![[GOLD WEEK]: Three Reasons Soaring Silver Steals the Stage!](http://images.ctfassets.net/vha3zb1lo47k/qPts8uLPqHJZp5Qx3Skk3/577205a354a65905bbee762082a69402/shutterstock_2511003879.jpg)

Posted October 07, 2024

By Sean Ring

[GOLD WEEK]: Three Reasons Soaring Silver Steals the Stage!

Paradigm Press Executive Publisher Matt Insley asked if I’d like to do a “Gold Week” on the Rude for our new subscribers. I told him it’d be my pleasure. It’s a good idea. It saves me from coming up with new stuff every day. And, well, he’s my boss, so I want to keep him happy.

Of course, you know what they say about the best-laid plans. It would be utterly remiss not to cover the enormous silver news that came out since I last wrote on Friday. And since silver is gold’s partner-in-crime, I can introduce precious metals and then tell you why it’s critical to get silver into your portfolio if you haven’t already.

As you may know, I’ve been a precious metals bull for a long time… nearly as long as I’ve been writing the Rude. But this time, I think it’s for real. Not only did we call gold’s fabulous run, but we also participated in it. Now, silver is genuinely joining the party. If you didn't get involved, I don’t think I’m exaggerating by saying it would be a shame for your heirs and descendants.

In this edition of the Rude, I’ll cover why you should own gold and silver in one easy lesson. And then, I’ll talk about the three amazing things that have happened since Friday that practically demand you to own silver.

Why Own Precious Metals At All?

It’s difficult—some would say stupid—to contradict Warren Buffett. After all, the man is as rich as Croesus and has lived nearly as long. Buffett hates metals for the simple reason they don’t produce cash flow. I sympathize.

But it’s important to mention that old Warren has friends in the highest places, so he’s privy to what’s going on in the government in a way we are not. And so for us, we must defend ourselves against the government’s continued destruction of our purchasing power.

The great James Grant, author and editor of Grant’s Interest Rate Observer, once said, “The price of gold is 1/T. T equals the trust in government.” It’s a smart way of saying every time you think your government will print more money, you should buy gold.

In essence, gold is an insurance policy. Billionaire resource investor Rick Rule says he owns gold with the hope that he will never have to use it. There’s nothing Rick fears more than a $10,000 ounce of gold. That would mean the government has indeed destroyed our purchasing power.

So, investing in gold is for fear… But investing in silver is for greed.

Gold’s little brother, silver, has many industrial applications besides being used as jewelry. So, it’s priced and behaves differently than gold.

When gold investors tire of buying the yellow metal, they purchase silver. And there just isn’t enough silver to go around. So, on rare occasions throughout history, silver’s price has utterly roofed it.

Right now is one of those times in history.

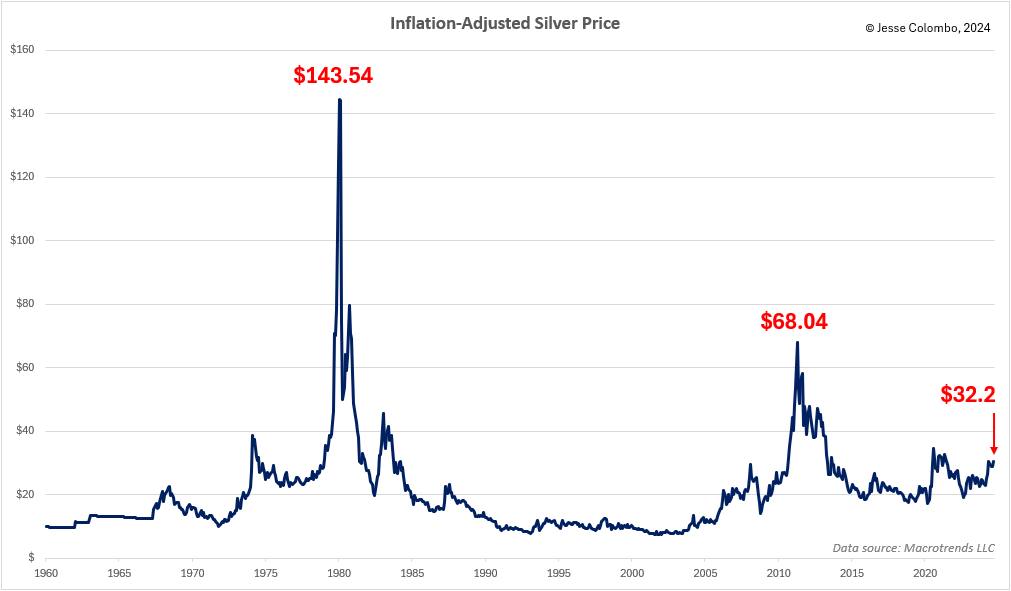

Silver’s Technical Picture

Silver fell off a cliff after hitting $50 in 2011, bottoming at $14. It’s been a while, but now silver is infringing on the $32.50 level. Last week, the silver futures contract closed at $32.39. Back in May 2024, it closed at $32.75, so it’s knocking on the door again. Once we break above $32.50 for good, it’s off to $35 and then to the 2011 high of $50. But we don’t think it’s stopping there.

Here’s the kicker. Once you adjust for inflation, the all-time highs look like this:

If you’re thinking, “Why are you looking at charts? Isn’t that the astrology of finance?” I hear you. We look at charts for metals and rates, among other things, because price is the best thing we can look at. We’re not Glencore, Cargill, or Coeur Mining, who can send geologists to scour the world for silver. So we do the next best thing: watch what people with money are betting on in the markets.

Ace precious metals analyst Jesse Colombo also produced this chart:

Credit: Jesse Colombo

Colombo writes in his The Bubble Bubble Report:

Silver now needs to close above its $32.50 resistance level with strong volume to confirm that the next leg of the bull market is underway. Once silver clears the $32.50 resistance, it’s likely to surge toward $50 rapidly. I'm focusing on $50 as an intermediate-term target because it’s a significant psychological level and the peak reached during both the 1980 and 2011 rallies.

Colombo also showed this cup-and-handle pattern on silver’s log scale that’s incredibly bullish once we close above $50:

Credit: Zero Hedge

“But Sean, what makes you think we’re hitting $50?” you ask. Let me tell you…

Russia’s Central Bank is Buying Silver

Central bank buying is the primary driver of the gold price hitting $2,600 per ounce. Most retail and institutional buyers aren’t participating yet. But it’s only a matter of time before they do, and the price will explode further to the upside.

The same thing is happening in silver, and Russia opened those floodgates.

Russia’s intention to boost its silver reserves aligns with its broader strategy of accumulating precious metals, particularly gold, to safeguard against economic sanctions and currency volatility.

Russia’s ongoing isolation from Western financial systems, such as SWIFT, has prompted its government to seek alternatives to dollar-dominated reserves. As fiat currencies lose value and government bonds become riskier, assets like gold and now silver offer safer alternatives. While gold has been the traditional go-to, silver is gaining traction as a complementary asset.

Russia’s decision is particularly noteworthy because it challenges the traditional role of silver as a purely industrial metal. Historically, most silver demand has come from industrial uses—solar panels, electronics, and green energy technologies. However, Russia acknowledges its dual role as an industrial commodity and a potential financial asset by including silver in its state reserves.

The implications of this move could be profound. Silver demand could spike if other nations follow suit, driving prices higher. Some analysts speculate that silver could rise to $50 per ounce or even higher as central banks worldwide reconsider its strategic value.

This makes silver an incredibly attractive asset for investors. It could follow the same trajectory as gold.

Finally, let’s talk about the silver mining sector.

The Coeur/SilverCrest Merger

Friday’s announced merger between Coeur Mining and SilverCrest Metals is a prime example of consolidation in the silver mining sector. Coeur, a major player in the precious metals mining space, acquired SilverCrest to boost its silver production capabilities.

SilverCrest’s flagship project, Las Chispas, located in Mexico, is one of the highest-grade silver deposits globally. This acquisition strengthens Coeur’s position in the silver market by expanding its asset base and production potential. The merger also comes when the demand for silver is projected to grow, driven by both industrial applications and, as I wrote above, increasing interest from central banks.

From an industry perspective, this merger signals a wave of consolidation in the silver mining sector as companies seek to strengthen their positions in anticipation of rising demand. With industrial demand for silver expected to remain strong—particularly from the green energy sector—and central banks like Russia beginning to stockpile the metal, silver miners are positioning themselves to take full advantage of this emerging trend.

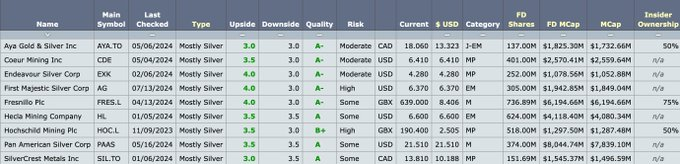

Ace precious metals analyst Don Durrett had this to say on X about the CDE/SILV merger:

Here's the outcome (if it closes):

1) Silvercrest had a pipeline problem (they didn't have one), and Coeur had a cost problem (they are too high). Both got fixed in this merger.

2) Coeur is now a monster. I already had it ranked as the #2 silver miner. They just got better. If you own either of these stocks, you just got handed a present.

3) You want to be overweight Hecla and Coeur. Why? When sentiment finally improves for the gold/silver miners, these stocks will benefit in a huge way. Wall St, ETFs, Hedge funds, and private equity will buy them like candy. They are the go-to names!

Normally, these stocks do poorly in bear markets, thus, they have a bad reputation among investors. However, they do remarkably well during bull markets.

Here’s Don’s list of favorite silver stocks (from the same post):

Full disclosure: I own CDE, EXK, AG, HL, and SILV. SIL.TO is SilverCrest's Canadian listing. I own the US listing SILV.

Wrap Up

What an opening for Gold Week on the Rude! Ok, it was a silvery beginning, but you’ve got a bunch of homework. Take a look at silver. See if you like it. I sure hope you do.

Tomorrow, I’ll write about different ways to own gold. All of those ways will apply directly to silver, as well.

But more immediately, check out those tickers from Don Durrett. Mining stocks are an excellent way to increase your leverage in the metals space.

Have a great week ahead!

WTI…WTF?

Posted December 18, 2025

By Sean Ring

Icing The Green New Scam

Posted December 17, 2025

By Sean Ring

8 Things That Will Turbocharge The Gold Price

Posted December 16, 2025

By Jim Rickards

Can Miners Double Again?

Posted December 15, 2025

By Sean Ring

How FDR Put America Behind Golden Bars

Posted December 12, 2025

By Byron King