Posted October 23, 2024

By Sean Ring

If Powell Cut, Why Are Rates UP?

Jay Powell, you deserve this.

Look, I’m sure you’re a nice enough guy. And you’re one of the few bureaucrats left in Washington who means well. I know you view yourself as the last line of defense between a sensible economic policy and oblivion.

But your addiction to “data dependence” is your undoing.

You’re a lawyer, Jay. Stop pretending to understand how the data is compiled. You’re a driver, not an engineer.

My favorite philosopher, the utter miseryguts once known as Arthur Schopenhauer, once said, “Talent hits a target no one else can hit. Genius hit a target no one else can see.”

Stop trying to hit a target, Jay. You don’t need to be talented. You need to be a genius.

And that means seeing things before everyone else does.

The Keystone Cops Monetary Policy

The Keystone Cops were fictional, incompetent policemen featured in silent slapstick comedies between 1912 and 1917. They were funny the first few times you saw them, but their popularity waned.

You know, kind of like the Fed’s.

I told you to cut rates in June, Jay. You would have been so far ahead of the curve that you could’ve—and should’ve—sat out this crazy election.

But you didn’t move then, because you wanted more data.

Next, July’s FOMC meeting came and went without you moving… again.

Then you took August off, like the Fed does every year.

Finally, the September meeting came, and you pooped the bed. You cut by 50 basis points instead of 25. You told the market something was wrong by pulling that stunt. Do you know how I know that?

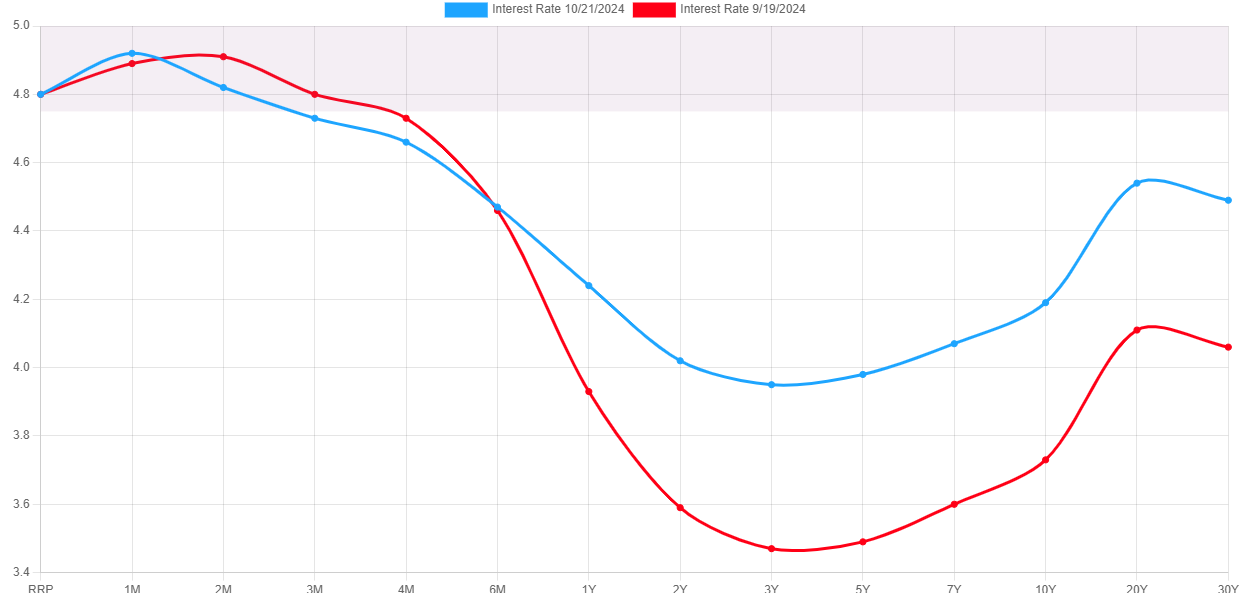

Because a month later, market yields are UP, not down, by 50 bps!

You cut the base rate, and market rates have increased since you did so.

Credit: US Treasury Yield Curve

It seems we’re partying like it’s 2008 – the last time this happened.

How can this be?

What’s In a Yield?

For simplicity’s sake, “yield” is synonymous with “return.” Why do we have two terms? It’s hard to say, but back in the day, banks specialized in one thing.

If you wanted to be a great retail banker, you worked for Citibank. If you wanted to work in a money center bank, you worked for J.P. Morgan. If you wanted to be in equity, you worked for Morgan Stanley. If you wanted to be in M&A, you worked for Goldman Sachs. If you wanted to be in bonds, you worked for either Lehman Brothers or Salomon Brothers.

Then, at the behest of Larry Summers, Bill Clinton talked Congress into repealing the Glass-Steagall Act, which separated commercial and investment banks. (That’s why J.P. Morgan and Morgan Stanley became separate entities.) The repeal allowed commercial and investment banks to merge and created the mess we’ve been in for the last quarter century.

Anyway, they worried about “yield " in fixed income houses and " return” in equity houses.

Alfonso “Macro Alf” Peccatiello has a great way of breaking down yield. I’ll use his definition, with only grammatical corrections, as it’s intuitive and easy to understand.

But what makes up a yield?

Simply put, yield = growth expectations + inflation expectations + term premium.

Growth expectations

When it comes to economic growth, we must consider two angles: structural and cyclical growth.

Structural economic growth can be generated through more people joining the labor force (good demographics) and/or more productive use of labor and capital (strong productivity trends). An economy's ability to generate structural growth is an essential driver behind long-dated bond yields (strong structural growth = structurally higher long-dated yields and vice versa).

Short-term economic cycles also matter for bond yields, particularly at the short end. Cyclical growth trends are driven by the credit cycle, the fiscal stance, earnings growth, labor market trends, and more. The healthier they are, the higher short-end bond yields can be pushed due to a likely tightening from central banks that might grow worried about economic overheating and inflationary pressures in such an environment.

Inflation expectations

The second component driving nominal bond yields is inflation, but NOT TODAY's inflation - instead, we are referring to long-term inflation expectations.

Central Banks might temporarily react to concentrated bursts of inflationary pressures by raising short-term interest rates. Still, investors will always pay close attention to inflation expectations when it comes to long-dated bond yields.

That's because consumers and borrowers will tend to make crucial decisions based on these rather than volatile short-term inflation trends.

Term premium

An investor looking to gain fixed-income exposure can buy 3-month T-bills and roll them each time they mature for the next 10 years.

Alternatively, it can decide to purchase 10-year Treasuries today.

What's the difference? Interest rate risk!

Buying a 10-year bond today rather than rolling T-Bills for the next 10 years exposes investors to risks—the term premium compensates for this risk.

The lower the uncertainty about growth and inflation, the lower the term premium and vice versa.

So What Happened?

When Jay Powell and his crew cut by 50 basis points in September, the market immediately knew something was wrong, as we did in the Rude.

Growth expectations may have been dampened, but long-term inflation expectations and the term premium roofed it.

This is precisely why central banks must remain calm and ahead of the curve.

To remind you, the last time this happened was in 2008. What did gold and silver do from 2008-2011? Why is Costco selling gold bars as soon as they come in? Gold and silver may be slightly overbought, but things can stay overbought for a long time.

Wrap Up

Get ready for some turbulence. If you’re already long gold and silver, you’re doing all you can. Keep some extra cash in your drawer.

The USG is in serious fiscal trouble, and the Fed needs to regain control of the economic narrative.

Rates will continue to rise as the Fed fooled no one with its latest stunt.

Stay vigilant and aware.

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring

Trump’s Victory at Sea

Posted January 29, 2026

By Byron King

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring

Dollar Detonation

Posted January 26, 2026

By Sean Ring