Posted December 04, 2023

By Sean Ring

Gold’s Midnight Madness

I grabbed my iPhone to see what was happening as I got out of bed this morning.

Boy, were the gold bugs excited! Of course, since we’ve been very bullish here at Paradigm Press, I got excited, too.

It wouldn’t take months for gold to get above $2,100; it took mere days.

Follow along with me.

Last Night Into This Morning

Before we start, if you notice different prices, you may have looked at gold futures instead of gold spot.

A spot price is the price of the underlying commodity (in this case, an ounce of gold), excluding any transaction costs.

A futures contract is the obligation (not a “right;” that’s an option) to buy or sell a specified quantity of a standardized asset (in this case, 100 ounces of gold) at a price agreed today (the futures price) for delivery in the future.

Since the gold will be delivered in the future, the futures price includes the cost of carry, which includes storage, insurance, foregone interest, and the convenience yield.

Essentially, the futures contract is the spot commodity moved through time. It’s not a prediction of where the price will be once the futures contract matures.

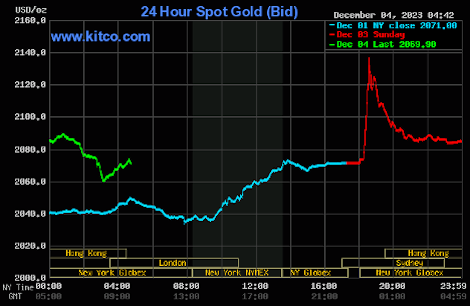

Here’s the spot gold chart for this morning.

Credit: Kitco

Let’s start with Friday’s light blue line. We saw nice price movement from about $2,040 to the close of $2,071.

Then we go into Sunday’s market (the red line). This is where the Twitterverse exploded, along with the gold price.

Spot gold spiked to nearly $2,140, a tremendous $100 move over little more than a day.

But what goes up parabolically usually comes down as fast. And so it was with gold. Gold closed Sunday with only a $10 move up.

Today, it opened at about $2,082 and is currently trading at about $2,070.

In short, the entirety of the crazy spike was eliminated.

Mr. Slammy Returns

“Mr. Slammy” is the euphemism gold traders use for the entities that short gold futures when the price goes too high. When the price gets “monkey hammered” overnight, it’s usually Mr. Slammy, whoever he is, who does it.

A high gold price isn’t good for the US,

Let’s look at the consequences of high gold prices:

For the United States

- Inflation Indicator: A high gold price often signals high inflation, harming the economy. Gold is traditionally seen as a safe haven in times of economic uncertainty, and its rising price can indicate a lack of confidence in the stability of the current economic situation.

- Currency Devaluation: Gold prices often move inversely to the U.S. dollar. So, when gold prices are high, it can suggest a weaker dollar, affecting the U.S.'s purchasing power and trade balance.

- Impact on Interest Rates: The Federal Reserve might raise interest rates to combat inflation, slowing economic growth. Higher interest rates can make borrowing more expensive, affecting consumer spending and business investments.

For "Enemies" or Rivals like Russia and China

- Diversification Away from USD: Countries not allied with the U.S. might use gold to diversify their reserves away from the U.S. dollar. A high gold price benefits these countries as it increases the value of their gold reserves.

- Economic Leverage: If a rival country is a significant producer of gold, high prices can boost its export revenues, giving it more financial leverage.

- Weakening US Influence: As gold prices rise and the dollar weakens, countries that rely less on the dollar for international trade can see a relative increase in their economic and geopolitical influence.

Contextual Factors

- U.S. Debt: The U.S. holds a large amount of debt. A weaker dollar (implied by high gold prices) can make servicing this debt more expensive.

- Global Economic Conditions: The reasons behind the rise in gold prices matter. Due to global uncertainties, it could harm all economies, not just the U.S.

- Market Dynamics: The rise in gold prices is sometimes driven more by market speculation than fundamental economic weaknesses.

While high gold prices can signal challenges for the U.S. economy, particularly in terms of inflation and currency strength, the impact on its "enemies" depends on its economic structure, reliance on gold, and its relationship with the global financial system dominated by the U.S. dollar.

To be sure, a lower gold price is good for the USG.

And Let’s Not Forget Bitcoin

Bitcoin has moved from $25,000 to roughly $42,000 in the last three months. It’s an incredible haul by any standard.

For you math geeks out there, that’s a 68% holding period return over three months. Wow.

Safe Haven Assets

What gold’s and Bitcoin’s moves say to me is the world is searching for a safe haven away from government-induced inflation (fiscal policy) or central bank-induced inflation (monetary policy).

With Powell tightening the way he did, the blame for high inflation is on the government or whoever controls The Bot Known As Joe Biden.

Wrap Up

There were some delighted gold traders overnight, but eventually, they went to sleep disappointed.

While gold hit $2,170 overnight, it’s below Friday’s close.

Bitcoin has been rallying furiously over the past three months.

Silver also opened up intensely and then sunk below Friday’s lows.

The fight between inflation fighters and Mr. Slammy has entered a new phase.

A Minor Miner Correction

Posted October 03, 2025

By Sean Ring

$50 Silver: Ceiling or Floor?

Posted October 02, 2025

By Sean Ring

Equities and Metals Soar in a September to Remember

Posted October 01, 2025

By Sean Ring

Keep These Things In Mind When Riding the Wave

Posted September 30, 2025

By Sean Ring

Pennies and Steamrollers

Posted September 29, 2025

By Sean Ring