Posted October 09, 2024

By Sean Ring

[GOLD WEEK]: The Best Way to Play The Gold Rally

Gold is rallying again with economic uncertainties, inflationary pressures, and geopolitical tensions rising.

While physical gold is undeniably attractive, savvy investors understand mining stocks offer a unique and potentially more profitable way to ride the gold wave. Why settle for modest gains in physical gold when mining stocks provide leverage, growth potential, and dividends, making them a compelling investment option?

Now, to be clear, you should own physical gold.

It's not just a suggestion. It's a necessity. You absolutely should own physical gold, especially for insurance purposes. It's a reassuring hedge against potential unfavorable outcomes in these uncertain times.

Who knows what’s going to happen over the next year? November may only be a month away, but there’s no clear winner to be called. Though I must admit, with much relief, The Donald has been polling better lately.

But what if Deep State pulls off a coup and nullifies the election results? Kackling Kamala will be the Figure Airhead in an apparatchik-run government. So physical gold, in a safe, in your house, is a necessary hedge against that outcome.

It doesn’t have to be an enormous amount. Two percent of your liquid assets in physical gold should do the trick.

But what about the rest?

Let’s review why we’re so bullish on gold. Then, we’ll visit the miners.

The Gold Rally in Context

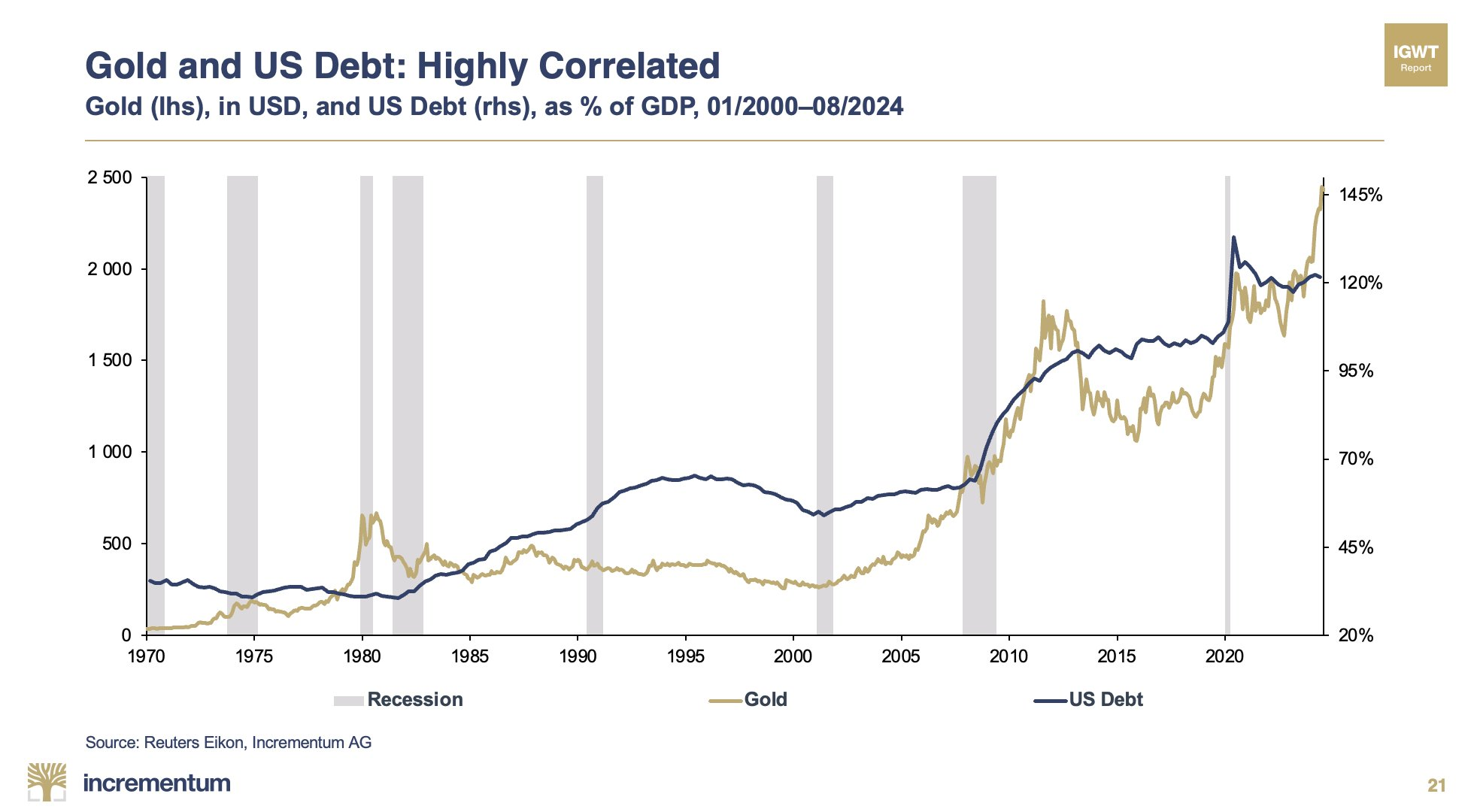

Economic factors are aligning to support higher gold prices. Lower interest rate expectations, currency fluctuations (USD down), and demand dynamics (retail and institutional buyers haven’t even woken up yet) signal a continued upward trend.

Credit: @IGWTreport

Gold isn’t just a hedge against inflation but also against uncertainty and government distrust, which are all in ample supply today.

Why Mining Stocks?

In a word, Greed. Or, if you prefer, taking advantage of the opportunity.

Only a few times in history have we been afforded this kind of profit opportunity.

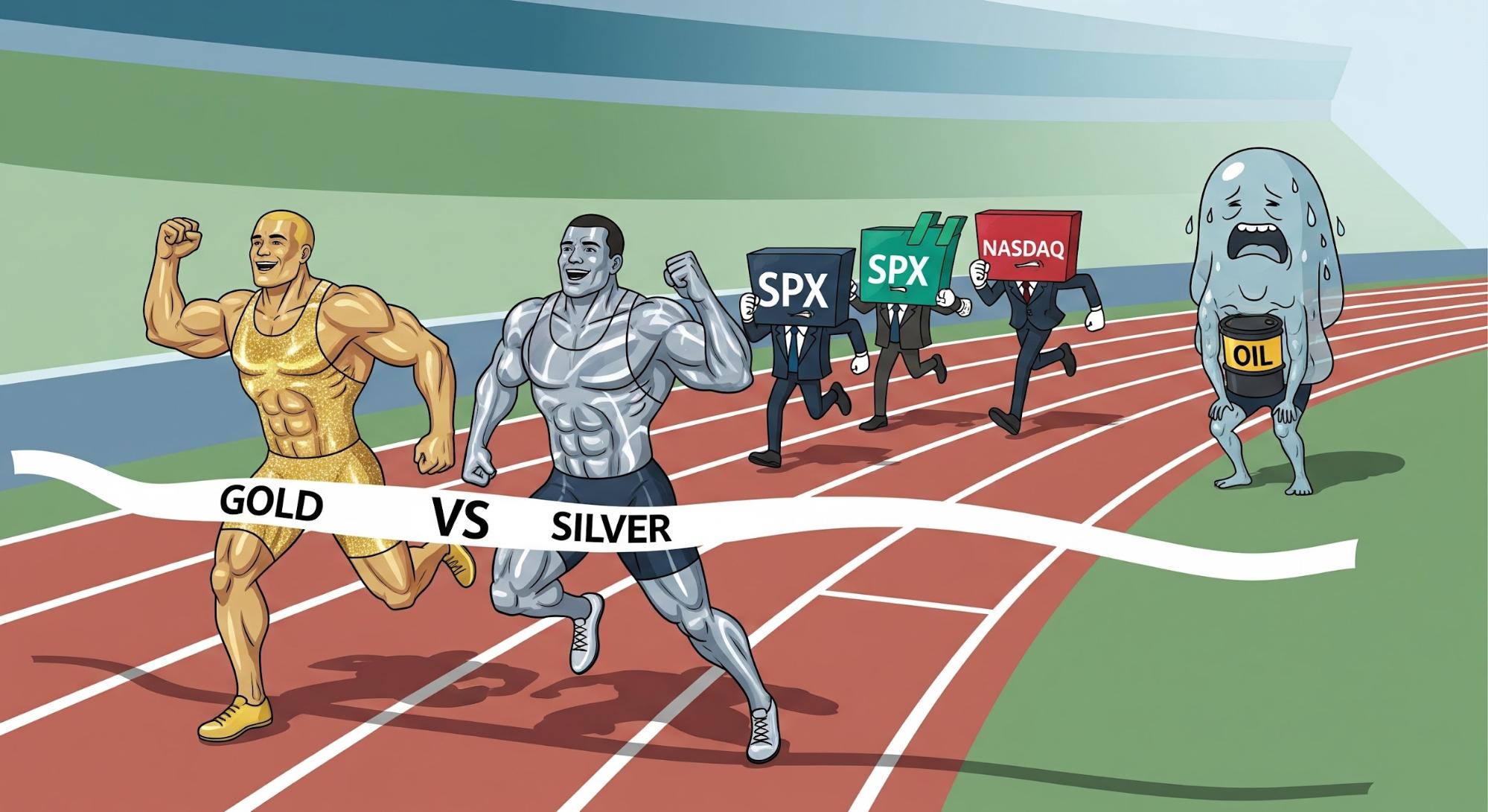

Investing directly in gold means you’re only getting exposure to the metal’s spot (cash) price movements.

But mining stocks provide leverage to gold prices—when gold prices rise, mining company profits can increase even more significantly. This is due to their fixed costs; as the price of gold rises, the difference between their costs and revenues widens, enhancing profitability.

Credit: @hajiyev_rashad

Mining analyst Rashad Hajiyev posted on X, along with the above chart:

Gold vs. GDX monthly chart

Gold miners continue to lag vs gold. Since September 1, 2024 gold is up nearly 6%, while GDX gained a miniscule 2.6%. Usually GDX should have been up 12 - 15%, but it only managed to make a miniscule gain.

Also, gold still holds above September highs, but GDX already lost half of September gains.

The lag cannot go on forever and should find a resolution at some point...

So we’re looking for the miners to catch up to gold’s rally.

Willem Middelkoop posted this on X back in August:

Credit: @wmiddelkoop

His comment accompanying the chart above is, “Gold miners are valued so low (versus gold) that they could have an upside of 40x.”

How would a 40-bagger feel for you right now?

A return that big is certainly worth risking a few dollars.

Leverage and Profit Potential

The first advantage of mining stocks over physical gold is leverage. Miners benefit exponentially as their profit margins grow with rising gold prices.

Large mining companies like Barrick Gold and Newmont Mining are positioned to benefit from economies of scale, increasing their leverage on gold prices and profitability.

Since bottoming out in February, both Barrick and Newmont have been up big.

While junior miners are riskier, they offer even more tremendous upside potential due to their focus on exploration and smaller, more agile operations.

Alamos Gold and IAMGOLD are two of the better-performing junior miners.

Dividends and Income Generation

Warren Buffett is correct in that gold doesn’t pay dividends.

But gold mining stocks often do.

Companies like Franco-Nevada, Wheaton Precious Metals, and Barrick Gold provide income streams for investors. These dividends can serve as an income source, and they offer a unique blend of capital appreciation and income generation—ideal for investors who want to hedge risk while receiving regular payouts.

I favor riskier investments right now, and I’ll explain why tomorrow.

Risk Considerations

When it comes to risk, a few things stick out.

One is that average investors will make average returns. That’s why I don’t favor the ETFs.

But taking on the risk that futures confer upon an investor is insanity unless you’re chained to your desk all day and make sure your stops go off properly.

Trust me. In a past life I was a futures broker.

Of course, mining stocks have risks.

Operational challenges, geopolitical risks, and management missteps depress performance. Investors should focus on companies with solid balance sheets, experienced management teams, and diversified operations across multiple safe jurisdictions.

Due diligence is not just a recommendation. It's a must when selecting mining stocks. This is particularly true when exploring junior miners, which carry higher risks but potentially higher rewards. It's the responsible approach to investing.

Valuation and Timing

Valuations in the mining sector remain relatively attractive, even as gold prices rally. (Over the past few days, gold has taken a breather. It’s an excellent opportunity to get in.)

Many mining companies have been improving operational efficiencies and managing costs effectively since the 2011 peak. Billionaire resource investor and great friend of Paradigm Press, Rick Rule, once told me that gold mining companies somehow managed to create negative(!) cash flow during the 2000-2011 bull market run. That kind of insouciant management makes it no wonder Wall Street hates them so much!

But since they’ve cleaned house, they’re in a solid position to capitalize on gold’s rise, with boatloads of upside potential. Timing is also critical. Investors shouldn’t chase momentum, as my good friend and colleague Byron King always reminds us. They should look for periods of consolidation in gold prices or pullbacks in mining stocks (like right now!) to enter positions and maximize their potential gains.

Investment Vehicles

I much prefer single mining stocks to ETFs. They’re cheaper and have far more upside potential. The ETFs hold too many stocks, diversifying away the big profit. If you do your homework, you can make serious money. Tomorrow, I’ll show you exactly which mining stocks I hold in my retirement portfolio.

But if you’re still unsure, or even unwilling to spend the time doing homework, you can choose ETFs like the VanEck Vectors Gold Miners ETF (GDX) or the VanEck Vectors Junior Gold Miners ETF (GDXJ). Indeed, ETFs provide diversification, reducing individual company risk.

Wrap Up

In today’s uncertain, or possibly deteriorating, economic climate, gold will continue its upward trajectory.

Investing in mining stocks gives you a compelling option to leverage the gold rally.

With the potential for outsized returns, income through dividends, and leverage to gold prices, mining stocks provide an attractive proposition for those looking to maximize their return on the current and future gold rally.

Tomorrow, I’ll be back with my favorite mining stocks.

Swamp, Brains, and the Game

Posted December 19, 2025

By Sean Ring

WTI…WTF?

Posted December 18, 2025

By Sean Ring

Icing The Green New Scam

Posted December 17, 2025

By Sean Ring

8 Things That Will Turbocharge The Gold Price

Posted December 16, 2025

By Jim Rickards

Can Miners Double Again?

Posted December 15, 2025

By Sean Ring