translate into trading? I tend to leave positions on for too long. With winners, that’s great… until the position turned around on me. I’d be up 100%, and then watch that profit dwindle to zero… or even a loss. (That’s why you can’t fall in love with your trades!)

The second was my neuroticism score. We tend to call people neurotic without having a genuine understanding of the word. In psychology, neuroticism means getting overly down when bad things happen. In trading terms, that means when I’d have a loser, I’d get depressed and paralyzed. I’d literally watch the trade get decimated without closing out the position.

So I’d get giddy with open winners and paralytic with open losers. It’s easy to see why my record at the time was so bad: I should’ve been born with my own VIX Index!

The Solution

You may have guessed at how I talk myself back from the ledge.

Notice how my mind raced to Mark Antony losing the Battle of Actium. Now, really, was Friday that bad? Of course not.

Take a step back.

Next, I remembered Warren Buffett talking about how he felt after the 1987 Stock Market Crash. Did we have another 1987 crash on Friday? Of course not.

Take another step back.

I read Adam’s excellent piece in the DR. I know he’s a smart guy, and we agree. Sure, you can call it confirmation bias, but I’ve read absolute horror stories on X, too.

Take another step back.

Now, critically: do the math. After a trading day of allegedly biblical proportions, my portfolio finished up 6.7% for the week. Up for the week. Up, not down.

Ok, we’re off the ledge now.

But even if you suffered a small loss on the week, that’s ok, too. It happens. We all get smacked in the chops occasionally. The trick is to deal with it decisively. And usually, that means doing nothing.

Remember Charlie Munger’s famous advice:

The big money is not in the buying and selling ... but in the waiting.

Wrap Up

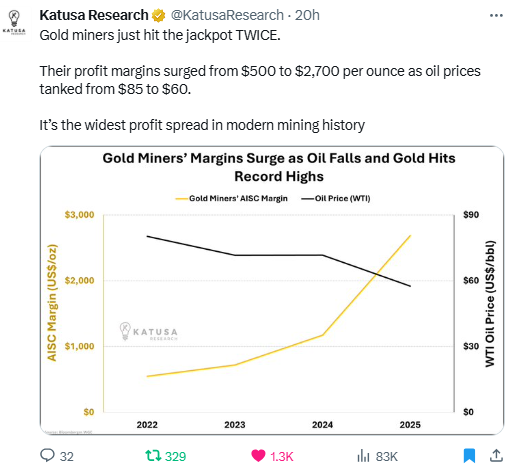

If all this doesn’t make you feel better, then remember that Q3 earnings for the miners will trickle out between October 27th and November 5th. Marin Katusa just posted this, and it’s optimistic as can be.

Keep calm and have a great week ahead!

HODL Your GODL!

Posted October 17, 2025

By Sean Ring

I See Black Gold Risin’…

Posted October 16, 2025

By Sean Ring

Powell Pivots: QT Ends, QE Begins

Posted October 15, 2025

By Sean Ring

Silver Squeezes the Yankee Miners

Posted October 14, 2025

By Sean Ring

Send in the Golden Meteor!

Posted October 13, 2025

By Sean Ring