Posted September 03, 2024

By Sean Ring

Pre-Election Everything Rally!

August 2024 Monthly Asset Class Report

I’ll go to my grave thinking Jay Powell should’ve cut rates in June and removed himself from the political stage. But some people just can’t help themselves, and Jay stayed his hand.

As the September FOMC meeting rapidly approaches, it looks like he will finally cut 25 bps from the US base rate.

While it won’t do much economically, it will goose traders’ expectations and make the bots buy faster than you can say “algorithm!”

The stage is set for a mini-rally anyway, as Friday gave us some lovely numbers for the holiday weekend. Personal income was slightly up, while the core PCE index was softer than expected. The Chicago PMI was stronger than expected, while consumer sentiment was just below the consensus estimate.

We know the economic numbers are nonsense, especially after the BLS revised nonfarm payrolls downward by 818,000 jobs. But that’s okay. Everyone’s dealing with the same nonsense.

And so starts the rally. Most people are looking for a recession, but I don’t think you’ll find it here. As it’s September, the traders will return to work, and the junior varsity will return to getting coffee. The first-team players may see some buying opportunities their counterparts missed.

Sell NVDA?

Crazy.

Do you think the market’s overcooked?

It may be wobbly, but we’ve just closed on a monthly all-time high for the S&P 500.

And how about gold?

Still over $2,500. Ain’t that grand.

Let’s get to the charts.

S&P 500

***New Monthly Closing High of 5,648.40.***

The SPX rose roughly 120 points to establish a new monthly closing record of 5,648.40. I just don’t know how anyone can want to get short right now. The problem with brilliant people is they see far into the future. Too far, by half. Sure, there will be a day to sell, but it’s not today, and I don’t think it’ll be anytime soon.

I still target 6,000.

Nasdaq Composite

Even the allegedly beleaguered Nasdaq closed up 200 points on the month. Of course, I’ll feel much better once we establish new all-time highs. But for now, we’re only 1,000 points away from there. Percentage-wise, it’s not all that much.

Russell 2000 (Small caps)

The Russell had a terrible first week of August but nearly recovered all its losses. It finished the month down less than 4 points, which is a major victory.

As the small caps are holding up, this bodes well for the rest of the stock market.

The US 10-Year Yield

We indeed fell another 12 basis points this month in the 10-year. The 10-year fell slightly lower than that but found a floor at 3.80%.

Much of where the 10-year goes depends on the upcoming cuts from Jay Powell and friends.

Dollar Index

The dollar index fell out of bed this month before recovering in the last week of August. Still, a fall from 104.36 to 101.62 is nothing to sneeze at.

This goosed stocks and bonds, but not crypto, surprisingly.

The yen and euro seem strong, thanks to central bank action.

USG Bonds

Grabbed another few points this month. The target remains 99.

Investment Grade Bonds

From two months ago:

If we clear 109, we can retest the 132 level. Scary, but possible.

We have now cleared; off we go to 132. The next target after that is 146.

High Yield Bonds

Again, from last month:

Junk continues its ascent. I’m looking at 79 as the next upside target.

That still stands, too, but our new upside target is 85.

Real Estate

After another positive month, VNQ was up about 5.5%.

The target is now 116.

Energy: West Texas Intermediate (Oil)

Even on a weaker dollar, oil is getting hammered.

I thought we’d turn it around, and that still may happen. But it certainly hasn’t happened yet.

From 77.91 to 73.55, it was a terrible place to be in August.

Perhaps if the Fed cuts rates this month, we’ll see a rally start to form.

Base Metals: Copper

We had a nice recovery this month. I’m still erring to the downside, though I think we’re close to, or at the beginning of, the next big commodities cycle.

For now, the big downside price target is $2.25. But I’m hoping the ascent continues.

Precious Metals: Gold

***HIGHEST MONTHLY CLOSE OF 2,527.60***

From last month:

$2,609 is still the next target. But beyond that, we’re now looking at $2,759.

With the Fed set to cut rates before inflation has been slain, I think we’re still nearer the beginning of a bull market than at an end.

Precious Metals: Silver

Silver performed much better in August, but we still need to get above $33 to get excited.

Cryptos: Bitcoin

Despite Bitcoin's recent downturn, I maintain a bullish outlook.

I reiterate my target of $100,000 by January 2026, and I see the current consolidation pattern as a potential precursor to a breakout.

This could be a nice consolidation pattern here. Let’s see which way it breaks out.

Cryptos: Ether

Ether has broken down. I’m unsure what the problem is, but ETH is considerably weaker than BTC.

We could see ETH hit $1,950 from here.

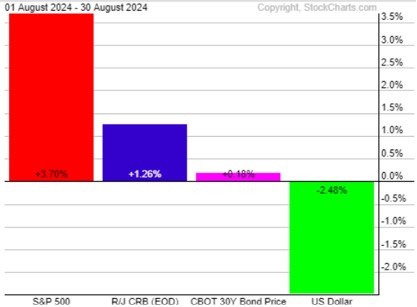

Trad Asset Class Summary

This month, the big loser was the USD, following last month’s downer.

The SPX and commodities did well, up 3.70% and 1.26%, respectively.

The long bond was as flat as a pancake, moving up only 18 basis points.

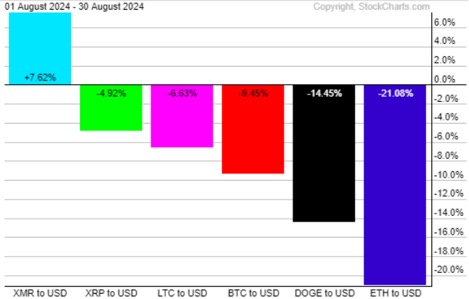

Crypto Class Summary

Crypto had another stinker this month. Only Monero, the most secretive coin, was up this month. Bitcoin, Doge, and Ether were the three biggest losers, with ETH down over 20%.

Wrap Up

The party is far from over. In fact, Jay Powell is about to bring the punch bowl back out.

So participate. We’re not at the end yet. We’re still in moneymaking mode.

Enjoy it while it lasts.

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful day!

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso