Posted February 28, 2025

By Sean Ring

NVDA Dives; Eggs Thrive

I can’t tell you how much good it does my heart to hear from you. This mailbag was better than ever, and that’s saying something! Let’s get straight into it.

NVDA Gets Smoked Yesterday

Hello Sean,

[Yesterday’s] was a very interesting column. I agree with your thinking on NVDA's current position. I have been looking at the markets through a "broad lens", studying the chart lines, reading the many data tables. I am getting the general impression from everything I see and read that the "pace of the market" is slowing, and it has been slowing for 2 months. A Trump effect due to his unpredictable nature? Perhaps. We have seen the markets spending a fair amount of time recently just trading within ranges. You said something similar about NVDA in your column. My question is: How long will the "pace of the market" slow? A slowing "pace" impacts growth-oriented stocks (and related funds built upon them) since stock prices are not really increasing; NVDA is an example as are most of the "Mag 7" stocks. So perhaps we lowly "kitchen table traders" should consider adjusting our positions into "earnings oriented" stocks? Instead of gaining value from stock price appreciation, move into stocks that pay us to hold them. Stock prices of dividend-paying stocks are not as "flashy" as NVDA, META, or AMZN, but some dividend-paying stocks pay out nicely, and investors can choose to reinvest those payouts wherever they want. I am seeing a shift from 'growth' to 'dividend paying' stock sentiment in various readings that are out there. What are your thoughts?

Jeff R.

Hi Jeff! Thanks for writing. First, no one trying to increase his wealth by trading stocks is a lowly kitchen table trader. Stock trading is the world’s toughest game —not poker, not chess, but stock trading. Think more highly of yourself and your craft. I certainly do.

First, as yesterday’s piece turned out to be rather prescient - oh, were it always that way - let me talk more about NVDA first. I zoomed in on yesterday’s chart, but removed the lagging line for more clarity, and added three support levels and a rectangular box I’ll walk you through now.

On January 25th, NVDA stock gapped down significantly from 142 to 124. What often happens after these crazy moves is that the stock moves up to close the gap, which it did over the next two weeks. After that, we had a flurry of red candles, ending with yesterday’s shallacking. The stock finished the day at 120.15, down 8.48%. As I write, in the premarket, it’s only up 60 cents or so.

We have much more downside, with the first support level at 114.70. If we decisively fall through that level, we’ll head to 102.80 - 100 (psychological level). But it wouldn’t surprise me to see the 92 level at last.

Regarding your question about dividend stocks, they’re a good idea. But keep in mind that in a crash scenario, all correlations go to one. That’s a fancy way of saying that investing in those stocks won’t protect you from a substantial capital loss (though the dividend payment, if it still comes, will offer small downside protection). You can see the “dividend aristocrats” here.

EGGstremis

Sean,

You and Jim Rickards have the best perspectives. Thank you. Keep on keeping on. I’ve said for years that “Calories and BTUs will soon be your only priorities.” Unfortunately, this is coming true.

Thanks,

Dumb ‘n Dumber

Sean,

You should add to your Eggs musings that you can stockpile eggs in pickling lime. I’m pulling massive, orange-yolked, pasture-raised beauties out of a tub we stocked in April, ‘24. At $2.50/doz! You should also do a piece on the need for 2 grams of protein/# of bodyweight: a major imperative Greenies don’t want acknowledged.

Meanwhile, beef herd supply is at a record low, and beef will be far more expensive for years. No problem: we have relationships with grass-fed herds booked years in advance, expecting deep state chaos and media bs. Let’s see if Orange Man brings us back from the brink. Tx, again.

Carry on.

Rick L.

Good Afternoon, Sean.

Your article, "EGGStreme Inflation," had an incredible amount of great nutrition advice. Few have an understanding approaching yours. Unfortunately, most doctors have no clue about nutrition. Here's the last 2% of the nutrition picture…

First, the sugar industry paid Brother Keys at my alma mater to vilify saturated fats. The sugar manufacturers were worried that sugar made people fat. But sugar does not cause weight gain. Sugar consumption per capita in the US has not changed for over 100 years, and saturated fat consumption has dropped drastically in the last 50 years. So, neither of those causes weight gain.

Second, higher body weight in the USA came from substituting saturated fats with unsaturated fats. Linoleic Acid (LA), the unsaturated fat abundant in the vegetable oils that Keys' research promoted, is a specific problem. Soy, corn, and canola vegetable oils are cheap products of mass agriculture, so Americans love of cheap food brought a vast increase in LA to the diet. An example in the animal kingdom demonstrates LA's effects... When Fall approaches, squirrels eat and store a lot of nuts. Most nuts are high in LA, which causes the squirrel to put on weight for hibernation. But humans don't hibernate and the half-life of LA in the body is 600 days, meaning that it takes about 8 years of a low-LA diet to get a typical American's body fat back in balance. LA is pervasive in American food. Even American eggs have VERY high LA. That comes from the cheap soy meal that makes up most chicken feed. Cheap meat from American chicken and pigs also has high LA because of the animals' diets. Only animals with multiple stomachs, like cows and sheep, don't incorporate LA in their body mass. Most Europeans value the taste of foods made with traditional, saturated fats; Americans value cheap food. Thus, the greater health and longevity of Europeans.

Third, the last piece of the American weight-gain puzzle lies in their adoption of frequent snacking. If Americans ate only at meal time and narrowed their hours of eating each day, our country would gradually lose the world sickness crown. You live in a place with food that provides traditional nutrition. You made a good choice of home country on many levels.

To your family's health,

Gary H.

Sean,

Are you sure it's Biden's deadhand? Not Newsom's live one? The California Cage-Free Egg Standard must affect the transmission of bird flu. Hens are required to have free access to the outdoors where wild birds may visit and transmit endemic avian influenza virus. The State of California might have the right to regulate egg production within its borders, but it clearly does not have the right to regulate Interstate Commerce directly or by market effect (non-tariff barriers), which they have.

Robert R.

Thank you all for writing in. I wanted to include your full remarks because they’re so informative. Robert, thank you for asking about the California Cage-Free Egg Standard, or Proposition 12. As far as we know, the Biden cull is still the number one reason for drastically reduced supply (hence much higher prices), and supply chain disruptions are the second most significant contributor to eggflation. Prop 12 gets the bronze medal.

Wrap Up

I wanted to include more, but the issue runneth over. On Monday, we’ve got the monthly asset class report. I’ll try to do another mailbag on Tuesday, important news notwithstanding.

In the meantime, thanks again and have a great weekend!

Brazil Pays for Prosecuting Trump’s Buddy

Posted July 10, 2025

By Sean Ring

Trump’s Copper Craziness

Posted July 09, 2025

By Sean Ring

The DOJ Killed Itself! (Unlike Epstein)

Posted July 08, 2025

By Sean Ring

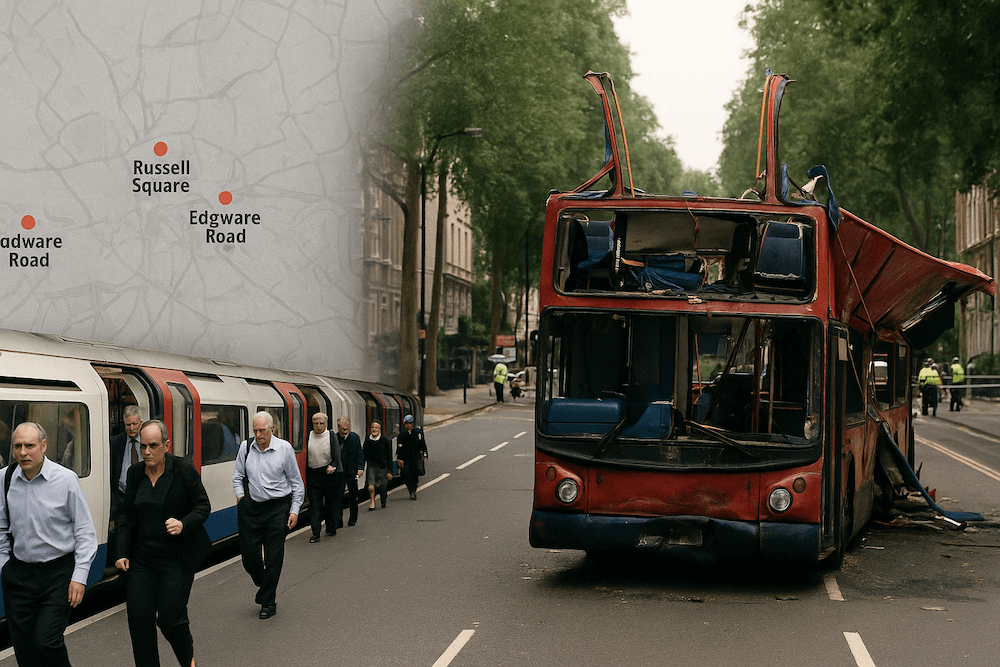

The Day London Bled

Posted July 07, 2025

By Sean Ring

Born in the USA!

Posted July 04, 2025

By Sean Ring