Posted January 30, 2026

By Sean Ring

METALS MELTDOWN!

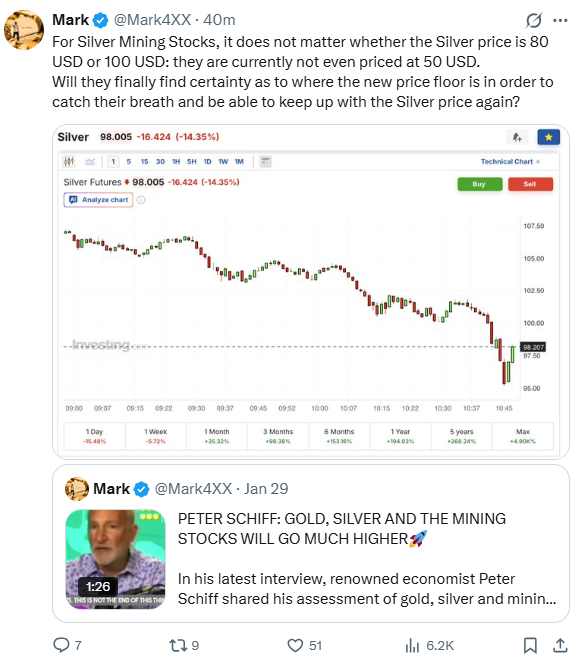

Between the moment I sat down to write this piece and about 45 minutes before it was due, silver dropped from about $108 to $95. Yes, silver traded under $100, and right now, it’s about $99.

I had to scrap the article I had written previously, because it was obsolete in two hours.

Here’s a chart of today’s price action, starting at midnight my time (6 pm ET in the US) and about 11:20 am my time (5:20 am ET):

That’s a year’s worth of price action in barely a half-day.

Mr. Slammy went into the Asian hours and decided to destroy the Chinese traders. Or Chinese traders decided to front-run Mr. Slammy and short silver themselves. I honestly don’t know.

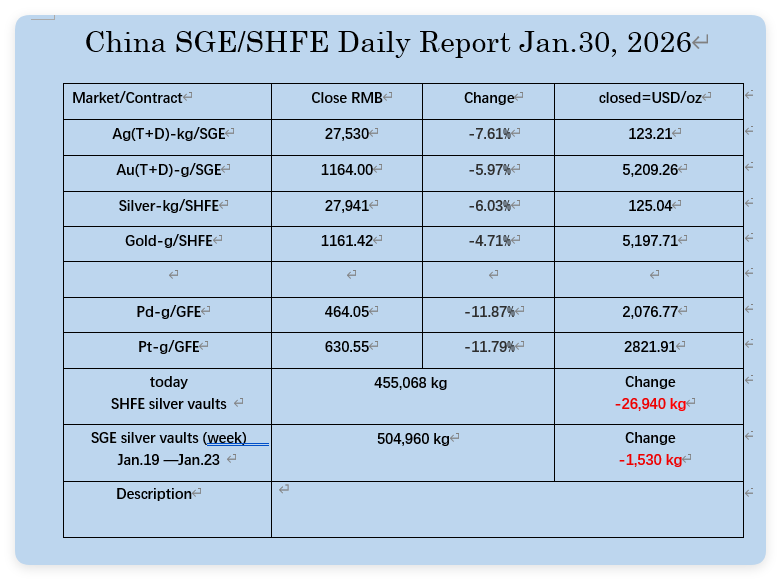

As I write, Shanghai silver is still trading around $122, so the western markets are badly, badly mispriced.

Other than some crazy market manipulation, I’m not sure what precipitated this move.

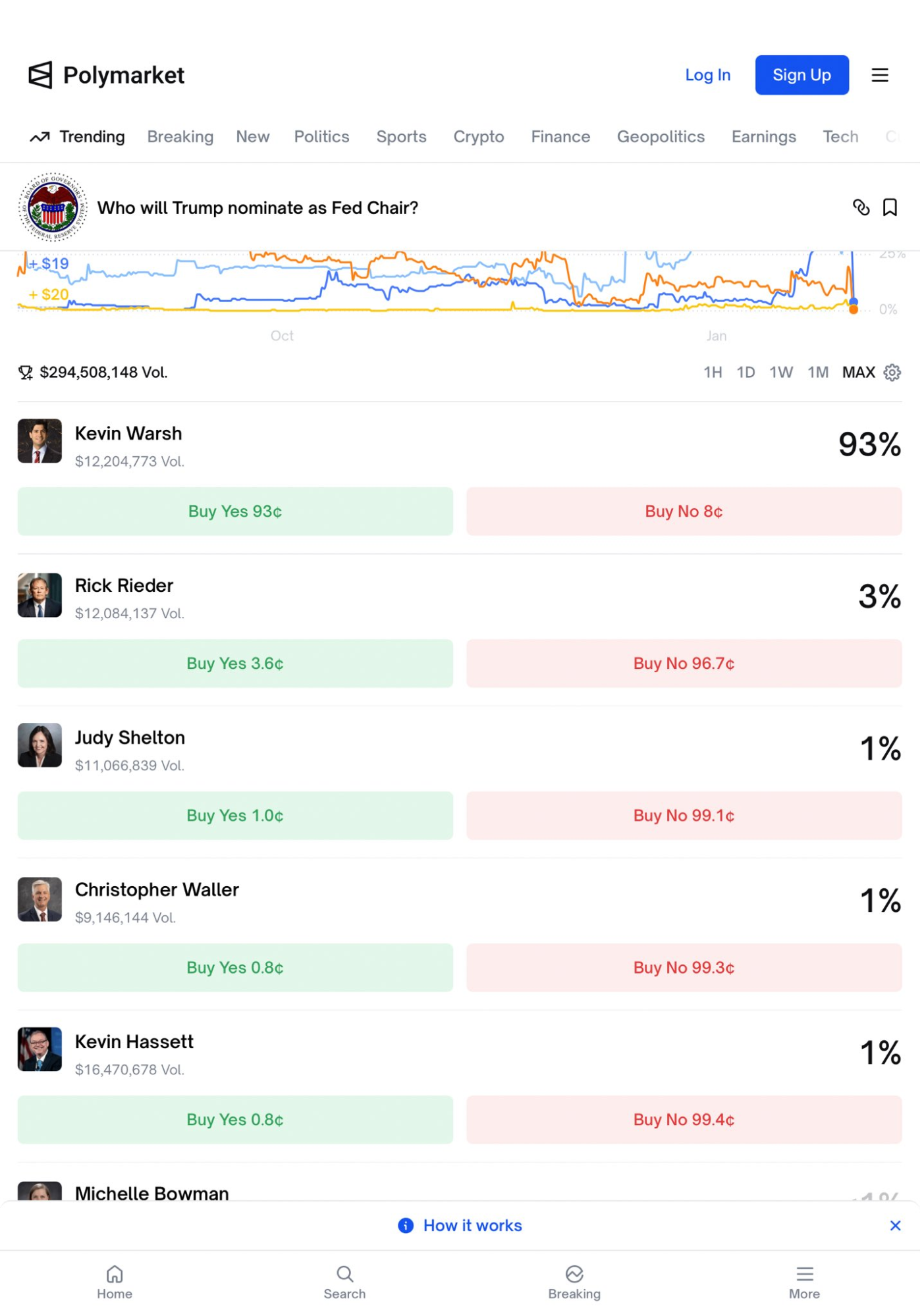

Kevin Warsh looks like he’s going to be the new Chairman of the Fed, which, according to the more conspiratorial members of X, means a takeover by the Bilderberg Group, since Warsh is Ronald Lauder’s son-in-law. Doubtful this smashed silver, but interesting nonetheless.

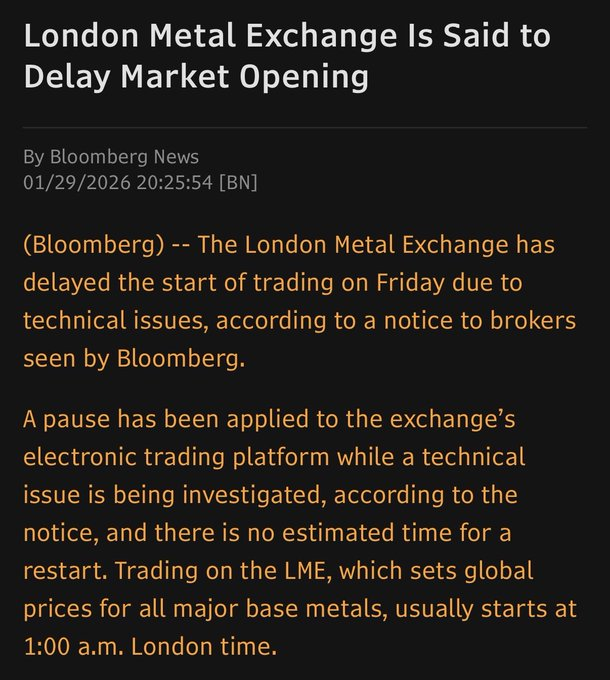

The London Metals Exchange, where base metals trade, delayed its usual opening at 1 am London time today due to a technical issue (allegedly). Again, not sure if this is related.

HSBC also experienced a system shutdown, but I’m not sure if this is related.

Talk about overnight risk!

Peter Spina posted this:

I have never seen anything like this, and the people who have are either 80 years old or long gone.

@Mark4XX had this to say:

He may be correct in the long term, but I doubt mining stocks won’t get monkeyhammered, at least on the open.

Gold was also destroyed, with the yellow metal losing 6%... but staying above $5,000.

Copper was whacked as well, but is down only 4.5%:

Back to Silver

Last night, one of the unofficial Rude portfolio holdings, Viszla (VZLA), lost almost 15% because cartel members kidnapped 10 employees. This introduces another level of geopolitical risk, given how high silver trades.

Since silver is down over 20% from its recent high, technically, it’s in a bear market. But that’s just labeling.

This just in: Shanghai silver closes at $123.21.

That’s some serious disconnect.

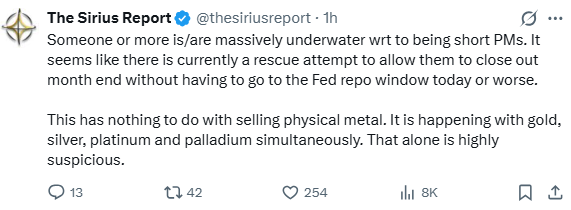

This may have some truth to it, but there’s no way to be sure right now:

A Few Things to Keep In Mind

The first is: if you hit the sell button as soon as you wake up and read this, you will probably have sold at the bottom. I’d wait. And I will wait, myself.

To comfort you somewhat, this is a thin market. Only 80,000 contracts have traded in the silver futures market. For comparison, on Monday, when we had that wonderful spike up from 104 to 115.50, over 312,000 contracts traded.

That means there was no liquidity in the market to sop up the selling. So when the adults return to the market, we’ll see whether they think this is an excellent opportunity to buy. If there’s more selling, it may be time to get out. But we need more evidence.

Second, if Chinese silver closed above $120, do you think the likelihood is that the physical Chinese market will come down to the U.S.’s paper pricing? Or is it more likely this is a shakeout of weaker hands and a bailout of one of the bigger Western players, with the paper silver price once again rising to meet the Chinese physical price? I’m certainly a believer in the latter.

One last thing: someone may have wanted the monthly charts to look different from how they would’ve been otherwise. Bots do crazy things when they see blood on the streets.

Wrap Up

Apologies for this abbreviated edition of the Rude. I simply need to find out more, and I’m at my deadline.

At the top of this piece, which I started barely an hour ago after trashing my first draft, and now, silver rose three dollars to $102.35.

What an insane morning!

On Monday morning, my monthly asset class report will be in your inbox at 7 am, and we’ll see today’s price action and how it affected the month-end closing prices of the metals.

In the meantime, breathe deeply, remain calm, and don’t act emotionally. I know, easier said than done.

And have a restful weekend.

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring