Posted December 11, 2023

By Sean Ring

Is the Uranium Rally Just Beginning?

When I chatted with Rick Rule the other week, he said, “The easy money has been made in uranium.”

I’m sure he’s correct, as uranium was a hated asset early this year and has rallied 50% since that bottom.

The URA ETF was trading at $9 pre-Covid and has nearly tripled since then. Since the Covid bottom, it’s quadrupled.

We may have a ways to go with this rally, especially if URA breaks above $30.

Let’s walk through uranium and its growing importance to the energy market.

The Cat’s Out of the Bag

Last week, COP28 President and CEO of the Abu Dhabi National Oil Company (ADNOC) Sultan Ahmed Al Jaber said:

I accepted to come to this meeting to have a sober and mature conversation. I’m not in any way signing up to any discussion that is alarmist. There is no science out there, or no scenario out there, that says that the phase-out of fossil fuel is what’s going to achieve 1.5C.

Basically, the John Kerrys and Al Gores of the world have been unmasked. No one believes the earth will melt if we don’t get temperatures down 1.5C (at an exorbitant cost).

So they’ve had to retrench.

If you recall, when Fukushima happened in 2011, Merkel’s Germany, in its seemingly bottomless stupidity, canceled all its nuclear reactors. Since Mutti was the face of Europe, many other countries followed suit. (Luckily for them, the French weren’t so stupid.)

Germany has returned to coal plants to keep the lights on and industry going. And China and India never got off coal plants.

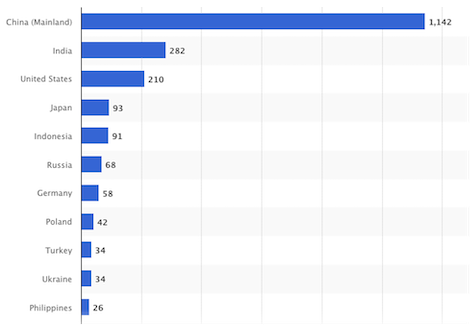

According to Statista, at the end of July 2023, these countries had the most coal-fired plants:

Credit: Statista

China and India are at the top of the list.

With the climate alarmists feeling their precious agenda taking hit after hit, they’ve felt the need to sound sensible for once. Hence, we need to start talking about clean-burning nuclear energy again.

That’s great, as nuclear is indeed the way forward. But there’s one huge obstacle in the way.

RUSSIA!

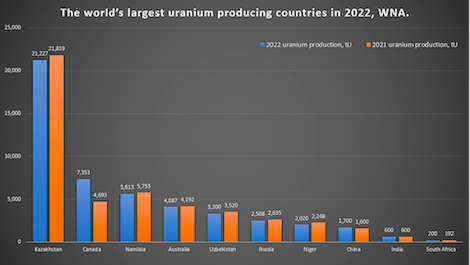

Now, Russia, per se, isn’t the problem. It’s just that two of the biggest uranium-producing countries are former Soviet satellites that use Russian technology to get the uranium out of the ground.

Credit: Kitco

And, of course, the Russians are wise. If they can’t control the reserves, they’ll control the process.

So, what does the process look like?

From Ore to Energy

This process of converting uranium from metal to energy has four main stages:

- Mining and Milling: First, uranium is extracted from the ground, similar to other kinds of mining. Once the ore is obtained, it undergoes milling. This involves crushing the ore and treating it with chemicals to separate the uranium from other minerals in the ore. The result is a powder called "yellowcake" (U3O8), the raw form of uranium.

- Conversion: The yellowcake is then taken to a conversion facility. It's transformed into uranium hexafluoride (UF6), a gas at relatively low temperatures. This step is necessary because it's easier to process uranium in its gaseous form in the next stage.

- Enrichment: In nature, uranium consists mainly of two isotopes: U-238 and U-235. U-235 is the fissile one, meaning it can sustain a nuclear chain reaction, but it's only about 0.7% of natural uranium. To be used as fuel in most reactors, this percentage needs to be increased, which is done through enrichment. During enrichment, the concentration of U-235 is increased, often up to about 3-5% for typical reactor fuel.

- Fuel Fabrication: The enriched uranium hexafluoride is finally converted into uranium dioxide (UO2) powder and pressed into small pellets. These pellets are then loaded into thin tubes of a special metal alloy to form fuel rods. These rods are assembled into fuel assemblies, which are then ready to be used in a nuclear reactor.

So, how does Russia control this process? It may not have the uranium in the ground, but It’s an expert at conversion, enrichment, and fuel fabrication.

Uranium’s US Supply Constraints

The United States relies on other countries for most of these steps (conversion through fuel fabrication), mainly due to the specialized facilities and technologies required for each stage and economic, environmental, and policy reasons.

For example, the U.S. can mine and mill uranium but might depend on other countries for the complex conversion, enrichment, and fabrication processes. This reliance has enormous implications for energy security and policy.

There's only one US-owned converter and no US-owned enricher for the current fleet of nuclear reactors. Meanwhile, Russia dominates both of those steps.

From a 2022 article in The Wall Street Journal (bolds mine):

Russian uranium enrichment accounts for around 35% of the global market, according to UxC. Uranium’s conversion into a gas is the other weak link in the supply chain. The only commercial uranium conversion plants outside of Russia operate in France and Canada.

The sole U.S. plant in Illinois has been idled since 2017, though it is scheduled to come online again in 2023, according to owner Honeywell International Inc. China has uranium conversion and enrichment plants but tends to supply its own reactors instead of exporting to other countries.

The price of raw uranium is the most visible part of the market, but costs for each processing stage are rising, too, as power producers rethink supply chains and sign new deals with Russian companies.

Boosting domestic capacity would take several years, said Adam Rodman, founder of hedge fund Segra Capital Management LLC. “This market has become too comfortable despite a fragile supply chain,” he said.

Wrap Up

The ridiculous sanctions have come back to bite Westerners once again. Once an unloved asset, Uranium is now one of the world’s most sought-after.

The U.S. needs to get its house in order just to be able to compete.

If not, it’s at the mercy of Russia and its allies.

And in this race, there’s no silver medal for second place.

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards