Posted November 28, 2023

By Byron King

King: This “Doctor” Is Interested In You

My talk with Rick Rule - coming tonight on the Paradigm Press YouTube Channel - still has my intellectual juices stirring. (We’ll send you the link when the edited video is uploaded later.)

One of Rick’s tenets is to buy things when they’re out of favor. Rick likes to buy stuff when no other speculative competition drives up the price. It’s a much more eloquent way of saying, “Buy when there’s blood in the streets.”

All eyes are on gold for the second straight month to see if it’ll finally hold above $2,000/oz at the month's end. I’ll write more on that in our Monthly Asset Class Report this Friday.

But our good friend and frequent Rude contributor Byron King is already looking ahead to the next thing out of favor.

Read on… and I’ll see you tomorrow.

You May Not Be Interested in Copper, But Copper’s Interested in You

The title of this article is a riff on what Leon Trotsky once said about war.

Some things are out of your control. When war breaks out, it breaks out. You may not have assassinated the Archduke in Sarajevo, but you’re still involved after some other guy did the deed.

When things break down, you just have to roll; you make your way as best you can.

Today, we’ll apply that same thinking to an element of the periodic table, namely copper.

We’re in the early innings of significant changes in the world’s use of copper, and by extension, we’ll see major price moves. There’s money to be made if you play it right. And, of course, I’ll give you some ideas below.

There’s much more to say, so let’s dig in…

No doubt you’re aware of price increases in just about everything lately.

Go to the gas station or the grocery store. Buy some lumber. Or consider the empty shelves and order backlogs for everything from new furniture to swimming pool chemicals.

You know what happened. Last year, the global economy twisted itself into a knot with Covid and related shutdowns.

Across the globe, vast and intricate wiring diagrams of supply chains tangled up into tight knots, as we saw with the problems created by a single ship running aground in the Suez Canal not long ago.

You see the effects at the cash register now: increasing prices, aka inflation, considering the Niagara of new federal money supply chasing fewer goods.

Now, you may not buy much raw copper — unless you perhaps install new, high-end gutters and downspouts.

What’s happening here?

It’s a copper-led industrial recovery that touches many things across the world.

First, one quick point. Note that copper isn’t Bitcoin or some other cyber-instrument. Copper is a real thing, not an encrypted code. People mine copper, process it, and refine it into metal that goes into almost everything — including the machines that crunch crypto keys.

If you’re reading this article, think copper. And thank copper. Your computer, smartphone, and other electronics wouldn’t work without it. Your electricity arrives via copper wires. And much more copper is involved in the upstream process, from transformers on utility poles back to the power plant.

Your car uses copper. And if it’s an electric vehicle (EV), it uses a lot of copper. Airplanes use copper. Refrigerators and microwave ovens use copper. New and remodeled houses use copper. And I could list many more things if we had the time and space.

In other articles, we’ve discussed how the Biden administration’s new emphasis on “infrastructure” will require more copper. Well, yes. That’s true if the U.S. begins to rebuild its aging and accident-prone electric grid.

It took 150 years to build out the current U.S. grid. If the U.S. goes “all-electric,” the country will have to triple the size and scope of this system within the next 25 years.

We’ve looked at the growing focus on EVs for transport, from the car in your driveway to delivery trucks, buses, and more. Part of it is the Biden administration’s push against hydrocarbon fuels. Much of it is an industrial trend that was happening in any event.

One way or another, we’ll see more and more demand for copper.

This looming copper rush is not just an American thing, either. Indeed, over half of the world’s annual copper supply is used in China, and there’s no sign of a slowdown there. Belt-and-Road, military buildup, factory to the world, you name it. China does copper, big time.

Meanwhile, the rest of the world is also following similar demand trends for copper. According to Germany’s Commerzbank AG, “The decarbonization trends in many countries — which include switching to electric vehicles and expanding wind and solar power — are likely to generate additional demand for metals (meaning copper and others, ed.).”

Other major trading houses and merchant banks expect copper to extend gains from Bank of America to Citigroup. According to Goldman Sachs, “Copper is the new oil.”

All is well and good, but there are problems.

At the outset, one critical issue was that most of the world’s largest copper mines were old. And I mean old!

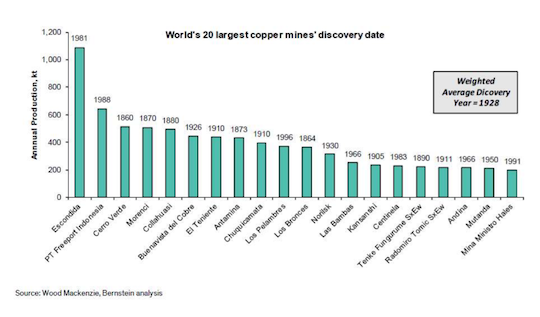

According to the consulting firm Wood Mackenzie, the average date of discovery of the world’s top 20 copper mines was 1928. No typo. 1-9-2-8.

You don’t have to be a geology scholar to understand the importance of this point. The average age of the world’s copper discoveries is 93 years old. In other words, they happened a long, long time ago.

As a real live geologist, I must admit that even I was impressed (if that’s the word) at the age of some of the names on this discovery list above.

If you follow the copper space, then you recognize several true icons. Mines like Escondida in Chile, Freeport’s Grasberg in Indonesia, Morenci in Arizona. And even a personal favorite of mine, Norilsk in Russia. Superb operations, really.

All of these mining projects have their unique geologic merits. They’ve served mankind quite well over the decades. But even the best mines play out over time.

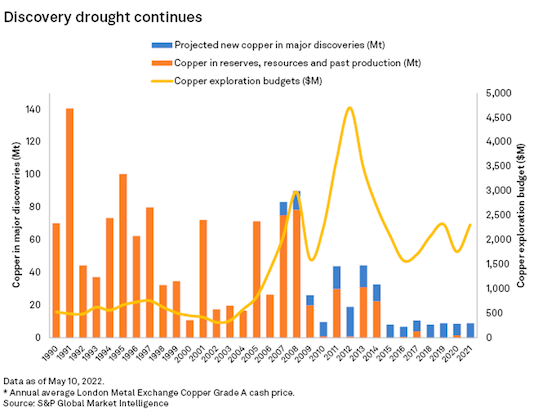

As mines play out, the industry must explore and find new deposits. So, is that happening? Well, not so much.

Here’s a chart from S&P Global Market Intelligence, tracking discoveries over the past 30 years. You can see the trends.

Per this chart, you can see how, in the past decade, copper exploration budgets spiked up and down. But the general trend in discoveries is down.

Meanwhile, the average ore grade of copper mines worldwide has been steadily falling, per another analysis by Wood Mackenzie.

Look at those two lines in the chart. The average processed grade is steadily falling, meaning that ore that runs through the mill holds less and less copper. This means more tonnage to process, using more energy, water, and chemicals, and generating more waste rock. It’s more costly in every respect.

Look at that other line for the average reserve grade. It’s even lower than the processed grade line. What’s left in the ground for future mining is even lower grade than the low grades we see now.

Let me say that another way. Whatever we’re mining now, we’ll be mining lower grades in the future, meaning higher costs and less final product for each input of energy, labor, and materials.

So where is this all leading? Glad you asked…

Here are several points to keep in mind:

- Politically, the world is on a trend to decarbonize. But that’s not possible without mining and delivering a lot more copper. Going “green” requires much “red,” meaning the red metal copper.

- The copper industry needs to prepare to meet rising demand with new supply at the level of mines and mills. Large new deposits are just not there. In other words, as economists say, supply is “sticky.” Thus, the world is staring down the barrel of major shortages.

- From recent prices of $8,000 per ton, expect copper up to $10,000 and even $15,000 or more.

- Much of the world’s copper comes from South America, primarily Chile and Peru. Much more copper comes from Africa, especially the Democratic Republic of the Congo. And for now, just plant the idea in your head of what’s called “resource nationalism,” meaning that mining jurisdictions are watching the price increases and writing new tax laws.

Closer to home, is all of this investable? Of course.

And as I’ve noted many times before, we’re not here to give you personal financial advice. But I do follow the mining space. Indeed, I watch it like a hawk. And along those lines…

Consider an industrial giant like Freeport-McMoran (FCX), a significant player in the copper space. It’s a great company, but the share price has increased from $6.20 last year to well over $40. Likely, there’s upside left as copper prices rise, but the big, multi-bag gains are behind us.

Or look at BHP (BHP), another industrial giant. Its shares are up quite well in the past year, although not the stratospheric runup we saw with Freeport. But BHP pays a nice dividend of over 4%, which isn’t shabby nowadays.

In past articles, I’ve mentioned a much smaller company named Riverside Resources (RVSDF), which trades over the counter (OTC) in the U.S. It’s under contract with the above-noted BHP to go out and find large deposits of copper and related metals in Mexico. In this respect, Riverside gives you exposure to BHP with more of an upside.

Another intriguing exploration play is Western Copper and Gold (WRN), an advanced explorer and early-stage developer in the Yukon. Western controls a massive copper-gold play up there, and yes, I’ve been to the project site numerous times. It just partnered up with mining giant Rio Tinto (RIO), which made what’s called a “strategic investment” in the company, a very positive sign. (And Rio itself pays a dividend north of 5%.)

I could offer a list of other promising copper exploration plays in the U.S. and Canada, let alone Mexico or South America. There are many fine names in the early exploration and development days.

At this point, I’ll mention another name, an under-appreciated “copper” play called Group Ten Metals (PGEZF), also trading OTC.

Group Ten works in Montana, adjacent to the massive Sibanye-Stillwater (SBSW) platinum group metals (PGM) complex. The company is an early-stage explorer. Its mineralogy combines copper-nickel, PGM, and various other valuable metals. That is, it’s more than just a red metal play.

Still, for speculative investors, Group Ten is one of those companies with upside on top of upside. When I visited the site a year and a half ago (pre-Covid), the first thing I saw coming out of the drill core was fresh, high-grade nickel-PGM sulfide mineralization.

Group Ten offers domestic, exploration-level exposure to copper, nickel, cobalt, PGM, gold, and silver. All are sitting immediately adjacent to a major mining operation in the Sibanye group. You don’t get much better than that.

That’s all for now. You can invest or not. But wrap your head around the idea that copper is in play, and there’s not enough.

You may not be interested in copper, but copper is interested in you.

On that note, I rest my case.

That’s all for now… Thank you for subscribing and reading.

❤️🔥HOLY SMOKE! An American Pope!

Posted May 09, 2025

By Sean Ring

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring