Posted April 11, 2024

By Sean Ring

Measure Twice, Cut Once

The saying "Measure twice, cut once" is timeless wisdom, especially cherished by tailors, carpenters, and anyone whose work involves precise alterations.

The crux of this saying lies in the gravity of its consequences. In tailoring, it's a stark reminder that a single, irreversible action can lead to wasted materials and time. The same principle applies to life and work, urging us to double-check our decisions and actions to avoid unnecessary setbacks.

This proverb transcends its literal meaning, offering a metaphor for life and work: It's wise to be sure before making decisions or actions that can't be undone. It champions the virtue of caution and foresight, encouraging us to consider our actions thoroughly to avoid unnecessary mistakes and do-overs.

If only our politicians and central bankers would heed those words.

Let’s look at why the Fed needs to be damn sure before it cuts - if it even cuts this year.

What Larry Said

Former Treasury Secretary Larry Summers, seen in his secret lair high upon the mountains, talked to Wall Street Weekon Bloomberg yesterday.

Credit: @BloombergTV

Summers said, “In an economy that's growing faster than potential, with an unemployment rate that has a three handle in the presence of massive and growing budget deficits and especially easy financial conditions, the idea that inflation would remain robust or even accelerate should not be a surprise to anyone. And that's what today's data suggests.”

I’m not surprised. You’re not surprised. Larry’s not surprised.

But, for some reason, everyone inside the Eccles Building seems very surprised.

Joe Biden hadn’t winced that hard since he left $85 billion on the ground for the Taliban.

How in Sam Hill is the Fed supposed to cut rates to goose the Biden campaign if inflation won’t go away?

And inflation isn’t the only problem the Fed has.

Fiscal Dominance

Fiscal dominance happens when a government's fiscal policy—the way it spends, taxes, and borrows—overwhelms or dictates the monetary policy set by its central bank.

This situation arises when a government has a high level of debt and relies on the central bank to finance its deficit, either through direct lending or by influencing the central bank to keep interest rates low.

Here’s the onion: In this scenario, the central bank may find itself unable to implement monetary policy effectively to control inflation or stabilize the currency because its primary aim is catering to the government's borrowing needs.

Under normal circumstances, monetary policy should be independent, focusing on managing inflation and keeping the economy stable.

However, with fiscal dominance, the central bank might be pressured to print more money to fund the government's deficit, leading to inflationary pressures or even hyperinflation in extreme cases.

The concept of fiscal dominance highlights the delicate balance between fiscal policy and monetary policy and the potential consequences when one overshadows the other.

Sound familiar?

Here’s the fiscal budget deficits - how much more Congress spends than it receives in tax revenue - under Biden, according to the Congressional Budget Office (CBO):

- 2021: $3.0 trillion

- 2022: $1.4 trillion

- 2023: $1.4 trillion (estimated; final numbers aren’t in yet)

- 2024: $1.6 trillion (projected)

The Fed is Congress’ prisoner.

A Hot Jobs Report

Let’s head back to Larry, who five days ago on Wall Street Week said this about the jobs market:

This was a hot report. Jobs above 300,000, upward revision, strong household survey hours up, payrolls up at nearly a 10% annualized rate. This was a hot report that suggested that, if anything, the economy is reaccelerating. This is very different from what lots of people, most people I think, are expecting and fits the thesis that the neutral rate is much higher than people supposed, and tight money is much less potent than people supposed.

Summers continued:

My view is that the evidence is overwhelming, that the neutral rate is far higher than the 2.5%, 2.6% that the Fed talks about. That evidence comes from four places.

First, we have high interest rates and we have an economy that is, if anything, growing faster than its long-run potential, creating jobs as fast or faster than natural growth in the labor force, even allowing for immigration.

Second, we have an economy with financial conditions that are extremely loose, that are actually looser than they were before the feds started the whole tightening process; if you look at credit spreads, you look at the stock market suggesting that in the fullness of it, all financial conditions actually haven't been tightened in an appreciable way.

Third, if you look at the market's estimate of the long-run neutral rate as formed by looking at longer-term forward interest rates, that neutral rate is comfortably above 4%.

Fourth, if you look at the fundamental determinants of the neutral rate, we have big surges in budget deficits that if anything looks to get worse given the political process. We have big changes in resilience, investment in green investment, in new investment in data centers, along with deglobalization, which may limit capital inflows into our country.

So whether you look at the fundamentals, market estimates, financial conditions, or the current strength of the economy, the evidence seems overwhelming that the neutral rate is far higher than the Fed supposes.

So you have rampant inflation, fiscal dominance, and a hot jobs market, and you need to cut rates to get your boss back in the Oval Office… unless you want a new boss… who was your old boss?

What a mess!

Getting Biden Back In

If you have time later this morning, read my piece in the Morning Reckoning titled “Powell’s Pickle.” It should be out about 11 am ET.

There, I expand on this thesis, with the inflation numbers thrown in for good measure.

The Fed Got Pantsed

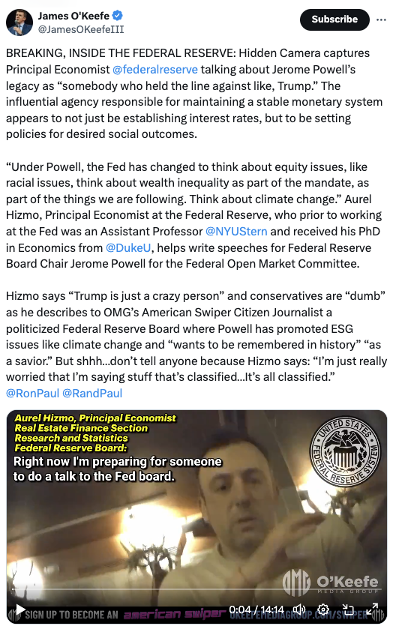

Finally, James O’Keefe, formerly of Project Veritas and now at O’Keefe Media Group (OMG), just caught an economist at the Fed named Aurel Hizmo bragging about how Jay Powell “held the line against, like, Trump.”

Credit: @JamesOKeefeIII

Who talks about this stuff on a random date? Dumb ass.

As our friend Jeff Deist said on Twitter, it’s just one more data point indicating the Fed isn’t a serious organization anymore… and it’s certainly not independent.

Wrap Up

The economic evidence overwhelmingly shows an economy that, if anything, is overheating from all the spending Congress is doing. Not only that, but the Fed hasn’t tightened as much as we thought. This has created increasing prices, a hot jobs market, and a soaring stock market.

Yet, there’s still talk of a rate cut. Why? Because we live in Clown World, folks.

In Clown World, there’s a fair chance that despite our 7,000 RPM economy, The Fed will make the political decision to cut rates in a robust economic and market environment.

It won’t be June. And maybe not July. But the closer it gets to the election, the more political a decision will look.

Unless, of course, we get market turbulence. Then the Fed will ride to the rescue, guilt-free.

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring