![[MACR]: Gentlemen Preferred Bonds](http://images.ctfassets.net/vha3zb1lo47k/7qecujzYMAbaVLgU2JJLdl/99421980f25e8fd72de74420baa647cd/SJN-Issue-03-03-25_Featured_.png)

Posted March 03, 2025

By Sean Ring

[MACR]: Gentlemen Preferred Bonds

February 2025 Monthly Asset Class Report

Before I get into the charts, let’s talk about that spat in the White House.

I’m going to call it “ugly, but necessary.” I think Zelensky now knows when the Democrats brief him before a meeting with the President, he should take it with a grain of salt.

Of course, the US Deep State, British Civil Service, and Europe’s inept “elite” need this war to either not admit guilt or to clean out their economies. The last thing the American taxpayer needs is to finance this war.

As my good friend and former Mises Institute President Jeff Deist once told me in an interview, the main feature that distinguishes what we call libertarians from conservatives is that we’re antiwar.

Trump, Vance, and the rest of MAGA know this war is ridiculous and has nothing to do with America (other than its chickenhawk neocons like Nuland, Kagan, Sullivan, Blinken, and McCain starting it). Biden was all too happy to participate because of his family’s corruption.

The Brits have had an irrational hatred of Russia since The Great Game (for central Asia and India). The European elites are too far down the road to admit they killed their economy to kiss the American President’s ring.

That said, the price action from here on will be gripping. The Donald and his Treasury secretary are trying (and succeeding for the moment) to get the 10-year yield down. Will the dollar follow? Will assets rise on the back of that or fall?

S&P 500

Again, the chart doesn’t look terrible by any means, but we may be starting to roll over. We’ve got a new price target of 5,535. That’s only a 7% drop. If you’re an optimist, it’s a nice breather. If not, it’s the beginning of something more sinister.

Nasdaq Composite

As I wrote last month, we’re rolling over. Our downside target was lowered slightly to 17,729.

As you can see from the chart below, NVDA (which is a big Nazzie constituent) is looking shaky. I don’t like that it closed below its 200-day moving average and that its 50-day moving average is declining. We may have a significant downside move in the next month or two.

Russell 2000 (Small caps)

I called a 10-point drop for February and we got 12. It was a rough last two weeks for the Russell. Our original call of 192 is now the official downside target. We’re below the 200-day moving average with a sharply declining 50-day moving average. Another month or two to hit the target, I’d say.

The US 10-Year Yield

From last month:

We hit well above the 4.64% target we set last month, and the 10Y fell right afterward. The question is, “Does the 10Y stop at 4.30% (where resistance turns into support), or does it crash through there on its way to 3.50%?” Jay Powell won’t cut anytime soon (unless The Donald pressures him enough), so we may return to 5.00% after hitting 4.30%.

Credit to new Treasury Secretary Scott Bessant: he wants that 10-year down to make loans more affordable. He may just get it. Though the target is still 4.80%, my bet is we’re heading to 3.50% or so. But does the dollar come down with it?

Dollar Index

I was wrong on this one, as we dropped over a point this month. Bessant’s assault on the 10-year yield should pressure the dollar. But my bias against the euro (especially), sterling (doubly so), and yen (the BoJ just loves destroying their currency) makes it hard for me to see the dollar dropping significantly without an outright, and quite frankly, bloody recession.

The price target is still over 120, but I can’t see that yet. We may just hover between 107 and 109 for a while.

USG Bonds

I got this wrong. I simply hate bonds with the inherent inflation yet to be squeezed out of the system. But bonds were up because the inflation numbers don’t look “that bad,” the lack of consumer confidence, and the flight to quality (their words, not mine).

Investment Grade Bonds

Wrong again, here. That’ll be a theme with respect to bonds. However, the price target for LQD is down to 101.12, so maybe I’m on to something.

High Yield Bonds

We moved up ever so slightly. That’ll be the way until the fall.

Real Estate

Another incorrect call on real estate. IT rallied further and has an upside target of 102.59.

Energy: West Texas Intermediate (Oil)

Base Metals: Copper

Again, a big, unexpected rally at the beginning of February brought us up 27 cents this month. However, it looks like we’re heading back down. If we fall from here, we could easily revisit the 4.05-4.00 area.

Precious Metals: Gold

It looked so good until last week, when Mr. Slammy decided to come in and smash gold and silver merely to preserve the current monetary system. Yawn.

My price target is $3,700. So there.

Precious Metals: Silver

Ugh. Another pause on the way to glory. We may even hit $30 before resuming our ascent. Patience is a virtue, but you must have the patience of a saint while you wait for silver to break out, it seems!

Cryptos: Bitcoin

Bitcoin dove below $80,000 for a few moments, before The Donald announced a new Bitcoin reserve. I think it’s ludicrous, myself. But Michael Saylor must be breathing a sigh of relief.

Still looking for $126,000, but I wouldn’t be surprised to see more selling here.

Cryptos: Ether

Wow. Got this totally right. We fell even further than the $2,500 I called to $2,356. The downside target is $1,300. Ether is awful right now. Continue to avoid.

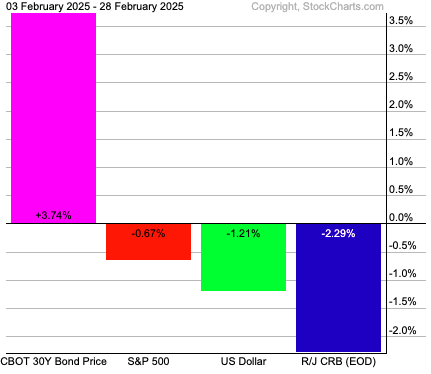

Trad Asset Class Summary

The Almighty Dollar fell another 1%, but stocks and commodities also fell this month. Against the odds, the long bond rose 3.74%, while the SPX fell 67 basis points. Commodities had a rough month, losing 2.29%. This is structurally odd, and it may signal something going on in the market’s plumbing that we’re unaware of.

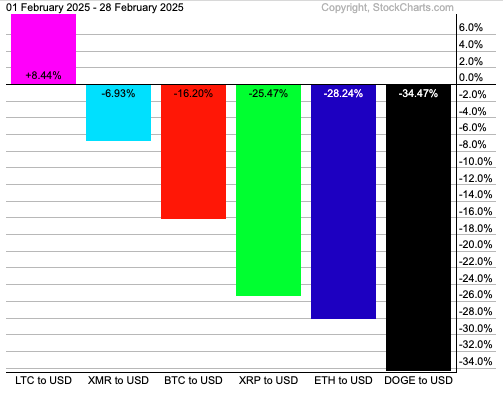

Crypto Class Summary

It was an awful month for the crypto bros. The only winner was Litecoin, gaining 8.44%. Everything else was down, with Bitcoin losing 16.2% but recovering since Friday’s close. XRP lost 25.47%, Ether continued its tough run, losing 28.24%, and Dogecoin got crushed, down 34.47%.

Wrap Up

Stocks and crypto look shaky. Bonds had a Fabulous February, much to my surprise.

Gold and silver will make us wait longer. And if you’re a miner investor, even longer than that.

Finally, let’s take a moment, courtesy of the X-verse:

Have a wonderful week!

L'oro dell'Italia

Posted December 05, 2025

By Sean Ring

The Border Threat No One Saw Coming

Posted December 04, 2025

By Sean Ring

Beating Inflation by Following the Trend

Posted December 03, 2025

By Sean Ring

The Curious Case of the Disappearing Silver

Posted December 02, 2025

By Sean Ring

Silver Surfing... and Bonus Tickers!

Posted December 01, 2025

By Sean Ring