Posted February 01, 2024

By Sean Ring

Powell Power: January 2024 MACR

“You’re not the boss of me!” Jay Powell seemingly screeched as he poured ice water on the stock market rally.

From Kitco:

After the Federal Reserve left interest rates unchanged on Wednesday, Chair Jerome Powell used his press conference to push back against market expectations for rate cuts as early as the March meeting.

“Based on the meeting today, I would tell you that I don't think it's likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that,” Powell said. “That's probably not the most likely case, or what we would call the base case.”

“There was no proposal to cut rates” among FOMC members, the Fed Chair added, though “some people did talk about their view of the rate path.”

Powell reiterated throughout the press conference that the FOMC “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” though he acknowledged that “inflation has eased over the past year.”

The central bank did drop its oft-repeated reference to the potential for further rate hikes in Wednesday’s statement. Powell said the Fed's interest rate target is “likely at its peak for this tightening cycle” and they expect to cut rates “at some point this year,” but said the committee will take the necessary time to confirm that the data supports monetary policy easing.

In response to a question about whether the U.S. economy has already achieved a ‘soft landing’, Powell said “We are not declaring victory, we think we still have a ways to go.”

Stocks, gold, and cryptocurrencies fell on the news. But some still look like very bullish cases on the charts.

With that in mind, let’s get to them.

S&P 500

The market did, indeed, take a breather, but only a small one. The long-term target remains north of 6,000.

That doesn’t mean it’ll get there. But it does mean we’ve likely got a long way to go on the upside.

Nasdaq Composite

A pullback to 14,400 would be healthy. We’re sitting above 15,000 here. Most of the drop is from Powell’s comments. We’ll soon see if there’s much followthrough or if the markets just shrug it off.

Russell 2000 (Small caps)

Indeed, we reversed down to 192, as we assumed would happen last month. However, it’s unclear where we’re going from here, as we may just bounce up off the 50-day moving average. But keep your eye on this small cap index. As it goes, so goes the broader market.

The US 10-Year Yield

The 10-year yield keeps declining. Much of the market is (still) looking for a rate cut, though I think they’ll be disappointed until mid-year.

I am looking at 3.4% next.

Dollar Index

We got above the 103 level I was looking for, but this is due to Powell’s hawkishness. How long will this last? I'm unsure. But if it continues, the next target is 105.5, followed by 106.5.

USG Bonds

We got our reversal, down over two points since last month.

But TLT popped on Powell. If we continue up, target 100. If we reverse from here, target 90.

Investment Grade Bonds

We had a tiny reversal, not worth even talking about.

This could be a consolidation for higher gains. The target would be 134 then.

High Yield Bonds

This looks like a consolidation over the month. The upside target is in the 90s.

I’d still be wary of a minor reversal here.

Real Estate

We've got a full reversal going on here. It looks like the next stop is 80. Below there, 75 and then 70.

Energy: West Texas Intermediate (Oil)

We hit 78, but Jay Pow lowered the boom, sending oil back to 75.85. Between Israel, Hamas, the Houthis, and the Suez being shut, I can’t believe we’re still under $80. That’s the best indication the world economy is weak.

Still, absent a universal peace, I can’t see this lasting. I’m looking at 83, at least.

Base Metals: Copper

I got this one plain wrong. I thought we were heading to 3.30, but we reversed up to 3.90. The real economy is still awful, but copper thinks better of it for now.

Precious Metals: Gold

Unfortunately, though the chart shows $2,067.40/oz., that bastard Mr. Slammy knocked it down to $2,040 overnight.

I’m still bullish and think we’ll reach $3,000, but it will be a far more brutal slog than we imagined. Unless we get a surprise rate cut, that is…

Precious Metals: Silver

Sideways Silver strikes again. There is nothing to report other than to hang on to your holdings. It’ll be worth it. We just need to get above $26 first.

Cryptos: Bitcoin

BTC took a breather this month. I still target $47,000. With that said, if this is a top and not a consolidation, we could be looking at $33,000.

Cryptos: Ether

Took a breather this month. New target is $2,820.

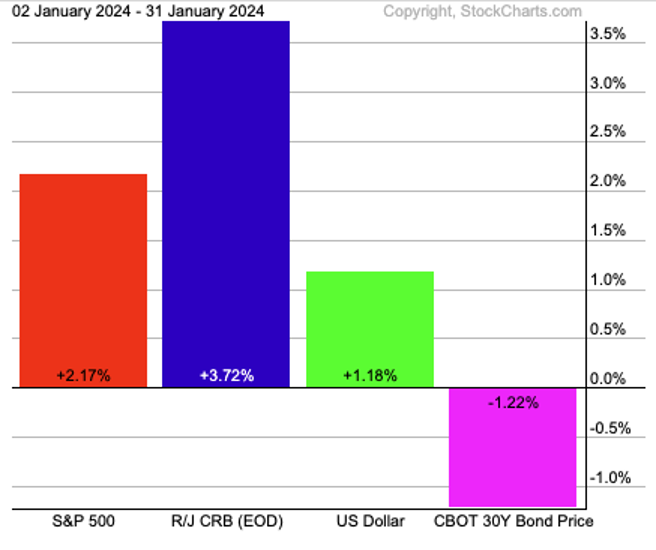

Trad Asset Class Summary

Commodities led the way with a 3.72% return.

Stocks finished second, with a 2.17% return.

Oddly enough, the dollar also finished positively, up 1.18%.

Bonds, as suspected, took a hit of -1.22%.

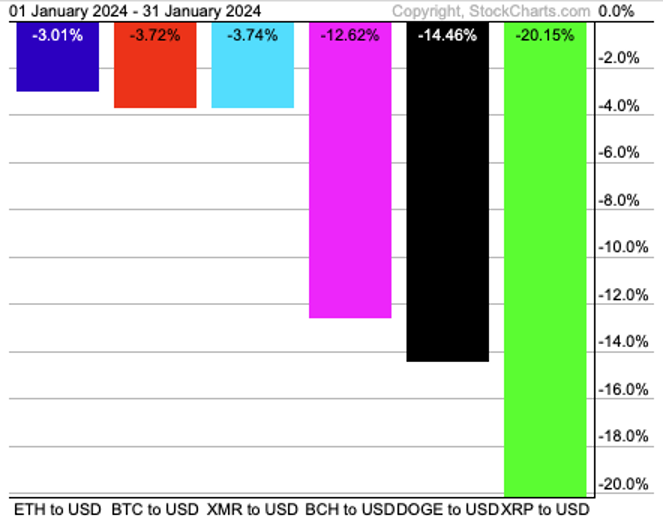

Crypto Class Summary

Ether, Bitcoin, and Monero each had a hiatus, down only single digits.

Bitcoin, Dogecoin, and Ripple were hammered by double-digit amounts.

Wrap Up

First, it was Christopher Waller. Now, it’s the man himself, Jay Powell, who’s thrown ice water in the face of March rate cuts.

These are tricky times for the markets. Between World War 2½, supply chain realignment, and central banks, investors have plenty of bullets to dodge.

Stay bulletproof, my friend.

Finally, let’s take a moment, courtesy of the Twitterverse:

Credit: @alifarhat79

Have a great day!