Posted March 17, 2025

By Sean Ring

Keeping The Green in Ireland

Happy St. Patrick’s Day! I hope you all enjoy a tipple or two tonight. Stay safe out there.

Funnily enough, I always think about my Italian grandmother on St. Patrick’s Day. She made the best corned beef and cabbage I’ve ever tasted. (After all, St. Paddy’s is a Catholic holiday.) Irish pubs never quite get the seasoning right.

Today, I’ll let you in on a few secrets. The Double Irish with a Dutch Sandwich isn’t a menu combo from your local pub. And the Single Malt that replaces it isn’t a Scotch.

Read on, my friend, to see how U.S. companies use Irish entities to keep your prices low.

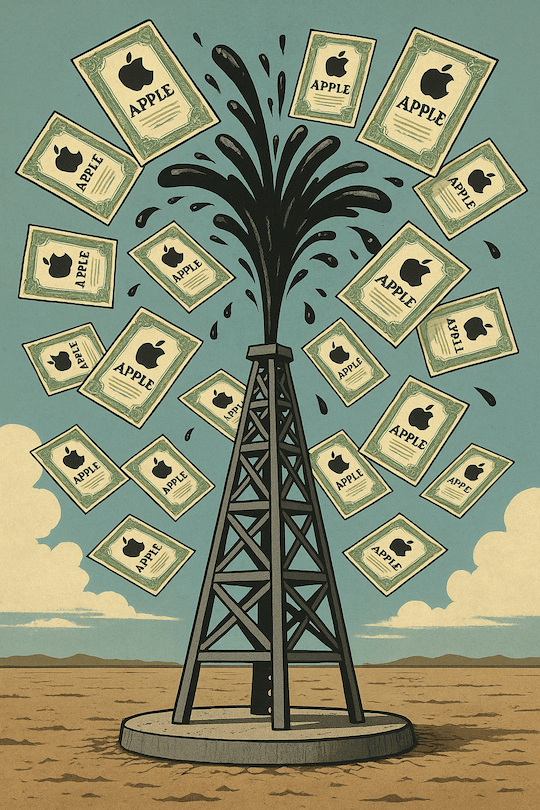

The Irish Double-Take: How American Companies Keep Dodging Taxes

Benjamin Franklin once said that there are only two things in life that are certain: death and taxes. But if you’re a multinational corporation with the right legal team, taxes aren’t all that certain. And nowhere is this clearer than in the ongoing saga of American corporations leveraging Irish business structures to avoid the soon-to-be halved IRS from stealing from them.

The trick? It’s called the Double Irish with a Dutch Sandwich. Despite efforts to shut it down, variations of it have evolved. This loophole has legally saved Apple, Google, Facebook (Meta), and, importantly, their customers billions in taxes.

How the Double Irish Works

- Company AAPL sets up two Irish subsidiaries: Irish Co. #1 and Irish Co. #2.

- Irish Co. #1 owns valuable intellectual property (IP) and is incorporated in Ireland but controlled from a tax haven like Bermuda, meaning it pays little to no corporate tax.

- Irish Co. #2 is a regular Irish company that generates revenue from sales in Europe and beyond.

- The profits from Irish Co. #2 are then shifted to Irish Co. #1 via massive royalty payments for the use of intellectual property.

- Before the money reaches Bermuda, it stops in the Netherlands—hence the Dutch Sandwich—where Dutch tax laws allow for the free movement of such payments without additional withholding taxes.

- Once in Bermuda (or another zero-tax jurisdiction), the profits sit comfortably offshore, tax-free.

The IRS vs. Irish Creativity

The U.S. government spent years trying to shut down this scheme. In 2015, Ireland announced it would phase out the Double Irish by 2020, which it did. But large corporations don’t just shrug and accept higher taxes—they adapt.

Today, many companies have transitioned to the Single Malt strategy (using Irish-Maltese treaties) or simply restructured their holdings to achieve similar tax efficiencies. Apple, for instance, famously shuffled around its IP holdings to another tax haven, Jersey - the old one off the coast of France, not Joisey - after its initial Irish strategy came under fire.

America’s Response: Global Tax Reform?

Former U.S. Treasury Secretary Janet Yellen campaigned for a global minimum corporate tax to stop companies from shopping for the lowest rates. In 2021, over 130 countries agreed to a 15% minimum corporate tax rate under an OECD-led initiative.

However, enforcement remains spotty, and the U.S. itself still encourages offshore profit shifting through loopholes like the Global Intangible Low-Taxed Income (GILTI—get it?) provisions, which—despite the name—often allow multinationals to continue avoiding higher rates.

What’s the Endgame?

As long as tax havens exist, corporations will find ways to avoid paying full corporate tax, and thank God for that!

Despite the pressure, Ireland remains a hub for corporate tax gamesmanship. Meanwhile, the U.S. tax code—all 6,000 pages—ensures companies will continue parking profits offshore rather than repatriating them at full freight. There are advantages in obfuscation!

Ultimately, the big winners are shareholders, employees, and customers.

Wrap Up

Far from being upset about this, the EU is finally doing something right. By letting Ireland be used as a U.S. tax runaround, those companies’ products and services are cheaper than they otherwise would be.

Though they’re called “corporate taxes,” companies don’t pay them. Customers, employees, and shareholders ultimately do.

Have a great day today and a great week ahead!

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring