Posted March 23, 2023

By Sean Ring

Hot CoCos, For All the Wrong Reasons

Happy Thursday from an overcast Asti.

In today’s Morning Reckoning, hopefully coming into your mailboxes in a few hours, I write about my feelings concerning Credit Suisse’s demise.

It was a fun trip down Memory Lane. But… there are some technical details that I couldn’t include there.

So I’m going to do that here. Then, when you read the Morning Reckoning, it’ll make a bit more sense.

In this Rude, I will define the Basel Accords, talk about a bank’s “cap stack,” and, ultimately, why there’s only one way to regulate banks.

The Basel Accords

Permit me to channel my inner Dickens (paraphrased from A Christmas Carol):

Basel was dead: to begin with. There is no doubt whatever about that. The register of its burial was signed by the clergyman, the clerk, the undertaker, and the chief mourner. A screwed banker signed it. And a screwed banker’s name was good upon ’Change, for anything he chose to put his hand to.

Old Basel was as dead as a door-nail.

Ah, that felt good.

The Basel Accords are the greatest example of bureaucratic “make-work” in human history.

Since The Basel Committee on Banking Supervision (BCBS) was created in 1974, it has prevented absolutely zero of our myriad financial crises.

The BCBS is a part of the Bank of International Settlements (BIS), the central banks’ central bank.

Settlement risk was an afterthought in FX trading until the Bankhaus Herstatt debacle in 1974.

Cutting to the chase, the bank failed to send its USDs to New York in exchange for the DEMs (Deutsche Marks - we didn’t have euros yet).

As a result, many trades, along with the bank itself, failed. To fix this, the G-10 formed the BCBS.

The BCBS sat around doing nothing until 1988. (For a time, there was talk of disbanding the BIS altogether.)

But luckily for them, the US stock market crashed in October 1987. So the BCBS gained renewed vigor.

The Basel Capital Accords (Basel I) were released in 1988 and concentrated on credit risk. Many in the international bureaucracy felt that credit risk, not market risk, caused the ‘87 Crash.

In January 1996, following two consultative processes, the Committee issued the Market Risk Amendment to take effect at the end of 1997.

In June 1999, the Committee proposed a new capital adequacy framework to replace the 1988 Accord. This led to releasing a revised capital framework in June 2004 called "Basel II." The revised framework comprised three pillars:

- minimum capital requirements

- supervisory review of an institution's capital adequacy and internal assessment process

- effective use of disclosure as a lever to strengthen market discipline and encourage sound banking practices

As we saw later in 2008, none of this guff worked.

Basel III was birthed in 2010 after the abject failure of Basel II.

Basel IV came into effect on January 1, 2023.

You see the pattern: write rules; rules don’t work; take no responsibility; write new regulations.

Now, let’s look at how that affects the banks.

A Bank’s “Cap Stack”

A bank's capital stack, or “cap stack,” differs from a regular company’s.

Remember, your cash is your asset, but to a bank, that’s a demand deposit and, therefore, a liability.

And your mortgage may be your most significant monthly payment. But to a bank, that’s likely its most important asset.

What regulators make banks do is hold reserves against “risk-weighted assets.”

Simply, a risk-weighted asset (RWA) measures the level of risk a bank's assets pose to its solvency.

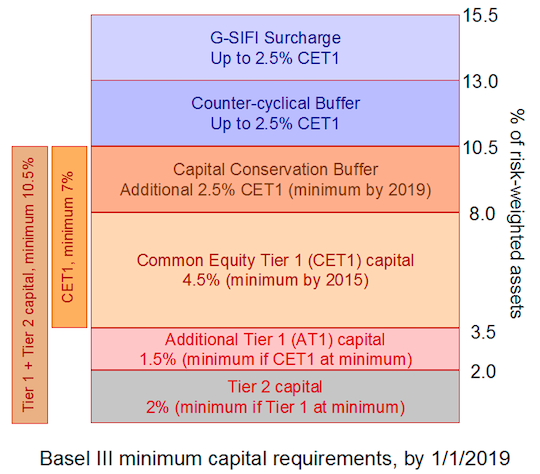

A bank’s cap stack looks like this:

Credit: Pearson

Common Equity Tier 1 capital is your common shares, retained earnings, and other comprehensive income. If you’re a perfect bank, your CET1 would be 12% (everything above the AT1 and Tier 2 capital).

And here’s where the kerfuffle is.

What about Credit Suisse’s AT1 sent shivers through the markets?

Additional Tier 1 Capital: What are CoCos?

To get their banks liquid again, the Europeans - who love bonds - came up with the idea of contingent convertible bonds (CoCos).

It’s another idea only an academic can love.

Here are three common types of CoCos:

- Trigger CoCos: Trigger CoCos convert into equity when a specific trigger event occurs, such as the bank's capital ratio falling below a certain threshold. These trigger events are usually set by regulators and are designed to ensure that the bank maintains a certain capital adequacy level.

- Mandatory CoCos: Mandatory CoCos have a fixed maturity date and convert into equity when this date is reached. They can also convert into equity if the bank's capital ratio falls below a certain threshold. Mandatory CoCos provide investors with more certainty about the timing of the conversion, but they may not be as effective at absorbing losses during times of financial stress.

- Optional CoCos: Optional CoCos allow the bank to convert the bonds into equity under certain conditions. This gives the bank more flexibility in managing its capital structure but may also make the conversion less certain for investors.

Credit Suisse issued a type of CoCo known as a “principal write-down” CoCo. That means the holder could lose their investment immediately, which is what happened to Credit Suisse CoCo holders.

Writing Down the CoCos to Zero

From The Wall Street Journal (bolds mine):

Late Sunday afternoon, UBS agreed to lift its offer and pay a little over $3 billion—less than half Credit Suisse’s market value on Friday. Crucially, Swiss regulators would write off $17 billion on the riskiest type of Credit Suisse bonds. The market for these bonds, commonly issued by European banks, was severely hit Monday. UBS would also get a more than $200 billion liquidity line from the central bank, and a government guarantee of over $9 billion against some potential losses.

To get the deal done, the government waived antitrust laws on the grounds that financial stability was at stake.

The upshot of all this is the following:

- The Swiss government rewrote its rule book to get this deal done.

- The Swiss regulators buried the CoCo holders with a write-off.

- The CoCo bond market was hammered after this announcement.

- Equity holders got something, though it was meager.

- In an ordinary “order of liquidation,” bondholders get paid before equity holders. But because these were principal write-down CoCos, bondholders got nothing, while equity holders got something. That’s why the word “lawsuit” is being bandied about.

- The backstop UBS was given to buy CS is nothing short of amazing. This deal may even work out for UBS in a few years.

Honestly, if the Swiss are just making it up as they go, what hope do the rest of us have?

The Only Way to Regulate Banks

The Basel Accords are on the side of a milk carton. Nowhere to be seen.

Credit Suisse wasn’t an unhealthy bank. It just made terrible decisions.

The only way to regulate banks is to let them fail.

Sure, the Swiss authorities thought a full-blown financial crisis would ensue, but truth be told, this should’ve happened years ago. That’s when bankruptcy would’ve been manageable.

Silvergate, SIVB, Signature, and now CS. Different reasons for their bailouts, but it boils down to one thing: Boards that were about as useful as chocolate chastity belts.

Wrap Up

I’m sorry I got into the weeds a bit there.

But there’s no other way of explaining the situation.

If you have time, I hope you read the Morning Reckoning today.

That will add more color to the story.

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali