Posted July 17, 2025

By Sean Ring

Patience is a Precious Virtue

Let’s take a break from reporting on the nonexistent Epstein Papers to bring you solace and succour concerning precious metals.

The precious metals complex—gold, silver, platinum, and palladium—isn’t dead. It’s just catching its breath. After ripping higher in the first half of 2025, these metals have entered what traders politely call “consolidation mode.” In plain English, that means we’re stuck in a choppy range with no clear direction.

Gold’s trading sideways, just below its all-time highs. Silver’s bumping its head on 13-year resistance. Platinum is quietly outperforming everything else, but has stalled. And palladium? Well, it’s trying, but let’s just say it’s still working on its comeback story.

So what’s going on? Why the pause? And what’s likely to trigger the next big move—up or down?

Let’s dig in.

Gold: Waiting for the Next Shock

Gold is behaving exactly like an asset that just ran a marathon. After climbing over 28% year-to-date and approaching $3,500 in April, the yellow metal has been trading within a tight $3,250–$3,450 range for the past few months. This is a bullish consolidation, not bearish exhaustion.

Fundamentally, the cross-currents are strong. Central banks continue to buy—Q1 of 2025 saw 244 tons of net purchases, nearly double the usual pace. That’s providing a strong floor. Meanwhile, macroeconomic risks such as tariffs, war threats, and leadership uncertainty give gold periodic boosts.

But it’s not breaking out. Why?

Although the dollar has declined significantly year-to-date, it has rallied since July 1st. Yields remain stubbornly high. And while geopolitical tensions simmer, they haven’t boiled over. The result? Gold rallies on fear and then gives it back when markets calm down.

The market wants a reason to move—another inflation shock, a Fed pivot, a geopolitical black swan. Until then, gold is range-bound.

Silver: Industrial Muscle Meets Monetary Indecision

If gold is a calm, measured nobleman, silver is its jittery, streetwise cousin. Silver hit a 13-year high of nearly $39 last week. That’s impressive. But since then? Crickets.

It has been bouncing between $38 and $39, unable to break decisively higher. On paper, silver should be the biggest winner. It’s both a monetary metal and a key industrial input, especially for the green transition. Think solar panels, EVs, and semiconductors.

That demand is real and growing. However, the silver market is notoriously thin and prone to significant fluctuations. That makes it a dream for traders and a nightmare for long-term investors seeking a stable trend.

Silver has consolidated twice before rallying since April. Technically, it’s holding above its 50-day EMA and threatening to break out above $40. But it hasn’t done it yet. Why?

Because the monetary narrative is missing. Central banks buy gold. Retail flows chase gold. Even the crypto crowd respects gold.

Silver? It gets dragged along for the ride.

Still, the setup looks promising. If the dollar weakens further or industrial demand spikes—or both—silver will likely explode towards $50. But until then, expect more grinding sideways with a few head fakes to keep everyone guessing.

Platinum: The Quiet Outperformer

Platinum is having a phenomenal year. It’s up about 55% year-to-date, trading at $1,421. But nobody’s talking about it.

Why? Because it doesn’t have the flash of gold or the street cred of silver. But smart money is watching.

Platinum is in deficit. It’s primarily mined in South Africa, a country plagued by labor unrest and chronic power outages. Meanwhile, industrial and investment demand is rising, particularly as automakers look to substitute expensive palladium in catalytic converters.

(This is also a big reason why I hold Sibanye Stillwater [SBSW], which is the biggest platinum miner in South Africa.)

There’s also the “gold fatigue” effect. After years of pouring into gold, some investors are now looking for cheaper ways to hedge currency risk and inflation. Platinum offers that, with upside.

The metal has paused here as it digests its gains. That’s healthy. It’s forming a base. The next leg higher likely depends on confirmation that the supply situation is deteriorating, or that demand from hydrogen fuel cell technologies starts to ramp up faster than expected.

Until then, it remains the best-performing metal no one’s talking about.

Palladium: Trying to Get Off the Mat

If platinum is the quiet winner, palladium is the reluctant struggler. It’s up about 35% year-to-date, trading near $1,300, but still well below its highs. After years of being the darling of the auto industry, palladium is now facing surplus conditions and substitution pressure.

Its primary use—auto catalysts—is being cannibalized by platinum. As EVs grow, demand for combustion engines is no longer what it used to be. That’s not great news for a metal that had a spectacular bull run from 2016 to 2021.

Still, it’s holding steady. The worst is probably over. Supply shocks could return, and any uptick in combustion vehicle demand—say, from lagging emerging markets—could breathe life into the price. But for now, it’s stuck in the $1,250–$1,300 range, looking for direction.

Don’t count it out entirely, but don’t bet the farm either.

Why They’re All Stuck

Despite strong fundamentals, all four metals are in holding patterns. Here’s why:

- They’ve already run. Gold’s up 28%, silver 31%, platinum 55%, and palladium 35%. After big rallies, consolidation is a healthy sign. The market is resetting expectations.

- The macro is a mess. Yields are high, but inflation data is inconsistent. The Fed sounds hawkish, but traders don’t believe them. The dollar is strong, but vulnerable. These crosswinds keep prices range-bound.

- Liquidity is thin. Central banks and large funds have already invested. No marginal buyer is driving new highs. Without fresh inflows, metals drift. We need the institutions to come in, and then retail buyers to bring up the rear.

- Geopolitics is noisy but not explosive. Sure, there’s drama—Trump tariffs, Middle East heat, China tensions—but nothing’s tipping over into full-blown crisis. Metals spike on headlines, then fade.

- Technicals favor a pause. The charts say we’re in digestion mode, not breakout mode.

That’s the holding pattern: no conviction, no capitulation.

What Could Break Them Out

This won’t last forever. Here’s what could light a fire under the metals—or drop them through the floor.

- Hot inflation data. A CPI print above 4% would panic markets and send gold and silver vertical.

- Fed pivot. Even a hint of rate cuts would send all metals flying. And will Trump fire Powell?

- Dollar drop. A 5% decline in the DXY could unlock huge gains, especially in silver and platinum.

- Geopolitical crisis. Actual shooting wars—not just threats—would be massively bullish.

- Supply shock. A major mine strike, export ban, or new tariffs could send platinum and palladium prices skyrocketing overnight.

- Industrial surge. If EV and solar demand surprise to the upside, silver and platinum prices could surge exponentially.

Flip those around, and you get the bearish case. Strong dollar, disinflation, calm geopolitics? Precious metals go limp.

Wrap Up

The metals aren’t broken. They’re not being manipulated into the grave. They’re simply resting. After powerful rallies, they’re consolidating and waiting for the next big move.

That’s your edge.

As Charlie Munger once said, “The big money is not in the buying and selling, but in the waiting.”

If you’re a trader, stay nimble. The breakout will come—and when it does, it’ll be violent. If you’re a longer-term investor, use this chop to accumulate. Just know that sideways is still a direction.

In the meantime, respect the range, sharpen your entries, and don’t fall asleep. Precious metals are the quietest asset class in the room—until they’re not.

And when they move, they don’t ask for permission.

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring

Trump’s Victory at Sea

Posted January 29, 2026

By Byron King

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring

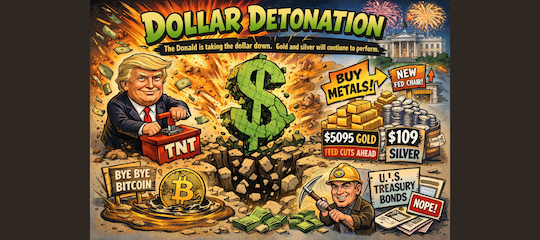

Dollar Detonation

Posted January 26, 2026

By Sean Ring