Posted June 05, 2023

By Sean Ring

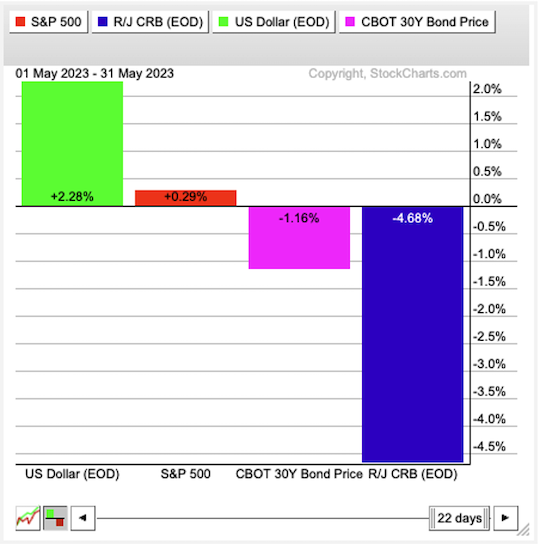

May 2023: Monthly Asset Class Report

- The USD was up over 2%.

- The Nasdaq’s tide is lifting the equities boat, save the small caps.

- Commodities underperformed, including the shiny stuff.

Happy Monday from sunny Northern Italy!

Sorry that I’m a day late (for the second consecutive month).

But, this was actually lucky. While May’s weekly charts ended on Thursday last week, we already know what happened on Friday.

So let’s cheat a bit. On Friday, the S&P 500 finally broke the dreaded 4,200 level. In fact, we’re at 4,282 as of Friday’s close. That’s a full two percent above 4,200.

My guess is the bots will jump on this and buy like gangbusters.

The next resistance level is 4,450 or so. So there’s plenty of room to the upside, from a technical standpoint.

But here’s the onion: on May 31st, Nikileaks (Nick Timiraos) wrote a piece in The Wall Street Journal titled, “Fed Prepares to Skip June Rate Rise but Hike Later.”

An independent source of mine has confirmed the same.

I think Jay Powell pausing here is utter lunacy.

The reason why is that the markets will interpret this “pause” as a “pivot” and rocket the equities markets to the moon.

Then, when Powell is forced to raise again, look out below!

It’s a recipe for disaster and yet another unforced error.

As for commodities, many have asked, “Why is oil so low?”

My answer is this: we’re already in a global recession, and if the CBs around the world didn’t print so much needless cash, oil might have been trading around $10 a barrel.

Now, let’s get to the charts.

S&P 500

The Nasdaq’s rising tide is lifting all boats.

Though this chart shows us ending below 4,200, we’re now well above that level.

If the Fed pauses this month, the next stop is 4,450.

Nasdaq Composite

Two thousand zero zero party over it’s out of time

So tonight I’m gonna party like it’s 1999…

We’ve rallied nearly 3,000 points this year in the Nazzie. That’s nearly 33%.

If this is a sucker’s rally, it’ll be a painful resolution.

It’s worth noting 76 of the 101 Nasdaq stocks are in positive territory.

Russell 2000 (Small caps)

I still think this is the canary in the coal mine.

The spread between the tech stocks and the small caps is getting too wide here. I’d like some participation from the Russell stocks before I get comfortable with the tech and board market rallies.

The US 10-Year Yield

We rose twenty bps (0.20%) since our last asset class report. My comment from two months ago remains:

This is because the market thinks the Fed is done hiking and will cut soon.

I don’t think the Fed is done hiking, nor do I think it’ll cut soon after. There will be a decent interval between the end of the hikes and the beginning of the cuts.

So I think we’re going up from here, though the entire market disagrees with me.

Dollar Index

The dollar is up hard, but stocks didn’t fall.

The important thing to remember is that the euro is 57% of the basket the dollar is weighed against.

So no matter what you think about the dollar, you need to take the awful euro into consideration.

A pause will send the dollar down… temporarily.

USG Bonds

Last month’s comment still stands:

We’ve been rangebound for months now.

If rates head higher, TLT will head back down to 90.

If rates stay where they are, we’ll have a slight upside bias to 115.00.

Investment Grade Bonds

Again, from last month:

Same story here. LQD didn’t move this month.

Higher rates mean heading to 97.

Flat to lower rates send LQD to 111 and then 116.

High Yield Bonds

Again, from last month:

After that big rally last month, we haven’t moved.

We got to get comfortably above 76 before we can get bullish.

If rates continue increasing, HYG heads to 72 and then 69.

Real Estate

We resumed the down move, finally.

Below here, the first level is 77.

Then onto 74.

Base Metals: Copper

From last month:

Down about 20 cents this month, copper’s consolidation zone is starting to sag.

Still, it’s too early to call.

A break below here, and we’ll head down to 3.60 or so.

Yup, copper’s price action is dreadful. Once we get below 3.60, we’re onto 3.35, then 3.25.

Precious Metals: Gold

From last month:

We finally broke above $2,000… and then came right back down.

I’m still bullish on gold and reckon it’ll hit $3,000 from here.

But before then, expect lots of movement around this $2,000 mark. It takes some time to break away psychologically.

If Jim Rickards is right about the new BRICS currency, then you still have time to get in.

Precious Metals: Silver

Just when I told you to get excited, silver fell out of bed.

Honestly, I think we’ll turn this back around quickly. It’s just a pause in the upside.

Cryptos: Bitcoin

BTC got thumped on the head and is trading at around $27,000.

Again, this looks to be a plateau on which consolidation is building.

Cryptos: Ether

From two months ago:

A good chart, but not as good as Bitcoin’s.

I want to see a sustained move above $2,000 before I get excited about ETH.

We’re flat this month, but I can see a rally coming here if the Fed loses the plot.

Trad Asset Class Summary

The USD rallied hard for the second straight month.

The SPX was slightly up as well. But last Friday, June 1st, which isn’t included on this chart, we have a strong follow-through rally.

Bonds were down over 1%, while commodities got crushed to the tune of nearly 5%. Commodities currently suffer from a strong dollar and a weak real economy.

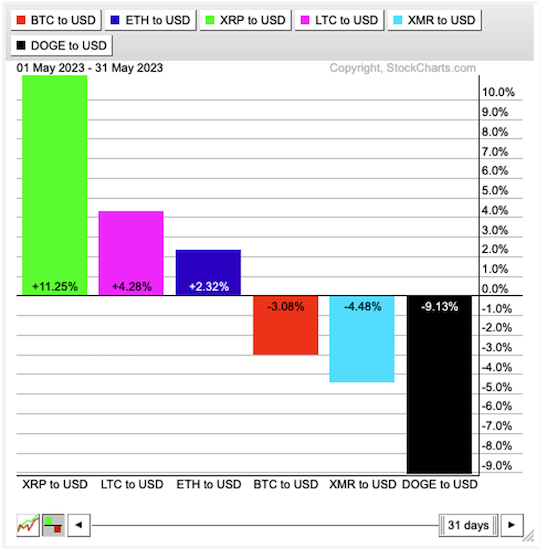

Crypto Class Summary

Ripple, Litecoin, and Ether led the way, while Bitcoin, Monero, and Dogecoin suffered losses.

Wrap Up

Again, if Jay Powell pauses, we’ll have a huge rally because the market will mistake that for a pivot.

And then he’ll rise rates some more before he breaks something.

And then, after much pain, he’ll cut.

In the meantime, enjoy the rally.

Finally, let’s take a moment to enjoy this meme, courtesy of the Twitterverse:

Have a great day!

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali