Posted April 09, 2024

By Byron King

King: Can Silver Pull a Cocoa?

Spot silver hit $27.80 per ounce yesterday. And like the rising gold price, which just surpassed $2,300 per ounce, it looks like there’s more yet to come. In other words, precious metals are rapidly repricing.

This immediately tells me that Wall Street and the City of London have lost control over the price of gold and silver. From all appearances, pricing power has shifted East to India, China, and other BRICS nations, which now dominate physical purchases.

If you bought gold or silver during the past decade, you must feel pretty good right now. The price is up and apparently heading higher.

So today, let’s discuss silver and a looming, much larger price jump than what we’ve already seen.

But First, We’ll Discuss Cocoa!

Yes, before we get to silver, let’s look at cocoa (like in chocolate) because, price-wise, cocoa has recently melted up and exploded.

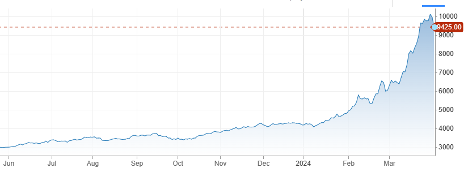

Could this also happen with silver? Begin with the one-year cocoa chart:

They Just Came for the Cocoa. (Now, Will They Come for Silver?)

Price chart for Cocoa (screenshot from CNBC)

This chart covers June of last year to the present. It shows over a triple in price for cocoa, with the big move from $4,000 to $10,000 per tonne coming in the past two months.

(By comparison, if this kind of price move happened with silver, we’d see the metal at over $80 per ounce, but this gets ahead of the story.)

Let’s be realistic, though. Is this situation with cocoa normal? Do massive price moves occur routinely in the cocoa space? No, and this is kind of weird. Indeed, the current cocoa price has rapidly climbed to a historic high. It’s unprecedented, and here’s a chart for the past 25 years to prove it:

A quarter century of cocoa; no big price explosion until now. TradingEconomics.com.

For decades, cocoa traded at under $4,000 per tonne; mostly, it traded well under $4,000. This chart goes back to 1999, and it looks much the same previously, back into the 1970s. Sure, over the years, Cocoa has had ups and downs, but there has never been an upward blowout like we have seen recently. This is definitely different, so what’s going on?

Yeah, What’s Going On?

First, it’s basic economics 101. There’s a cocoa supply issue because of dry weather across equatorial regions where people grow the crop. Per the map below, these areas range from East Asia to West Africa and the Caribbean and Central/South America.

The world’s cocoa growth regions, courtesy International Cocoa Organization

In fact, the world’s largest cocoa-producing nations are Ivory Coast and Ghana in West Africa, with Indonesia in Southeast Asia coming in a solid but distant third. These three nations together account for over seventy percent of total global cocoa production.

There’s no need to delve into meteorology or climate issues. Just think about the lack of water or soil moisture to nurture the cocoa trees in crucial producing nations. Then consider dry conditions and many uncontrolled wildfires, which result in a much smaller crop.

The long and short is that the world’s overall cocoa crop has fallen this past year. There’s a cocoa shortage in trade, and the problem cannot even begin to improve until next year and the next harvest season (with more rain along the way, growers hope).

Of course, high prices will draw new investments in cocoa farming: more trees, better irrigation, etc. But that will take time, and for the moment we have a supply crunch that can’t be fixed in the next eighteen months to two years at least, and perhaps longer.

Meanwhile, on the demand side, people across the world love chocolate. Right now, large-scale cocoa processing companies like Cargill, Hershey, Mondelez, and Nestle enjoy the luxury of selling into strong markets. Buyers will pay high prices for finished cocoa products, and thus, the bid continues to rise.

In addition, market momentum should be considered because cocoa futures have just exhibited an obvious rocket ride. As you might expect, that kind of flash and cash lures new hands to the table, who ask to be dealt in and then put additional money in play. This speculative component alone can exaggerate price moves.

Finally, consider the notion that what we see with cocoa is also evidence of a reboot in the arena of price discovery generally, with cocoa becoming the poster example of what can happen with a globally popular agricultural product.

And just as with gold, which I mentioned at the beginning of this note, the cocoa phenomenon may signal that price discovery is moving away from Western hands towards the East.

Don’t get the wrong idea about changes in global price-setting. Cocoa-based products like chocolate aren’t really “food” in the strict sense, not like wheat or soybeans. But many people across the world enjoy the taste of chocolate, and it’s no stretch to regard this kind of confection as a poor man’s luxury; hence, it enjoys a robust global market. In other words, cocoa exhibits what economists call “inelastic demand.”

To sum up, the recent rise in cocoa prices reflects a serious supply shortfall, rising demand, and the need for new investment, which will require time and a sense of momentum as people watch the price levitate. All that in the face of a world where the very idea of price discovery is rebooting towards the East, away from traditional Western markets and trading pits.

Now, How About Silver?

Silver isn’t chocolate, but it has long been called “the poor man’s gold.” And silver is both an industrial and monetary metal.

There’s an ancient pedigree for silver as money deep in the archaeological record. People write books about the history of silver as money (and on that point, I recommend The Story of Silver: How the White Metal Shaped America and the Modern World, William Silber [2019]).

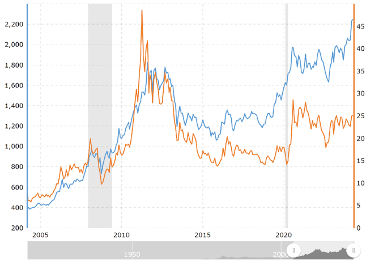

First, let’s look at the silver price over the past twenty years:

Silver price since 2004, courtesy Silverprice.

Note the enormous run-up and back down in price, 2011 – 13; at one point, silver was well over $40 per ounce (nearly $50 in 2011). Then, the metal was traded in the mid-teens' doldrums for a few years, from 2014 to 2020. And after a jump in 2020 (related to Covid panic buying), silver’s price support was range-bound in the low $20s for the past few years.

Now, over those same twenty years, let’s also compare the continuous contract price for gold and silver:

Gold (blue)/Silver (brown) prices since April 2004, courtesy Macrotrends.net.

Per the chart, silver and gold tracked closely through 2011 – 13; they both moved up and down pretty well in tandem. For the past decade, though, since 2014, silver has lagged gold despite a strong runup at one point in 2020 (the Covid panic-buy).

For our purposes, silver has traded in a range in the past couple of years and shows legacy weakness relative to gold, with an expanding gap even now. But can this change? Can silver pull off a “slingshot” effect and deliver strong gains?

Think Like a Cocoa Trader

Think like a cocoa trader for a moment. In terms of demand, silver is popular in a sticky, if not inelastic, way.

Begin with the monetary angle: even though silver is no longer used in the world’s currencies, it’s absent from U.S. coinage, for example, since a law in 1965 that took silver out of circulation. However, across the world, individuals, businesses, and governments (China and India come to mind) still buy silver, including old coins and raw silver bullion. Silver stacking is a worldwide phenomenon.

Meanwhile, silver is a crucial industrial metal. It is a key to every imaginable kind of electronics and absolutely necessary in the fast-growing sector of solar power. Silver also has growing uses in fields ranging from water purification to medical products like antiseptic bandages. Thus, its demand is solid and growing.

As for supply, statistics from the Global Silver Institute show that global silver output from mines is basically flat, if not declining. Countries like Mexico, Peru, and China struggle to maintain production at levels of previous years. Large silver-producing companies like Fresnillo, Newmont, Glencore, and more show declining numbers. Thus, it’s not far-fetched to say that the world may be at “peak silver” just now.

And yes, we have exploration plays for silver out there and more than a few strong developers. I follow the mining space, and I’ve seen and visited many great, promising companies.

But as with cocoa, these silver plays aren’t turnkey operations. All will require time for new silver deposits to see the light of day, plus immense capital to build mines, mills, and related infrastructure. Oh, and to find and train a new workforce because much of the present labor pool is “legacy,” if you get my drift.

And what about momentum? Well, the price of silver has moved up in recent weeks, but it’s not quite a rocket ride like cocoa—not yet, anyway.

Then again, people tend not to see tipping points, nor to appreciate how rapidly they can occur. That is, you may awaken one morning, and the price of something (like cocoa or perhaps silver) will be on a tear, and to the casual observer, it will make no sense.

Whatever the case, the question to ask yourself is if you are on the silver train right now, before it all begins to move very much? Or will you wait it out a while until you’re sure the train is rolling? Or will you be running down the platform, trying to grab onto something before it all leaves the station?

Another point to consider is what has happened with price discovery in metals in general, and precious metals in particular. Gold has definitely moved by over $300 in just the past four months. It hit new highs just last week. The formerly routine daily sell-down in, say, New York just can’t beat out the global army of bidders who want to move towards some semblance of monetary safety as the U.S. government destroys its currency in an orgy of growing debt and interest payments.

Final takeaway: Silver is moving, and I suspect it will do a slingshot to catch up with gold in terms of relative value, metal for metal. Own physical silver, of course. Own paper silver if you want to trade the space (e.g., iShares Silver Trust: SLV). And own silver producers like Pan American Silver (PAAS), MAG Silver (MAG), Hecla (HL), and Silvercrest (SILV).

Of course, there are many other smaller plays in the silver exploration, development, and mining space, many with great fundamentals and assets, and massive upside. The metal is moving by every indication, so you should buy a ticket and get on the train.

That’s all for now. Thank you for subscribing and reading.

Lessons I Learned from New Jersey

Posted May 02, 2024

By Byron King

Time For a Breather

Posted May 01, 2024

By Sean Ring

Sanctions For Thee, But Not For Me…

Posted April 30, 2024

By Sean Ring

A Matter of Trust

Posted April 29, 2024

By Sean Ring

Happy Rude Year!

Posted April 26, 2024

By Sean Ring