Posted September 27, 2024

By Enrique Abeyta

Half-Baggers From Half-Pint Stocks?

Good morning!

The stock market has been filled with macroeconomic and political news, which has driven volatility higher over the past few months.

Reports on employment and inflation have shaken the stock market as investors worry about an economic slowdown.

Of course, the presidential election has been heating up, and we saw an unprecedented change in the Democratic Party's candidacy.

Oh, and that’s not to mention the two assassination attempts on former President Trump.

We also saw a record spike in volatility during a huge stock selloff at the start of August. As dramatic as that may have been, the recovery immediately after was just as volatile.

Finally, the Federal Reserve cut interest rates last week for the first time since March 2020.

So, where do we go from here?

All Signs Point to a Year-End Rally

Despite all these momentous events over the past few months, the stock market has continued to churn and move higher.

After a brief digestion period following last week’s rate cut, stocks moved to new all-time highs. The market seems to be looking through the “noise” and focusing on the big picture.

Economic and earnings growth is still positive. Inflation appears to be under control. Input prices (commodities) and interest rates are headed lower. Balance sheets remain good.

I think we’ll see more of the same heading into the end of the year. Historically, if the market is up nicely year-to-date in the fourth quarter, it continues to move higher.

This is the most likely scenario for me in the coming months.

Small-cap stocks are an area of interest that attracted a lot of attention a few months ago and should be of interest again.

On Top Trades last week, I said that the Russell 2000 small-cap index doesn’t matter to the overall stock market. And really, it doesn’t.

The market cap of all 2,000 stocks is less than that of Apple, Microsoft, or Nvidia, and their combined net income is also less than that of Apple.

It’s made up of smaller companies that are more exposed to macroeconomic trends, including consumer demand, commodities, and interest rates.

That being said, small caps look especially interesting right now.

The last two items I mentioned above—commodities and interest rates—are now both moving in the right direction for small-cap earnings.

The Russell’s breakout in July was historic. Very seldom has it moved that far or that fast. Technically, it was the most “overbought” it’s ever been in its history, dating back to 1979.

Overbought might sound like a contrarian signal, and it can be in the short term. However, looking out six to 12 months, it can be a very bullish sign.

I look at a lot of different signals around price movements. One of these is when we have streaks of strong performance.

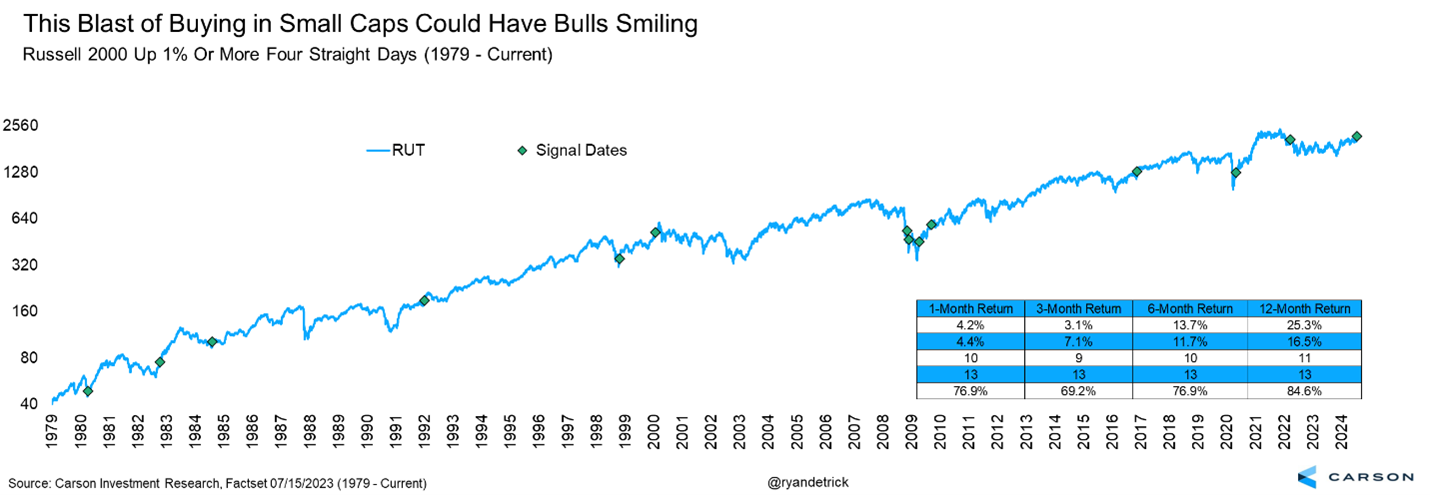

Back in July, the Russell 2000 did something rare when it had four consecutive 1%+ days. This had only happened 13 times in the history of the Russell.

Here’s a good chart from Ryan Detrick of Carson Group showing what has happened historically following these moves…

Source: Carson Group

Six months later, the Russell is higher 77% of the time. And one year later, it’s higher 85% of the time. Those periods show returns of 14%+ and 25%+ respectively.

Those are very high probabilities and great returns.

That move in the Russell also had it up 10%+ in 10 days and 5%+ in five days. These are also very rare moves that have similar high probabilities of moving higher in the next year.

While it faded quickly in the August selloff, history tells us that when it sees that kind of breakout, it’ll be higher a year later. And I mean MUCH higher, upwards of 50%.

These bull market cycles in small caps also are generally long-lived. Once they begin outperforming, they can continue outperforming for more than a decade on average.

Combine the macro factors going in its favor, cheap valuation (17x excluding negative earnings companies) and the fact it doesn’t take as much money to move them, and you could have the best backdrop for small caps in years.

What does this mean for you as a trader?

When headwinds become tailwinds, the opportunities become more profitable.

Over the last year, the attractive setups haven’t always worked very well. I think we’re entering a period when they can begin to work a lot better!