Posted March 13, 2025

By Sean Ring

It's Dusty, It's Silver-ish... And It's UP 20% In March!!!

“If you don't have rhodium, you don't have good jet engines.”

That's what our Harvard-trained geologist -- and friend -- Byron King told me yesterday.

And you know what? This rhodium trade might just be getting started.

If you’ve ever wondered what the rarest and most expensive precious metal in the world is, look no further than rhodium. This silvery-white, corrosion-resistant metal isn’t just another shiny thing for jewelry lovers—it’s a critical component in global industry, particularly in the automotive sector.

And if you’re like me and see the upside in mining stocks - one of which I’ll highlight in a moment - rhodium is a metal you can’t ignore.

What Is Rhodium?

Rhodium (Rh) is one of the platinum group metals (PGMs), which also include Platinum (Pt), Palladium (Pd), Iridium (Ir), Ruthenium (Ru), and Osmium (Os). Because of its high melting point, extreme durability, and unparalleled ability to catalyze chemical reactions, rhodium has become indispensable in certain industries. Although lesser known than gold or silver, its price often surpasses both, sometimes trading for over $20,000 per ounce during supply crunches.

What Is Rhodium Used For?

Rhodium has several critical industrial applications, making it one of the most valuable metals in the world:

- Catalytic Converters: 80-90% of global rhodium production is used to make automotive catalytic converters, which reduce harmful emissions, mainly nitrogen oxides (NOx).

- Chemical Industry Catalysts: Rhodium is a catalyst in various industrial processes, including producing acetic acid, nitric acid, and hydrogenation reactions.

- Glass Manufacturing: The metal is used to produce fiberglass, flat-panel glass, and liquid crystal displays (LCDs).

- Alloying Agent: Rhodium hardens and improves corrosion resistance in platinum and palladium alloys, which are used in furnace windings, laboratory crucibles, and thermocouple elements.

- Electrical Contacts: Rhodium is used in electrical contact materials thanks to its high electrical conductivity and corrosion resistance.

- Jewelry and Decorative Plating: Rhodium's high shine and resistance to tarnishing make it useful for plating jewelry and other decorative items.

- Optical Instruments: The metal coats optical fibers, mirrors, and headlight reflectors.

- Nuclear Reactors: Rhodium neutron detectors measure neutron flux levels in nuclear reactors.

Where Do We Get Rhodium From?

Here’s where things get interesting. Rhodium isn’t mined on its own; it’s a byproduct of platinum and palladium mining. About 80% of the world’s rhodium supply comes from South Africa, with the rest coming from Russia and North America.

This heavy dependence on South African production makes rhodium highly susceptible to geopolitical risk, labor strikes, and power supply disruptions—common occurrences in the region. Silbanye Stillwater SBSW), the company I’ll explain below, often pops and plummets in step with these… to my immense frustration. And when anything threatens supply, prices spike dramatically, creating volatility in the rhodium market and the stocks of companies producing it.

Rhodium’s Price History: A Wild Decade

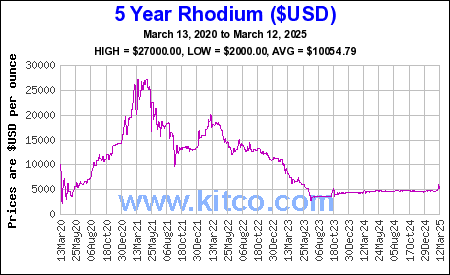

First, let’s look at this wild chart:

While this chart only shows the last five years, rhodium’s price has been on a rollercoaster over the past ten years:

- 2014-2016: Rhodium traded in a relatively stable range between $800 and $1,000 per ounce, as weak demand in the auto sector and ample supply kept prices low.

- 2017-2019: Prices began to rise, breaking above $2,000 per ounce by mid-2019, driven by tightening emissions regulations, particularly in China and Europe.

- 2020-2021: The real explosion happened here. As auto production rebounded post-pandemic and supply disruptions hit South African mines, rhodium shot an all-time high of $29,800 per ounce in March 2021.

- 2022-2024: The metal’s price collapsed dramatically, falling below $5,000 per ounce by late 2023, as auto production slowed and supply chains normalized. It remained there until this month.

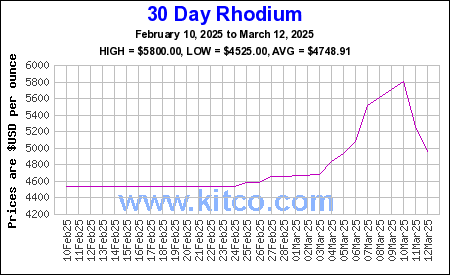

We’ve had a big rally, though it seems to be simmering down now:

The move from the low of $4,525 to the high of $5,800 is 28.17%. It has since cooled off, trading around $4,950 as I write. But I think this pullback is a great buying opportunity.

The SBSW Connection

If you’re looking for an investment exposed to rhodium, Sibanye Stillwater (SBSW) is one of the primary names to watch. Disclosure:I have owned this stock since November. The South African-based miner is one of the world’s largest producers of platinum group metals, including rhodium.

SBSW’s stock tends to move with PGM prices, especially rhodium. When rhodium prices soared to record highs in 2021 because of Scamdemic supply constraints and increased auto production, SBSW benefited massively, trading around $20 per share.

However, like all commodities, rhodium is cyclical. Its price can be highly volatile, meaning SBSW’s stock is subject to wild swings depending on market conditions. As I’ve mentioned before, it’s a frustrating stock to own.

The Risks and Opportunities

Investing in any rhodium-linked assets has risks:

- South Africa’s instability: Ongoing labor disputes, energy shortages, and political uncertainty will disrupt mining operations.

- Rhodium’s price volatility: The metal's market is highly illiquid, and small changes in supply or demand cause massive price swings.

- EV Transition: As the world moves toward electric vehicles, demand for PGMs in catalytic converters may decline. However, hybrids and plug-in hybrids will still require these metals for years.

But as long as traditional ICE and hybrid cars remain on the road and environmental regulations remain, the demand for rhodium will remain elevated.

Wrap Up

Rhodium might not be on most investors’ radars, but it’s essential for the global economy. For those looking to trade or invest in this niche but high-value market, stocks like SBSW offer exposure… and butt-clenching levels of volatility. Other stocks in this group include Impala Platinum (Implats) and Anglo American Platinum.

If you can stomach the ups and downs, rhodium-linked investments could provide golden (or silvery-white) opportunities.

As the great Sir Harry Flashman, VC, once said, “Courage. And shuffle the cards.”

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring