Posted March 05, 2024

By Byron King

Poor Man’s Bitcoin

Once again, Byron King has come to the rescue. This may be his best piece yet. It’s chock full of information you need to know about gold. As Rick Rule once said, “Buy when there’s no competition on the bid.” Byron highlights how there’s no competition on the miners’ bids right now. It's an incredible piece that may offer you a way to make outsized returns over the course of the next year or two. I'll be back tomorrow with a report from Riyadh. Until then, enjoy Byron’s great piece.

King: Gold, the Poor Man’s Bitcoin

“You want gold? I’ve got gold,” the long-time geologist said. “Sheeted quartz veins, and I can trace it back to a granodiorite intrusion. With strong hints of a gold-rich porphyry out there.”

Then he added, “Eighteen months ago, my market cap was over $200 million. Today, I’m under $30 million.”

This is how people talk when they’re in the mineral exploration biz. And there’s much more to the discussion, but I won’t bore you with minutia.

Point is, I’m in Toronto at the annual mining event, the gathering of the Prospectors and Developers Association of Canada (PDAC). And much of the mining world is here, everybody who’s anybody; except for Russia, a major power in mining but absent for evident reasons.

PDAC is the big conference, the “must attend” shindig every March since the depths of the Great Depression in 1932, except for one recent year of Covid. And this year is no exception.

Indeed, this year there’s a heck of a lot going on. And I mean “a heck of a lot,” and I mean “going on.”

Bitcoin!

But first… Okay, about that headline and Bitcoin; or more broadly, crypto. Let’s discuss what I mean, particularly in terms of gold.

Wow. You’ve never heard mining people cuss out a topic like they cuss out Bitcoin, and I assure you that most mining people can swear like a sailor; and I say that as an old U.S. Navy sailor.

That’s because Bitcoin, and crypto in general, has spent the past year sucking and soaking big whacks of funds out of the marketplace. And this is not good for the gold space. Here’s a chart to help illustrate the point:

Gold vs Bitcoin over the past 15 months. StockCharts.com.

Gold vs Bitcoin over the past 15 months. StockCharts.com.

You see what I mean, right? Since the beginning of 2023 Bitcoin has moved up, up and away, while gold has hung out in the rear. And this includes the remarkable point that the price of gold topped $2,000 per ounce at the end of last year and remains well above that level just now.

In a sense, gold has done exceptionally well. Don’t sniff at $2,000, right? It definitely helps that central banks across the world (except – foolishly – in the U.S. and Canada) are buying gold and building reserves. What do they know? Well, obviously they suspect that something bad is coming, so they are stockpiling yellow metal. Take a hint, some might say.

And of course, there’s nothing wrong with gold over $2,000. It’s money in the bank to many a mining concern. Many of those extra dollars in the price go straight to the bottom line.

Plus, if you own physical gold, the value of that asset you bought at some time in the past has risen. You’re good with that, too, right?

But for all the price moves with gold, Bitcoin and crypto have moved up way more. And that means that money has flowed like Niagara Falls across markets into the electronic stuff, and not as much into physical metal, let alone into the companies that explore for, develop, and mine the material.

Got Gold?

So what’s the problem, you inquire? Why are hard rock miners perturbed with the electronic side of life? As the late Rodney King once asked, “Can’t we all just get along?”

Well, exploration, development and mining are all capital-intensive activities. Mining requires large piles of money which then – literally – get drilled into the ground. Drill rigs, pipe, drill bits, diesel fuel, camps out in the middle of nowhere, work crews, helicopter time, professional and technical staff, and so much more.

Money, money, money. And when it works out, drilling and other exploration/development activity delivers solid engineering output that will form the basis of an eventual mining operation. All that geological and engineering data are intellectual property (IP), just as much as software or algorithms or crypto blockchains are IP.

Stated another way, with all that exploration investment your geologists and mining teams identify an ore body full of whatever: gold or silver, copper, lead, zinc, nickel, platinum group metals, lithium, rare earths, uranium and many more elements . Just look at the periodic chart and let your mind run wild.

Except right now, we have an immediate problem. Because massive levels of money are rolling into Bitcoin and other crypto, which has tended to leave the tangible side – the miners – high and dry.

In other words, right now it’s tough for the miners to raise funds. How tough? Ugh…

The fickle investor crowd has sold down shares in many a company, such that we have quite a large number of truly outstanding ideas just languishing in stock market limbo. And I mean great geological assets, in excellent jurisdictions, run by terrifically competent people, positioned for value creation. But the funds are not flowing and many market caps are unbelievably small.

Sure, a few companies have delivered spectacular geological results in the past couple of years, post-COVID. And yes, in some cases they’ve leveraged that success into successful fundraising, and hence are cashed up and ready to roll.

Then again, a distressingly large number of solid, well-run companies and great people/projects are starved for cash, which means a lot of things.

First, if there’s no money then there’s not much geologic progress. It’s now March, and most companies have already made their plans for the coming exploration season this summer. If the money isn’t there to sign contracts for rigs, pipe, drill bits, people, helicopters, etc.? Well, everything will be deferred, and management will cut operational costs to the bone.

Or there’s another unpalatable option with which those management teams are faced, namely the nasty prospect of raising funds at distressingly low share prices. This means dilution to existing shareholders, never the kind of issue that management teams (let alone shareholders) want to confront.

And again, I could discuss this at greater depth, but there’s no need for more mining minutiae here. If you’re a Bitcoin or crypto person, you see the point with the mining side, I hope.

Your Other (i.e., “Next”) Opportunity

Look at it this way. Why do people buy into Bitcoin and other crypto?

Well, people buy crypto because they see the U.S. government ruining the dollar, right? I mean, $34 trillion national debt kind of speaks for itself. And that debt is growing at a current rate of $1 trillion every three months, so today’s $34 trillion will be $37 trillion by the end of 2024.

So yes, sure. Go Bitcoin! Go crypto! Seek safety in electronic currency, backed by blockchain and everything else. It’s the money of the future, right? Sure, until the government figures out how to control it, if not crack all the codes.

Of course, your Bitcoin and crypto also rely on a reliable supply of electric power, coupled with a global network of internet connections. In this sense, your electronic money is, to borrow a phrase, someone else’s liability.

Let’s be clear here: to hold Bitcoin and other crypto, you must have faith that the national power and global communication grid will hold up. And that the government will not somehow wage electronic warfare on you. Hint: yes, that government.

And to be blunt, all of the foregoing is quite unlike the case with gold. If you hold physical metal, it’s yours and no one else’s liability. Just be sure to remember under what tree you buried the stash, eh?

And now, we return to those poor, beaten-down gold explorers, developers and miners. They hold gold, too, except that it’s still in the rocks. It’ll take time to dig it out and process into fine metal, but that’s more than doable.

To be sure, when you hold mining shares you must believe that the company can accomplish its tasks. There’s that “counterparty liability” thing again. But the counterparty thing is based on gold. Real atoms. An element of nature. Which people across the world respect and accept.

Gold, the Poor Man’s Bitcoin

Here’s the takeaway in this note…

If you’re up-up-up with Bitcoin and crypto, great. At Paradigm, we want all our subscribers to do well. And there’s no arguing with the charts. If you bought in and made gains, then you are in tall cotton.

But now, where do you go from here? Well, at current levels, gold has big upside.

Crazily, foolishly, mendaciously, maliciously, our U.S. government is killing its own currency. Just on the $34 trillion issue alone, there’s upside to gold from current and future inflation. And more golden upside from the massive interest payments that Uncle Sam must pay out on that debt.

All this, while gold and the mining side offer screaming bargains, to include beaten down share prices that reflect gold in the rocks and deep undervaluation by any reasonable market.

Back in 1969, Elvis Presley wrote a song entitled Poor Man’s Gold. It was a sweet tune about love and family, about spending time with children and grandparents. And poor Elvis, he never released the recording, nor did the song become a hit, nor part of his archive. Not until much later, anyhow.

Well, like the lost Elvis song, gold is also a lost idea just now. Yes, “everybody” knows about gold, or so they think; but extremely few players are dealing with it. The field is wide open. The sector is beaten down into the dirt, if you’ll excuse the phrase when talking about the mining side.

The electronic stuff has had a nice run, but how much more can it go? It’s time to play the disparities, to buy in to the gold side and the mining plays. Because that’s where the next seriously big money is waiting to be made.

That’s all for now.

Thank you for subscribing and reading.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

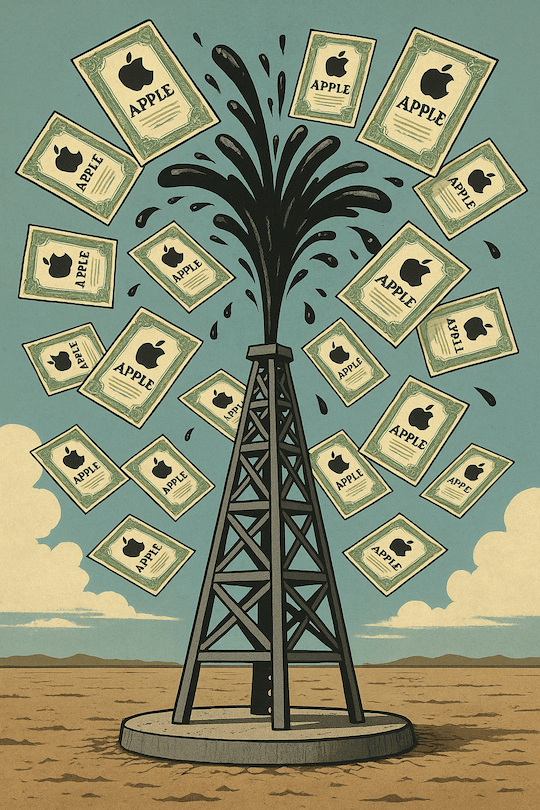

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring