Posted January 30, 2025

By Byron King

In the Face of Disaster, Hold Cash

It’s a new year with a new U.S. President and a new outlook on the future of America and the world. So, let’s discuss money, income, cash flow, wealth, and how to preserve that wealth in the face of whatever might come down the line.

But first…

“There’s Nothing Left”

I spoke with a friend who used to live in Pacific Palisades. Yes, that Pacific Palisades in Los Angeles. He was renting a house that burned in the recent fires. And now he doesn’t live there anymore.

Post-fire, Pacific Palisades. Courtesy Arizona Republic.

Post-fire, Pacific Palisades. Courtesy Arizona Republic.

“I’m personally okay,” he said, “but I lost everything. My place burned down to the concrete slab. There’s nothing left but ashes and crud, charred wood, and a few things made of metal, like the washing machine and refrigerator. Everything was gutted.”

Right now, he lives out of a spare room at a friend’s house. “I drove to Walmart to buy socks, underwear, and basic items like shirts, pants, and a belt. While I was there, I realized I didn’t have a toothbrush or even a tube of toothpaste. It’s strange to realize that you instantly go from a comfortable life, which includes a whole bunch of stuff, to having nothing except what’s in the back of your car, out in the parking lot.”

He added, “I never paid much attention to the homeless people camped along the streets and bike trails. In their own way, the homeless were part of the backdrop of LA, the sad scenery, and the unfortunate, uncomfortable downside of Tinseltown. And I lived my life in a different world. That’s California culture, right? Hey, that’s modern America.”

He went on: “All of a sudden? Guess who doesn’t have a home? Guess who’s driving around with no place to go? Some hotels jacked up the rates to $1,000 per night. Rental properties are out of sight, cost-wise. It’s humbling. And okay, at least I’m not sleeping under a plastic tarp with my whole life jammed into a shopping cart. But I’m definitely living through an epiphany.”

LA homeless site, near Union Station. BWK photo.

LA homeless site, near Union Station. BWK photo.

All I did was listen. My old acquaintance was pumped with adrenaline and still numb from events. But he wanted to vent, to unload. My job was simply to be there and take in what he was letting loose. My only comments were deep, meaningful insights like, “Yup,” and “Uh huh,” and “Wow,” and “Oh man, that sucks.”

As my friend described his ordeal, he hit on a major point in his life going forward: “I went to check out at Walmart and pulled a credit card. Instantly, it struck me that my bank branch burned down. But that’s okay because it’s a big bank. So, from wherever they do things like that, they’ll send me the statement with the charges. But since the house burned down, there’s no place for the mail to go. But I guess it doesn’t matter because I pay my bills online.”

Looking Ahead… to Insurance Claims

The good news is that this fellow still has a job. His place of employment didn’t burn, and he’s still working and on payroll. His income is directly deposited into an account at that big bank he mentioned, even though the local branch burned to a crisp.

Toward the end of the call, we touched on a substantive matter. I told my friend that no matter what he thought his occupation was before the fire, he was about to find himself up to his eyeballs in the insurance adjustment business after the disaster.

That is, he’ll submit claims to his insurance company. Then, he’ll wrestle with adjustors over every dollar. What burned up? What was it worth? And it’ll be frustrating.

Meanwhile, he must deal with issues like filing his 2024 federal tax return now that all of his home records are gone. He must also deal with similar matters at the state and local levels, with those innumerable layers of tax.

Again, the guy lived in a rental property, so he didn’t have to clean up the mess or worry about rebuilding. That pleasure remains for the landowner, unless that person decides to avoid headaches, sell out to some cash-rich carpetbag speculator, and then head off to other pastures.

And what of the future? Well, it’s California. Somebody, somewhere, always wants to buy property in the Golden State and then build something. This buy-build pattern seems to be the case out there, even in the face of legal and regulatory hurdles to development that literally fill volumes: everything from the California Coastal Commission to local and state building codes to finding cleanup firms, architects, bankers, contractors, building materials and more.

Post Disaster, Comes the Panic

The LA fires have been at the top of the news recently. According to AccuWeather, damage estimates exceed $250 billion, based on that company’s proprietary methodology. And unlike the case with many other disasters that have hit the country, massive and tragic as they are in their own way, these recent LA fires occurred in an uber-wealthy locale that carries outsized impact on the national economy, if not culture itself via Hollywood. So, what might happen?

One historical analogy is the 1906 San Francisco earthquake, which caused fires that destroyed much of the city.

San Francisco 1906, post-earthquake and fire. Courtesy U.S. Geological Survey.

San Francisco 1906, post-earthquake and fire. Courtesy U.S. Geological Survey.

The immediate damage was bad enough, as seen from this remarkable, early aerial photo of the city by the Bay. The earthquake and fires caused widespread destruction and loss of life. Imagine cleaning up a burnt, collapsed city in the days before people had heavy equipment like the ones we use today. It was all shovels and wheelbarrows.

Post-disaster, as 1906 unfolded, the economic effects spread far from California. Insurance claims from San Francisco pulsed through the U.S. and even the global banking system. Payouts drained funds from venues like New York, London, and Paris. Liquidity tightened across the globe.

By 1907, the world was experiencing what we today would call a recession, a significant contraction of business activity, mainly due to the widespread inability of buyers and sellers to close transactions for cash (aka the aforementioned lack of “liquidity”). As noted, large amounts of real money had rolled down the proverbial tracks to San Francisco to pay loss claims and finance reconstruction.

Later, in 1907, with the U.S. economy already weak, a relatively mundane series of failed Wall Street speculations and lousy business deals led to a spate of bankruptcies that pushed the U.S. into a financial “panic,” an old term seldom used anymore, but descriptive for what happened.

That is, a panic is marked by deep financial disturbances that include confidence-killing bank and insurance company failures. Often as not, feverish stock speculation occurs that leads to an overextended market, which sooner or later crashes back down.

Across the economy, during a panic, the psychology of money goes risk-off. People with cash stop spending and lending, which rapidly, dramatically slows business activity, reduces employment, and curtails tax receipts. Then comes a tidal wave of personal and business insolvencies and bankruptcies. And be aware: even cities, counties, and states can go bankrupt.

So, will the LA fires lead to something similar?

We’re a Long Way from 1907 (and 1914 Too)

If you know your U.S. history, you may recall that the Panic of 1907 was epochal. The federal government was nearly insolvent, running out of funds, and couldn’t pay its bills. So, Uncle Sam had to borrow gold-backed cash from banker J.P. Morgan.

For obvious reasons, the 1907 episode was politically embarrassing to the power players in Washington, D.C. The U.S. Treasury should never be at the mercy of some New York banking tycoon, right?

The short version is that out of it all came a political consensus (narrow, it’s worth noting) to establish an American central bank via legislation in December 1913 that set up the Federal Reserve.

The idea behind the Fed was to create a national-scale monetary entity capable of expanding or contracting the money supply in the economy. As people have called it from the beginning, the mission was to create an “elastic currency.”

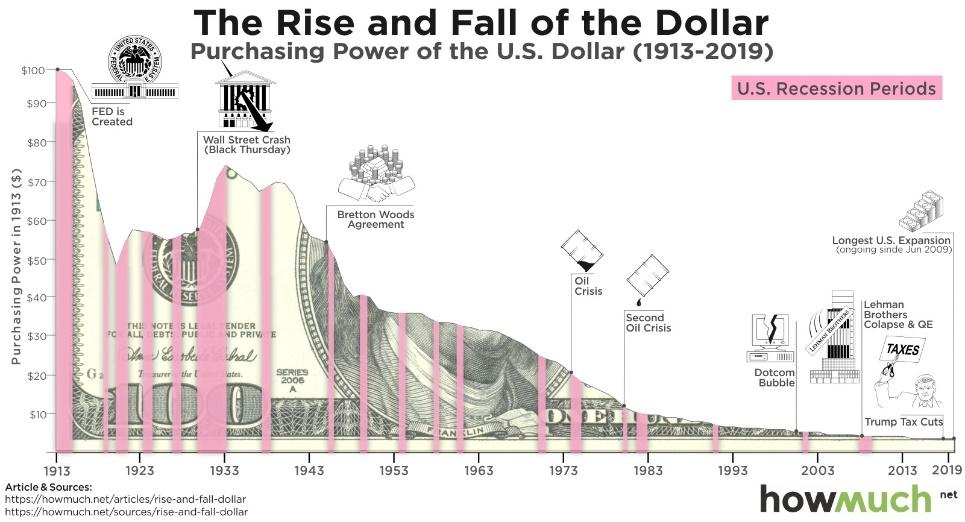

Of course, since 1914, America’s elastic currency has only expanded one way to add more and more dollars into the economy, almost always faster than the underlying expansion of productive capacity and output. Fundamentally, this is why we have inflation. It’s why the purchasing power of the dollar declines year after year.

Perhaps, along the road of your investing life, you’ve seen an image like this below; it shows graphically the long-term, 110-year decline in purchasing power of the dollar under the elastic, expansionist ministrations of the Fed:

Fed’s handiwork on the dollar, 1914 – present.

Fed’s handiwork on the dollar, 1914 – present.

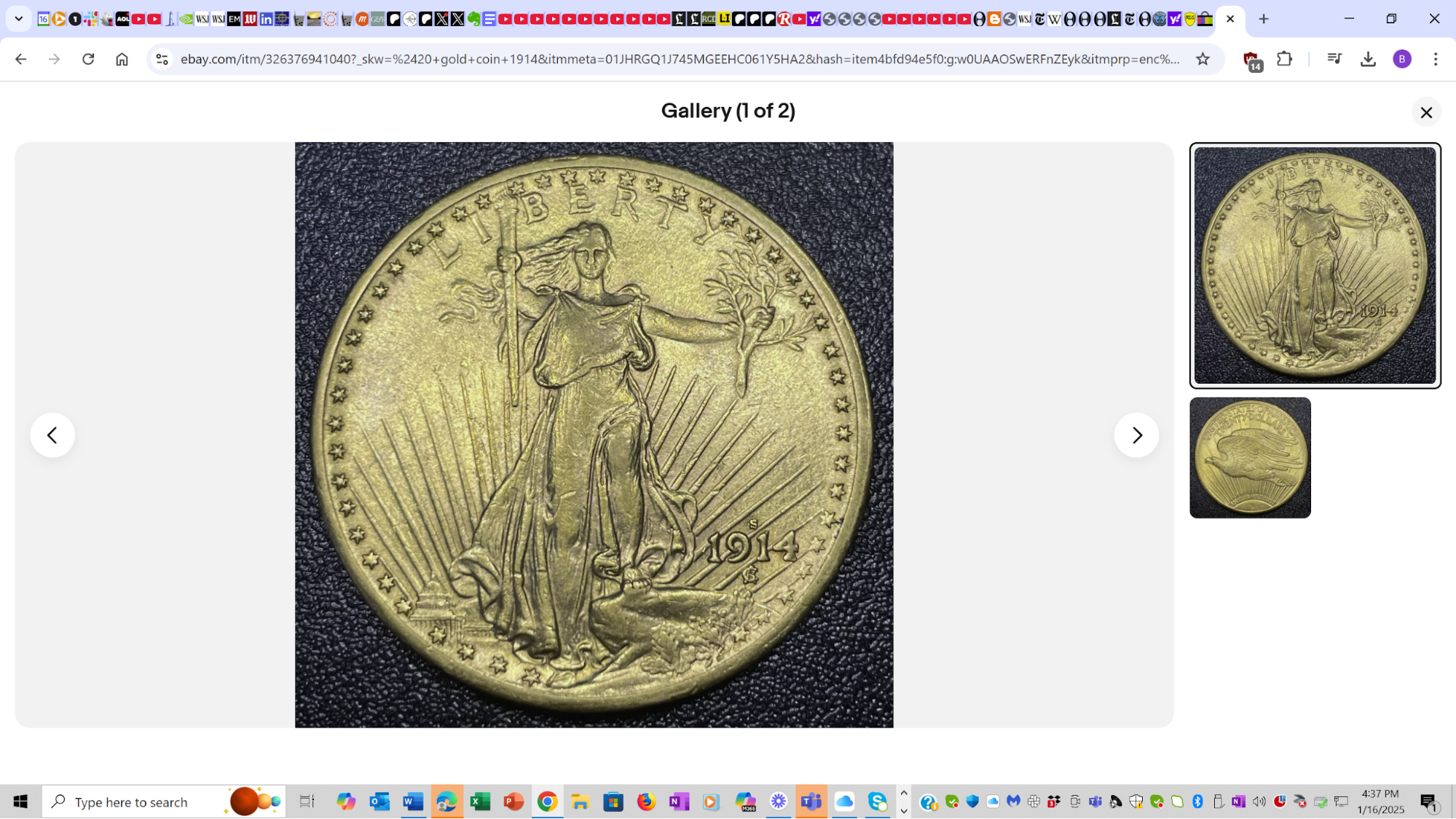

Another way to make the point is with this $20 face value 1914 Federal Reserve note, issued in the first year of the Fed’s existence.

1914 Federal Reserve Note, denominated $20.

1914 Federal Reserve Note, denominated $20.

Back then, a $20 Fed note was worth exactly… hmm… (checks notes)… $20; or in other words, it was worth one of these:

1914 U.S. $20-coin, St. Gaudens design.

1914 U.S. $20-coin, St. Gaudens design.

This is a 1914 U.S. gold coin, called a “St. Gaudens” after the designer, a sculptor named Augustus St. Gaudens. Its gold content is precisely 30.093 grams, and some copper was added to harden the metal.

If you follow coins, today you’ll pay about $3,000 or more for this item on eBay if you want to own it. The price depends on quality (i.e., scratches, nicks, etc.), and there’s a premium for the numismatic value. However, the gold content of this American monetary relic has always been the same, just shy of an ounce, meaning that the yellow metal content has a value of about $2,740 at current gold prices.

Preserve Your Wealth

With all this in mind, let’s discuss preserving your wealth. Beware of fire and floods, too; I’ve lived through a flood but never a fire. Whatever your situation, stay humble because you never know when something bad can happen. Fate is cruel.

Have cash in the bank, too—and I mean off-site, not stuffed into your mattress in a house that could burn up or wash away. Of course, be sure that your bank can withstand the impact of a major event such as what we saw in California or last fall in North Carolina.

Meanwhile, right now, as the new year unfolds, don’t be afraid to take some cash off the table from your market gains of 2024. Cash is dry gunpowder, to make a slightly unfortunate comparison to current events. And it’s nice to have some cash in the stash. You never know when an unexpected expense will hit your life.

As we’ve said many times before, own physical precious metals, certainly gold and silver. Over the long haul, gold has held its value, as we’ve just seen going back to 1914 and before.

Yes, Donald Trump is taking over the White House, and he’ll definitely run a different government than the one we experienced under the Biden administration. However, Trump’s new tenure comes with plenty of history and innumerable ongoing predicaments.

In particular, Trump must confront an embedded level of inflation that has not been quashed, not by a long shot. It’s no secret that interest rates are rising despite recent Fed rate cuts. At root, global bond markets just don’t buy the economic moonshine that many professional economists (and I mean those PhDs at the Fed) are selling.

In general, Trump is kicking off his second term in office with much upbeat hope, but also with many deep uncertainties out there about how things will unfold. Frankly, those LA fires make me nervous about regional and even national banks and insurance companies, with the 1906 San Francisco event serving as the model for a broader unwind in the next year. If Trump and his team can deal with this issue, great. But for now, I’m cautious about what’s coming at the country out of SoCal.

Along the way, while the dust settles, it’s a safe, low-risk bet to own shares in companies with solid cash flow from operations, like mining gold or producing oil and natural gas, plus technical prowess that will be in demand no matter how things unfold.

With that, I’ll end here. Thank you again for subscribing and reading.

Best wishes…

All the best,

How FDR Put America Behind Golden Bars

Posted December 12, 2025

By Byron King

Swamp Thing

Posted December 11, 2025

By Sean Ring

A Sliver of Silver

Posted December 10, 2025

By Sean Ring

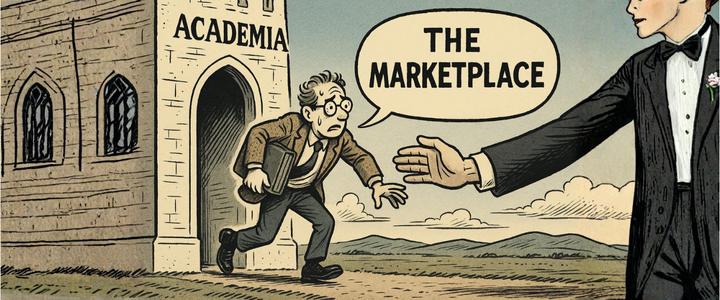

The Public Service of Pushing Brains Into Industry

Posted December 09, 2025

By Sean Ring

Did America Just Lose The Great Game?

Posted December 08, 2025

By Sean Ring