Posted July 13, 2023

By Sean Ring

It’s Disinflation, Not Deflation.

Happy Thursday from a surprisingly fun New York City!

I taught a class on Strategic Thinking today. It was a hoot. I’ll write about it later. But the CPI number came out yesterday, and that’s important.

But first, let me give you some news.

As a reader of the Rude, you know my good friend and colleague Byron King frequently contributes to our newsletter.

If you’ve read his research, it’s clear why.

Byron is a Harvard-trained geologist and an all-around fountain of knowledge. I soak up everything he writes.

I want to let you know Byron will be this week’s special guest on Rickards Uncensored.

With everything going on (including volatile markets, sky-high inflation, geopolitical turmoil, and more)… I highly recommend you attend.

If you don’t know, Rickards Uncensored is a private Zoom call we host every week with Jim Rickards and other members of his team. I’ve spoken many times and even hosted a couple of sessions!

This private group meets up once per week every Friday at 10 AM with Jim or a member of his team, where we carefully review all of the important developments from that week.

Members of this unique group can also directly ask Jim and us questions and more.

In short, being a part of this group gives you direct access to Jim and his entire research staff – myself included.

And it gives you access to all of our best predictions and insights.

As one of my readers, I’d hate to see you miss out.

Now, let’s get to the economics.

Inflation Has Come Down

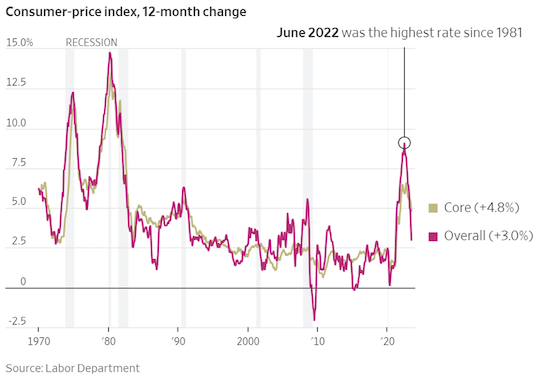

Year-on-year CPI was expected to come in at 3.1% but was actually 3.0%. Last month, it was 4.0%.

Year-on-year core CPI came in at 4.8% versus an expected 5.0%. Last month, it was a hefty 5.3%.

So the inflation numbers have come down. That’s indeed good news.

Credit: The Wall Street Journal

However, prices are still rising. Just slower than they once were.

But Did Inflation Decrease?

In economics, inflation, disinflation, and deflation are terms used to describe different trends in the general price level of goods and services within an economy. Here's an explanation of each term:

Inflation: Inflation refers to a sustained increase in the average level of prices for goods and services in an economy over time. It means that the purchasing power of money decreases as prices rise. Various factors, such as increased demand, supply shocks, changes in production costs, or expansionary monetary policies, cause inflation.

Keynesian economists consider mild inflation beneficial for an economy as it allegedly encourages spending and investment.

But at least they admit high inflation or hyperinflation has adverse effects, such as eroding savings and creating economic instability.

Disinflation: Disinflation refers to a decrease in the rate of inflation. It means the general price level is still rising but slower than before.

In other words, disinflation indicates a slowdown in the rate of price increases.

For example, if the inflation rate in an economy decreases from 5% to 2%, it’s experiencing disinflation. Disinflation is often the result of deliberate monetary or fiscal policies aimed at reducing inflationary pressures in an economy.

Deflation: Deflation is the opposite of inflation. It’s the sustained decrease in the general price level of goods and services over time.

In a deflationary environment, the purchasing power of money increases as prices fall. Deflation occurs because of reduced demand, overcapacity in production, technological advancements, or restrictive monetary policies.

According to Keynesian economists, falling prices may seem beneficial for consumers. But deflation has adverse economic effects, like decreased spending, lower investment, increased debt burdens, and even economic recessions.

I disagree with the Keynesians. Deflation is a good thing. Because young people can afford to buy houses, have one parent working, and raise children.

Where did I get that from? A man named Murray.

Rothbard on Inflation

Murray Rothbard's views on inflation were influenced by his broader libertarian and Austrian school of economics perspectives, which emphasized individual liberty, free markets, and limited government intervention.

He considered inflation primarily a monetary phenomenon caused by an expansion of the money supply.

Rothbard argued inflation wasn’t simply a price rise but a consequence of an increase in the money supply that distorted the market's price signals and disrupted economic calculation.

According to Rothbard, inflation benefited certain groups at the expense of others.

He believed the primary beneficiaries of inflation were the government and its favored interest groups, such as politically connected corporations and banks. They received the newly created money first. To me, this point is indisputable.

In contrast, those who received the money later in the process or held fixed-income assets, like workers and savers, suffered a decline in their purchasing power as prices rose.

Rothbard criticized the mainstream Keynesian approach to inflation, which views it as a necessary evil to stimulate economic growth. He argued that this perspective ignored the negative consequences of inflation, such as the erosion of savings, misallocation of resources, and economic distortions.

Rothbard advocated a sound money system based on a free-market approach to money and banking. He believed that a competitive banking system, unrestricted by government intervention, would provide a stable monetary system with minimal inflationary tendencies.

Now What?

The market popped today on the news. Here’s the SPX over two days with 15-minute bars.

As soon as the market opened (an hour after the CPI numbers came out), it spiked 0.7% and stayed there for the rest of the session.

Gold was up over $20 today to finish at $1,961.70.

The dollar index has been getting destroyed lately and took a beating today:

When the dollar’s down, it takes more of them to buy stuff. Hence, the price of stuff goes up.

That’s stocks, bonds, commodities, and real estate.

Bitcoin remained subdued, however.

Wrap Up

According to the charts and the dollar, there’s no reason to be bearish.

As bad as I think everything is, everything is going up.

That may change with the BRICS announcement. Maybe not.

Right now, this is a bull with big horns.

Have a great day!

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso