Posted October 16, 2025

By Sean Ring

I See Black Gold Risin’…

Bear with me, because I’m thinking out loud here.

When I gave my talk in Nashville, titled Six Impossibly Rude Things Before Breakfast, my fourth prediction was “Oil makes a stunning recovery.”

I’m not sure I really believed it, because the entire world hates oil right now. Heck, the mere mention of the word makes an Arab wince like he’s watching a Christening.

But that’s exactly why I should believe it. It’s the most hated asset on Gaia’s Green Earth. And like our good friend Rick Rule always says, you want to buy assets “when there’s no competition on the bid.”

Marinate in that statement for a moment: Buy assets when there’s no competition on the bid.

I did my master’s thesis at LBS on market microstructure, and yet I have never heard such a perfect strategy expressed so elegantly and succinctly.

It’s better than “Buy when there’s blood on the streets.” It’s better than “Be greedy when others are fearful and fearful when others are greedy.” And yet, they all mean the same thing.

In this case, oil has no bid. And worse, oil is getting utterly ridiculed online. It’s the leper’s trade. And that’s why we should love it.

Nevertheless, you have my permission to think I’m crazy. This is a pie-in-the-sky idea. But please don’t call the men in the white coats…

This Trend Isn’t Your Friend

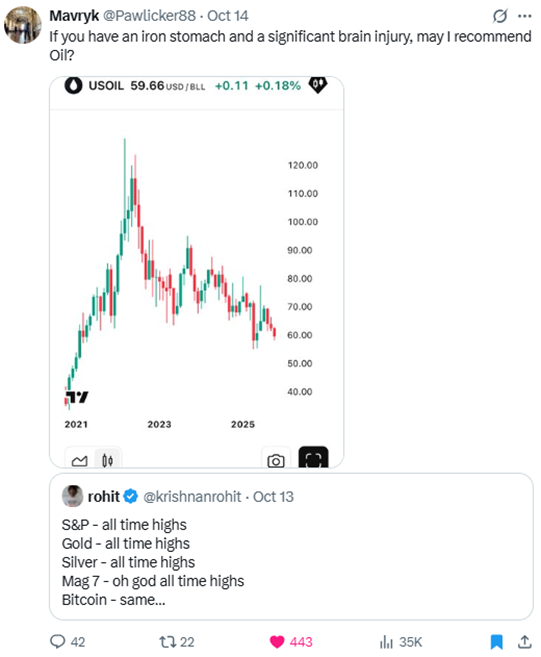

This chart is uglier than an 18-car pileup:

That’s America’s homegrown West Texas Intermediate. Even the world’s benchmark, Brent, from the North Sea, looks just as fugly.

A trend follower would tell you to short these two and call him in six months. But it isn’t just the charts. The online commentary would make you think oil is the next Agent Orange.

Online Ridicule

For our editorial meeting yesterday, our Maverick, Enrique Abetya, asked us to bring a big idea. I thought I’d expand on the oil thesis. Dan Amoss, the hardest-working man in the newsletter business, and Byron King, Paradigm’s own Gandalf the Grey, originally formulated the idea.

“Steal from the best,” as Francis Ford Coppola once said.

As I researched the idea, I found that oil is the complete opposite of a meme stock. It’s what the kids are making fun of. Check out this stuff.

Or this one…

Even Big Oil CEOs were pissing and moaning in cyberspace.

ExxonMobil’s CEO Darren Woods said that without new investment, oil’s supply glut would quickly vanish, with supply falling 15% per year.

Heck, ConocoPhilips CEO Ryan Lance said the glut doesn’t exist at all!

What to believe? Let’s go back to the charts…

But Wait… There’s Hope!

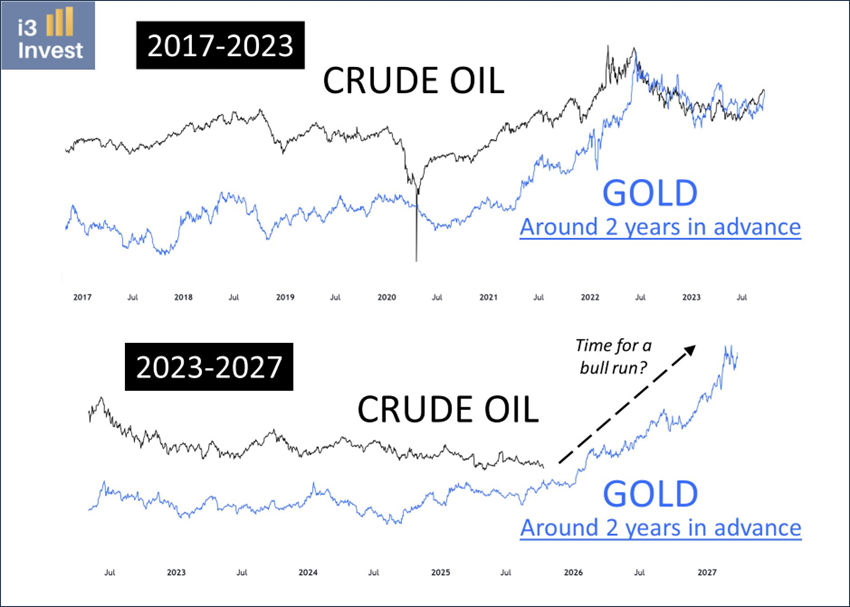

i3 Invest posted this excellent chart. It moved gold two years forward and shows how oil follows gold up.

Then, the Happy Hawaiian1 showed how the recent silver move is challenging the all-time highs of the silver/oil chart.

I don’t see silver cooling down anytime soon. It makes much more sense for oil prices to increase if this chart is to come down a bit.

So what do we do about this?

Look Before You LEAP

You can just ignore my ranting and raving and move on. Or you can place a cheeky trade to get in front of this thing.

In Nashville, I recommended to the crowd to buy the AROC May 15, 2026, 25 calls @ 2.50.

Quickly, LEAPs, or Long-term Equity AnticiPation securities, are merely options with an expiration date of more than one year away.

Archrock, Inc. is an oil services company whose chart was mildly bullish compared to others in its industry.

I thought it was a safe trade. The option has a 50 delta and AROC’s price target of 32.50. Essentially, you were risking $2.50 for $5.00 of upside. But the catch is this: AROC’s recent high was $29.00, so if AROC got above there, the sky’s the limit. Or, you could just buy the stock and receive a 3.05% dividend yield before the next leg up.

I just checked, and the May 25 calls closed yesterday at $3.18. It’s only a week, and the option is up 27% already!

Nice!

For yesterday’s meeting, I found the SLB Jan 15 2027 47.50 calls (closed @ $1.55). Schlumberger, another oil services company, is downtrending, but this is a good bet for the upside. Its implied volatility is 36; not cheap, but well within SLB’s normal volatility range.

I also liked the HAL Jan 15 2027 32 calls (closed @ $1.29). Its implied volatility is 39, which also isn’t cheap but well within Halliburton’s normal volatility range.

These trades have plenty of time to expire, which means you’d have a lot of time to make their central theses play out. They’re not in the unofficial Rude portfolio, but I’ll be watching them nonetheless.

Wrap Up

Oil is the ugly duckling of the investment world. Dipping your toe in by buying LEAPs may be the smartest way for you to get in early to these trades. Or, you can say I’m a lunatic and ignore this piece altogether.

I’m going to keep watching this theme, as we caught gold and silver early, and it’s paid off so handsomely for us. What if we could do it again? Why not? Stay optimistic, baby!

Everything Rally Returns as Markets Go “Comical Ali” On Us…

Posted October 21, 2025

By Sean Ring

Red Screens, but a Clear Mind

Posted October 20, 2025

By Sean Ring

Powell Pivots: QT Ends, QE Begins

Posted October 15, 2025

By Sean Ring

Silver Squeezes the Yankee Miners

Posted October 14, 2025

By Sean Ring

Send in the Golden Meteor!

Posted October 13, 2025

By Sean Ring