Posted November 27, 2023

By Sean Ring

Move Over Dollar, Here Comes the Petroyuan

Last week, China and Saudi Arabia inked a currency swap deal to shore up economic relations between the two trading partners.

China and Saudi Arabia are each other’s largest trading partners, so this makes complete sense. But it knocks the USD out of the picture. Though it’s a small move now, this has enormous implications for the future.

First, let’s define currency swap lines between central banks and show why they’re used.

The Ins and Outs of Currency Swaps

Currency swaps between central banks are a form of financial agreement where two central banks exchange currencies. This arrangement allows each bank to gain access to foreign currency liquidity, which can be vital, especially during times of financial stress or uncertainty.

Here's a breakdown of how they work:

- Exchange of Principal Amounts: The two central banks initially agree to exchange a specified amount of their currencies at a set exchange rate. For instance, the Federal Reserve might swap US dollars for euros with the European Central Bank. During the 2008 crisis, European banks needed dollars to maintain liquidity.

- Use of Funds: Each central bank uses foreign currency for various purposes, such as providing liquidity to their domestic banks, stabilizing their own currency, or supporting international trade and investment.

- Interest Payments: During the swap period, each central bank may pay interest to the other on the swapped amounts. The interest rates are typically determined based on market rates like the Secured Overnight Funding Rate (SOFR) and EURIBOR.

- Reversal of the Swap: The swap is reversed at the end of the agreed period, and the principal amounts are exchanged back at the original exchange rate. This means the exchange rate risk is mitigated since the rate is locked in from the start of the agreement. Also, these agreements can be rolled over for as long as need be.

What are the benefits of currency swaps?

Currency swaps help central banks manage liquidity risks, stabilize their currencies, and support their banking systems in financial strain. They also enhance cooperation between central banks, promoting financial stability on a global scale.

As a crisis management tool, these swaps became particularly prominent during the 2008 financial crisis when central banks worldwide used them to provide liquidity to their banking systems in various currencies, especially US dollars.

In essence, currency swaps are a tool for central banks to ensure financial stability, manage exchange rate risks, and maintain liquidity in different currencies as needed.

Why is This Deal Important?

From last Monday’s The South China Morning Post:

The central banks of China and Saudi Arabia have agreed on their first currency swap to foster bilateral commerce denominated in the yuan and the riyal, opening the way for more trade to flourish in local currencies.

The People’s Bank of China (PBOC) and the Saudi Central Bank (SAMA) signed a three-year swap agreement for a maximum value of 50 billion yuan (US$6.97 billion), or 26 billion riyals, according to statements on Monday by the two monetary authorities.

The pact, which can be extended by mutual agreement, reflects the strengthening collaboration between the two central banks, SAMA said. The Saudi central bank was looking to strengthen its connections with the PBOC via bilateral dialogues, collaborations in multilateral forums, as well as partnerships in international organizations, SAMA’s governor Ayman bin Mohammed Al-Sayari said in an interview last month.

The agreement with SAMA is the 30th swap signed by the PBOC over the past decade, as China quickened the pace of the yuan’s worldwide usage. The Chinese central bank already has swap agreements with several countries in the Middle East: the United Arab Emirates in 2012, Qatar in 2014, and Egypt in 2016.

In today’s editorial piece, the SCMP wrote:

In immediate terms, the pact will foster bilateral commerce denominated in both the yuan and the riyal. In the longer term, it augurs a petroyuan future as the two countries are already the most important trading partners of each other.

In a global political economy long dominated by the petrodollar, this could be the beginning of a seismic shift. It has been a very long time coming.

It continued:

However, the latest currency swap pact will be the most important. It means trade can be conducted in local currencies, instead of defaulting to the US dollar. This may be seen as a challenge to US dollar dominance. Perhaps in the longer term, it is. But there is a good economic reason.

The current US federal interest rate of 5-plus percent has pushed the dollar to historical levels against most other currencies, making trade denominated in the dollar more expensive.

There are obvious advantages for two big trade partners like China and Saudi Arabia to be able to utilize a local currency option, which will help relieve pressures from having to trade in a more expensive currency.

Global “de-dollarisation” may take a while yet, but the trend already reflects cracks in a global economy long used to US currency settlements.

The yuan may or may not pose a challenge to dollar hegemony, but its internationalization continues apace – to the benefit of both the Chinese and global economies.

We know de-dollarization is a slow-moving beast.

But what if the game plan is much, much more grand?

China’s Big Play

Tom Luongo of the Gold, Goats, and Guns blog is a prolific economic thinker.

Here’s only a tiny part of a mindblowing blog post about the Chinese Grand Plan:

- China is using their US Treasuries and US dollar surpluses to loan them to Emerging Market trade partners of significance to CHINA!

- They are asking for yuan in repayment.

- This stabilizes the yuan/usd exchange rates while China can and is rapidly expanding the money supply to deal with their sagging property markets as a result of the Fed’s aggressively tight monetary policy.

- In order for China to expand the yuan into the new dollar vacuum without also losing their gold (Luke Gromen’s point during the conversation), they have to create a demand cycle for their debt, keeping borrowing costs low.

- Since they have cross-currency swap lines with their SE Asian partners and offshore yuan settlement around the region, i.e., in places like Singapore, this is how they manage the expansion without creating a runaway inflation problem.

- Yuan replace dollars without a massive shift in exchange rates and/or bond yields.

Not only does this almost silently move the reserve status to the CNY, but it also inoculates China and its important trading partners from the danger of USD sanctions.

Wrap Up

And so it begins.

We didn’t get a BRICS currency in August. But we may have got something far more subtle - and lethal - to the USD.

If this plan works, we may see the global financial system remade far sooner than I thought.

Let’s keep a weather eye out for more developments.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

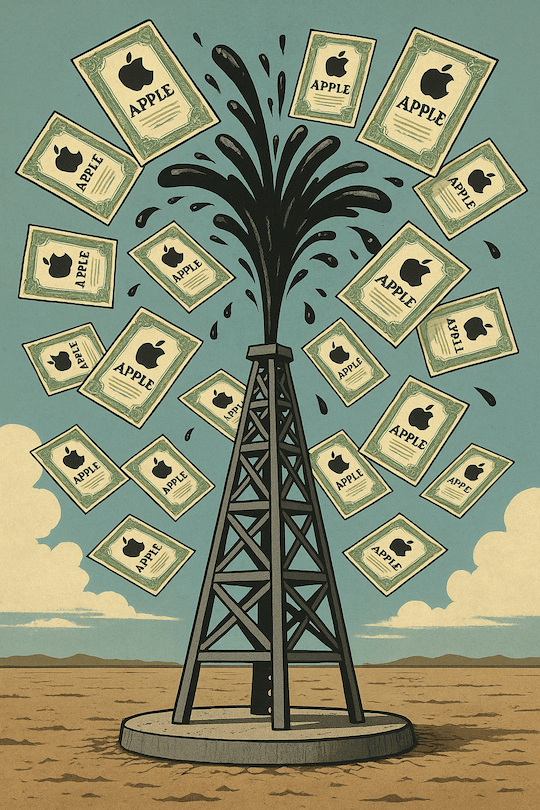

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring