Posted December 19, 2023

By Sean Ring

How About Those Houthis?

Just close your eyes for a moment and imagine the “War on Terror” never happened.

The USG didn’t piss $5 trillion in taxpayers’ funds up a wall. Gas prices are at a level where a $20 bill can get you a full tank of gas. The world still loved and admired America because America wasn’t exporting inflation and “democracy.” America didn’t give in to every Israeli request; there was peace between the US and the Muslim world.

OK, you can open your eyes now. The rest of this column will explain what’s happening because the American Military-Industrial Complex couldn’t keep its snout out of the taxpayers’ treasury trough.

In short, a bunch of angry goatherders has tied up the Suez Canal, the world’s most important shipping lane and choke point, adding days and millions to the costs of transporting goods across the planet.

How’s that inflation looking now?

150 Years of Supply Chain Down the Drain

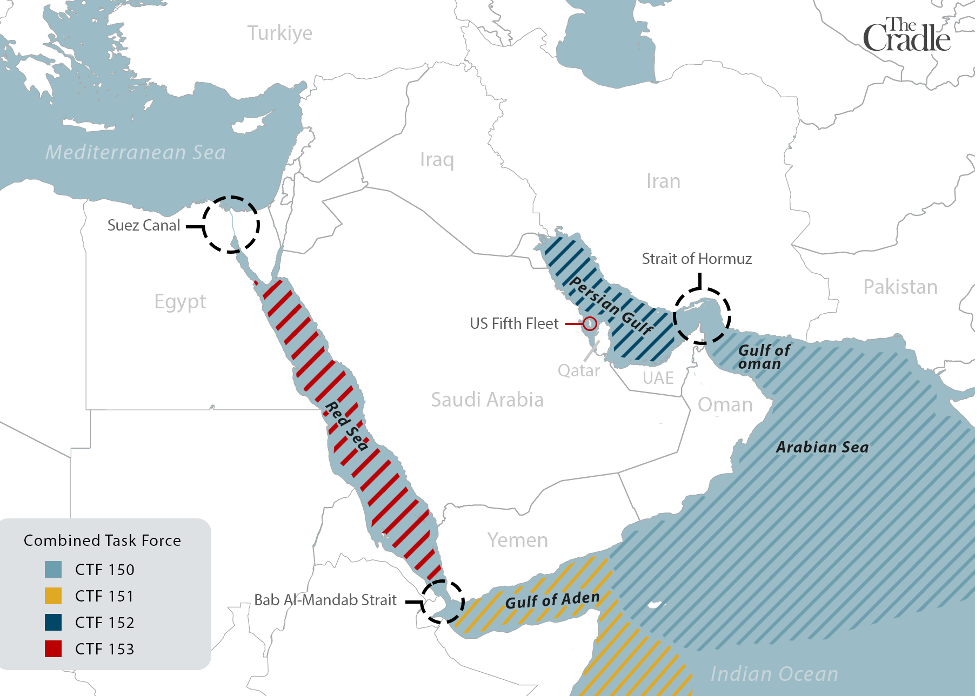

Red Sea is now largely closed to traffic. That's 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit.

Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance (and even more to cost)

Credit: @zerohedge

If you look at the above map, you must travel between the Arabian Peninsula (Yemen) and the Horn of Africa to get to the Suez Canal from Singapore and the East. That waterway is called the Bab al-Mandeb Strait.

Let’s get some definitions down first.

Bab al-Mandeb Strait: This narrow strait is between Yemen on the Arabian Peninsula and Djibouti and Eritrea in the Horn of Africa. It's a strategic waterway connecting the Red Sea to the Gulf of Aden and the Arabian Sea. Most importantly, it's one of the critical points of access to the Suez Canal, a major global shipping route.

Houthi Militants: The Houthis are a Zaidi Shia-led group in Yemen. They have been involved in a protracted conflict in Yemen, which has had regional implications, especially in the context of the broader Saudi-Iranian rivalry in the Middle East.

Impact on Global Trade Flows: The Bab al-Mandeb Strait is a critical junction for maritime trade, especially for oil and gas shipments. When shipping companies decide to pause transit through this strait, it can have considerable implications for global trade.

Ships would need to reroute around Africa via the Cape of Good Hope, leading to longer transit times and higher costs. This would not only impact but also restructure global supply chains and even contribute to fluctuations in global oil prices due to the delay and uncertainty in oil deliveries.

Vasco da Gama is shaking his head right now.

Reason for the Pause: The decision by shipping companies to halt transits was primarily driven by security concerns. The Houthi militants' attacks in the area, potentially including missile and naval mines, pose a significant risk to large commercial vessels. The risk assessment for shipping companies involves not only the potential for damage to their ships and cargo but also the safety of their crew.

From The Guardian:

The most immediate effect has been a rise in the cost of insuring vessels that travel through the Suez Canal and Red Sea.

Typically, ships must notify their insurers when sailing through high risk areas and pay an additional premium. This risk premium paid by shipping companies was just 0.07% of the value of a ship at the start of December, but has risen to about 0.5%-0.7% in recent days.

On Monday, a group of prominent marine insurers also widened the area in the Red Sea they deem to be high risk, meaning more vessels will have to pay the premium.

As a result of the cost of shipping goods through the Red Sea has risen by tens of thousands of dollars a week.

For most traders however, the risk is too great.

In the last week prominent shipping companies including Maersk, Hapag Lloyd, and MSC have decided not to use the Red Sea. According to thinktank the Atlantic Council, seven of the ten biggest shipping companies by market share have suspended shipping in the Red Sea.

Some ships are being diverted around the Cape of Good Hope, on the southern tip of Africa, adding up to two weeks in journey time.

Lloyd’s of London doesn’t want the risk without massively increasing premiums.

In essence, yes, a bunch of goatherders have just stopped world trade.

Who Are These Friggin’ Guys?

The Houthis, formally known as Ansar Allah, are a Zaidi Shia-led religious-political movement that emerged from northern Yemen in the late 1990s. Their ideology mixes Zaidi Shia revivalism (a branch of Shia Islam predominantly in Yemen) with anti-imperialist and nationalistic sentiments. The Houthis initially fought against the Yemeni government during several wars from 2004 to 2010, and their influence has grown significantly since the Arab Spring in 2011.

However, it's important to clarify that the Houthis have not closed off the Suez Canal. The Suez Canal, located in Egypt, is a critical shipping route that connects the Mediterranean Sea to the Red Sea, allowing for direct shipping between Europe and Asia without navigating around Africa. The Houthis' area of operation is primarily in Yemen, which is situated south of Saudi Arabia, bordering the Red Sea but not the Suez Canal.

However, the canal is effectively closed because you can’t reach the Suez without going through the Bab al-Mandeb Strait.

“If Saudi Arabia & the UAE are part of any coalition to attack Yemen, we will not leave an oil field or a gas field in Saudi Arabia or the Emirates, and we will target all ships transporting oil,” said Mohammed al-Bukhait, senior political official and spokesman for the Houthis.

The closure of the Suez Canal would have significant global consequences. The canal is one of the world's busiest waterways, facilitating about 12% of international trade.

A closure would necessitate the rerouting of ships around the Cape of Good Hope, significantly increasing transit times and costs. This would impact global supply chains, leading to delays in goods' delivery, increased shipping costs, and potential disruptions in global markets, particularly for oil and other commodities transported via this route.

This also wrecks Egypt’s finances, which I’ll touch on later.

A New Coalition of the Willing?

From The Wall Street Journal:

The U.S. unveiled a multinational naval force to protect merchant vessels in the Red Sea after Houthi rebel attacks threatened the Suez Canal’s central role in global trade.

On Monday, the Pentagon said it was establishing a security operation to protect seaborne traffic from ballistic missiles and drone attacks launched by the Houthi groups in Yemen. The effort, called Operation Prosperity Guardian, will include the U.K., Bahrain, France, Norway and other countries.

Many of the world’s biggest shipping lines, oil producers and other cargo owners in recent days started diverting vessels from the region, prompting a spike in oil prices and insurance rates.

“This is an international problem. And it deserves an international response,” U.S. Defense Secretary Lloyd Austin said in Tel Aviv on Monday.

Credit: The Cradle

Like the Fed rescues the markets, the US military attempts to protect real asset movement.

Egypt’s In Trouble

From Reuters, on June 21, 2023:

Egypt's Suez Canal Authority has seen revenues reach a record $9.4 billion in the current financial year, which ends on June 30, up from $7 billion in the previous year, Chairman Osama Rabea said on Wednesday.

"For the first time in the canal's history, the authority has achieved revenues of about $9.4 billion," he told reporters.

The chairman added that 25,887 ships have passed through the canal so far in the current financial year, the authority's website cited him as saying at the same conference. He said around 23,800 passed through the previous year.

For a country with only $477 billion in GDP, this is a decent chunk (about 2%).

This situation isn’t Egypt’s fault, but they’re suffering for it. What will they do with the Rafah crossing? No one knows.

Wrap Up

What a mess! And it shows how genuinely fragile the world economy is, especially at essential chokepoints.

What was once taken for granted will no longer be. The bifurcation of the world economy continues.

Do you think things are getting cheaper in the future? Think again.

This may just sink Biden’s presidency once and for all.

Oh, Cry Me a Canal!

Posted June 27, 2025

By Sean Ring

“You Better Get A Big Shovel!”

Posted June 26, 2025

By Sean Ring

مرحباً بكم في مدينة نيويورك!

Posted June 25, 2025

By Sean Ring

A Most Cordial War

Posted June 24, 2025

By Sean Ring

Trump’s Iran Bombing: More Questions Than Answers

Posted June 23, 2025

By Sean Ring