Posted June 03, 2025

By Sean Ring

Hi-Yo, Silver! Away!

I know. I always thought The Lone Ranger said, “Hi Ho, Silver, Away!” That’s why I’m so glad I look up stuff before I print it. The proper way is “Hi-Yo,” though it never sounded that way to me.

But honestly, who cares?

When silver has the kind of day it had yesterday, it could be “Hi Ya, Silver!” for all I care.

Because, as I had anticipated in yesterday’s monthly asset class report, it was silver’s day today. Though, honestly, I didn’t think it’d happen so fast! Long may it continue.

The Metal Itself

Here’s a shot of yesterday’s price action in silver futures:

The Monkeyhammer Breaks

For weeks, silver bulls have been tiptoeing around the proverbial zoo, nervously eyeing the monkeyhammer that’s kept their favorite metal subdued and sucker-punched. But yesterday, something changed. Silver didn’t just catch a bid — it erupted.

Silver futures exploded through the $34 barrier, ultimately trading between $33.20 and $34.80 — a price range not seen since the 2012 echo-bubble of the last precious metals bull market.

That’s not a rally. That’s a detonation.

And the blast radius was wide. Miners — long abandoned, under-loved, and shorted into oblivion — came charging back like they’d just been released from a multi-year prison sentence.

Let’s review the mayhem.

The White Metal Warriors: Performance Recap

Here is the unofficial Rude portfolio, as it's what I currently hold. And what a good day it was.

| Symbol | Name | Chg% | Notes |

|---|---|---|---|

| AG | First Majestic Silver | +11.51% | Silver flagship. Most shorted, now most explosive. |

| EXK | Endeavour Silver | +9.97% | Retail darling. High leverage to spot. |

| CDE | Coeur Mining | +6.81% | Swiss army knife of silver plays. |

| KGC | Kinross Gold | +6.51% | Gold-heavy, but silver uplift helped. |

| ASM | Avino Silver & Gold | +5.36% | Thinly traded, but spiked with the pack. |

| FVL | Freegold Ventures | +4.85% | Speculator bait — and rewarded. |

| SBSW | Sibanye Stillwater | +3.78% | South African PGM major, but caught a tailwind. |

| ORLA | Orla Mining | +3.69% | Good margins, solid project. |

| ITR | Integra Resources | +2.69% | Development-stage ride-along. |

| DSV | Discovery Silver | 0.00% | Strangely flat — someone check the algos. |

A few notes: First, though I’m thoroughly pleased with my portfolio - not bad for a free newsletter - these aren’t all the stocks you can own.

My friend and the hardest-working man in the newsletter business, Dan Amoss, recommended a wonderful silver play in the most recent Strategic Intelligence issue that came out yesterday. I can’t recommend you read it enough.

Second, I switched out ABRA for DSV on May 12th. And then (of course!) ABRA shot up over 23% on May 20th. DSV didn’t move yesterday, much to my dismay. ABRA was up 6.38%. However, if you look at their performances side by side since May 12th, it’s a bit of a wash:

ABRA leads by nearly 3%, but it’s a close race. Although I no longer own ABRA, it’s a good stock to consider right now.

Why the Surge?

Five main drivers lit the fuse on silver’s rally yesterday:

- Short Squeeze Chaos: Once silver pierced $33.80 overnight, the game was on. That level was the lid on the pressure cooker — and once that blew, CTAs and managed futures funds tripped over each other to cover.

- Industrial Demand and Supply Constraints: Robust industrial demand, especially from China’s rapidly expanding solar and electronics sectors, played a significant role. Supply also remains tight, with the world’s top producers (Mexico, China, and Peru) facing stalled mining growth. This has led to persistent deficits and declining above-ground inventories, making the market more sensitive to supply shocks.

- Record-Setting ETF Inflows: Institutional investors bought over 29 million ounces worth of a silver ETF last week.

- Safe-Haven Demand: US-China trade tensions flared up over the weekend. Silver is acting as a hedge against The Donald’s whims.

- Russia-Ukraine: Drone strikes do not make a peace settlement. This is safe haven investing at its finest.

Silver's Role in a Broken System

Silver isn’t just another shiny thing. It’s a monetary metal with industrial utility, which makes it uniquely disruptive to the status quo. It’s one of the few assets that can blow holes in both fiat illusions and Green New Deal fantasies — depending on who you ask.

When silver spikes, it signals something deeper is breaking. Confidence in fiat. Stability in supply chains. Or faith in central banks.

Unlike gold, which central banks hoard, silver is the people’s metal. And when it starts moving like this, it's telling you inflation hedges are back in play, industrial demand is real, and the old suppression game may be losing control.

What to Watch Next

If silver can hold above $34, we’re looking at a retest of $35 or higher, with an eye on $38, which would signal a true structural breakout. Beyond that? It's blue sky until $50, the all-time high from the Hunt Brothers and Bernanke eras.

Miners like AG and EXK are canaries in this silver mine. If they continue to soar, it confirms this isn’t a one-day wonder.

Bottom Line

This was no fluke. Silver just sent a signal. And the stocks screamed it louder.

If you’ve been sitting on the sidelines waiting for the “real” breakout… You might’ve just missed the starter's gun.

Don’t worry. The race is still young. In fact, silver is taking a breather this morning, falling back to the 34.39 level.

But the front-runners just made it very clear:

Silver season has begun.

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring

Trump’s Victory at Sea

Posted January 29, 2026

By Byron King

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring

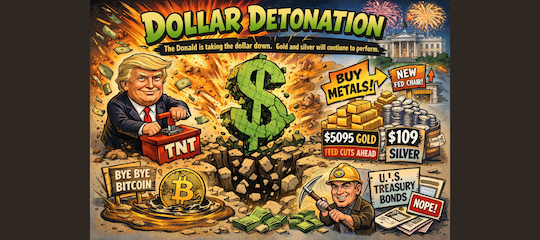

Dollar Detonation

Posted January 26, 2026

By Sean Ring