Posted April 17, 2024

By Sean Ring

It’s Higher For Longer

After the recent resurgence in inflation, Jay Powell is unlikely to give the markets their desperately desired rate cuts.

And who can blame him?

Contrary to what they say on Wall Street and inside the Beltway, inflation isn’t simply “going down.” In reality, prices are still going up, just not as fast as before. Bidenomic apologists conveniently overlook that fact when talking about the economy.

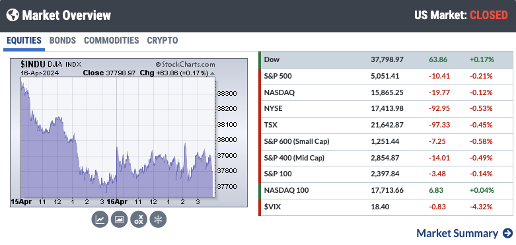

Amazingly, the major stock markets were flat yesterday rather than down hard.

But even in a world of fiscal dominance, Powell’s words still matter.

Powell’s Speech

Chairman Powell's speech yesterday, "The Economic Outlook and the Road Ahead for Monetary Policy," focused on the Federal Reserve's commitment to transparency, communication, and public trust.

He emphasized the importance of avoiding mission creep and respecting the limits of the Fed's mandate, particularly regarding issues such as tax and spending policies, immigration policy, trade policy, and climate change.

Powell also discussed the economic outlook and monetary policy, noting that the Federal Open Market Committee (FOMC) participants see it as likely to be appropriate to begin lowering the policy rate at some point this year, depending on the progress of inflation and the labor market.

He acknowledged the risks on both sides of the decision, such as reducing rates too soon or too much, which could reverse progress on inflation, and easing policy too late or too little, which could unduly weaken economic activity and employment.

The Outcome

Nick Timiraos, known colloquially on The Street as “Nikileaks” for his spot-on Fed watching, wrote in The Wall Street Journal (bolds mine):

[Powell’s] remarks indicated a clear shift in the Fed’s outlook following a third consecutive month of stronger-than-anticipated inflation readings, which derailed hopes that the central bank might be able to deliver pre-emptive rate cuts this summer. Officials had previously said they were looking for greater confidence that inflation was returning to their target and were optimistic another month or two of data might meet that standard.

“The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence,” Powell said at a moderated question-and-answer session in Washington. The remarks were his first public comments since an inflation report last week sent stocks sliding as investors recalibrated their rate-cut expectations.

The S&P 500 fell slightly after Powell spoke, and investors sold Treasurys, sending up yields. The 2-year Treasury note yield briefly hit 5% for the first time since November.

Powell indicated Tuesday the Fed wasn’t considering rate increases, either. Instead, Powell said officials would leave rates at their current level “as long as needed” if inflation proved more stubborn.He also said the Fed would be prepared to cut rates if the economy was slowing sharply. Officials raised rates last summer to a 23-year high and have held them there since July.

The Effects on the Convenience Yield

The convenience yield is a concept in finance that refers to the benefit of holding a physical asset, such as a commodity, like gold, or a bond, instead of a financial asset, such as a futures contract or a cash equivalent.

The Federal Reserve's decision to maintain interest rates at their current level has a profound impact, leaving the convenience yield high for several reasons.

First, the Federal Reserve's interest rate policy affects the supply and demand for reserves, which impacts the convenience yield on reserves. When the Federal Reserve holds interest rates steady, it increases the demand for reserves, increasing the convenience yield on reserves. Banks and other financial institutions may be willing to have more reserves if they earn a higher return than on different assets, such as Treasury bills or commercial paper.

Second, the Federal Reserve's interest rate policy affects the convenience yield on Treasury securities. When the Federal Reserve holds interest rates steady, it increases the demand for Treasury securities, increasing the convenience yield on these securities. Investors may be willing to hold Treasury securities even if they offer a lower yield than other assets, such as corporate bonds or stocks because they are perceived as safer and more liquid.

Third, the Federal Reserve's interest rate policy affects the convenience yield on other financial assets, such as futures contracts or options. When the Federal Reserve holds interest rates steady, it increases the demand for these assets, which increases the convenience yield on these assets. Investors may be willing to hold these assets even if they offer a lower yield than other assets, such as Treasury securities or corporate bonds because they are perceived as being less risky and more liquid.

The Federal Reserve's decision to hold interest rates steady leaves the convenience yield high for several reasons. Its interest rate policy affects the supply and demand for reserves, affecting their convenience yield. The Federal Reserve's interest rate policy also affects the convenience yield on Treasury securities and other financial assets, such as futures contracts or options. By holding interest rates steady, the Federal Reserve increases the demand for these assets, which increases the convenience yield on these assets.

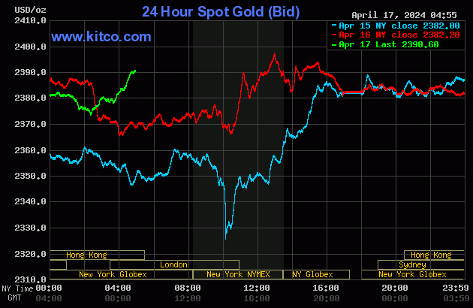

Bottom line: increase the convenience yield and decrease the asset price, like gold.

Or is it?

Wrap Up

That’s the theory, anyway.

Despite the economic fluctuations, gold, silver, and copper prices demonstrated remarkable resilience, providing a sense of stability in the market.

Now, they see these metals as hedges against war, keeping their prices up.

Gold should reach $2,400 any day now.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring