Posted October 11, 2024

By Sean Ring

[GOLD WEEK]: The Age of Gold Is Upon Us

This week, we’ve discussed gold and silver’s importance, different ways to invest in gold, the best way to invest in gold, and how I’ve personally invested in gold and silver mining stocks.

Today, I want to close out Gold Week on the Rude by explaining why gold and silver will reign supreme in the coming years.

Two big words come to mind: capital rotation.

Capital rotation—the movement of investments from one sector to another—has re-emerged as a central theme.

There are promising signs of a shift from tech-heavy investments to precious metals as investor sentiment and market forces adapt to new realities. Understanding this rotation is crucial, especially when considering how to position your portfolio to weather potential shifts and capitalize on emerging trends.

In this article, we’ll unpack what capital rotation is, why we may see a rotation out of tech and into precious metals, and the implications for your investments. We'll also discuss some practical strategies for positioning your portfolio to make the most of this shift.

What is Capital Rotation?

Capital rotation is a natural process in the markets. Investors reallocate funds from one sector to another, driven by changes in economic conditions, market sentiment, and sector-specific performance. This rotation can be subtle or significant, influencing asset prices, sector momentum, and broader market trends.

Historically, capital rotation occurs in cycles. For instance, during periods of economic expansion, we often see a shift into growth-oriented sectors like technology. Conversely, when markets enter a downturn, there's typically a rotation into defensive sectors or assets perceived as safe havens, like utilities, consumer staples, or, our favorite, precious metals.

Recognizing these shifts can provide a valuable edge in optimizing portfolio allocations and minimizing risks. It's a powerful tool that can give you a sense of control and confidence in your investment decisions.

The key to understanding this is that anywhere from 75% to 91% of your portfolio returns come from the asset class you’re invested in, not from being a good stockpicker.

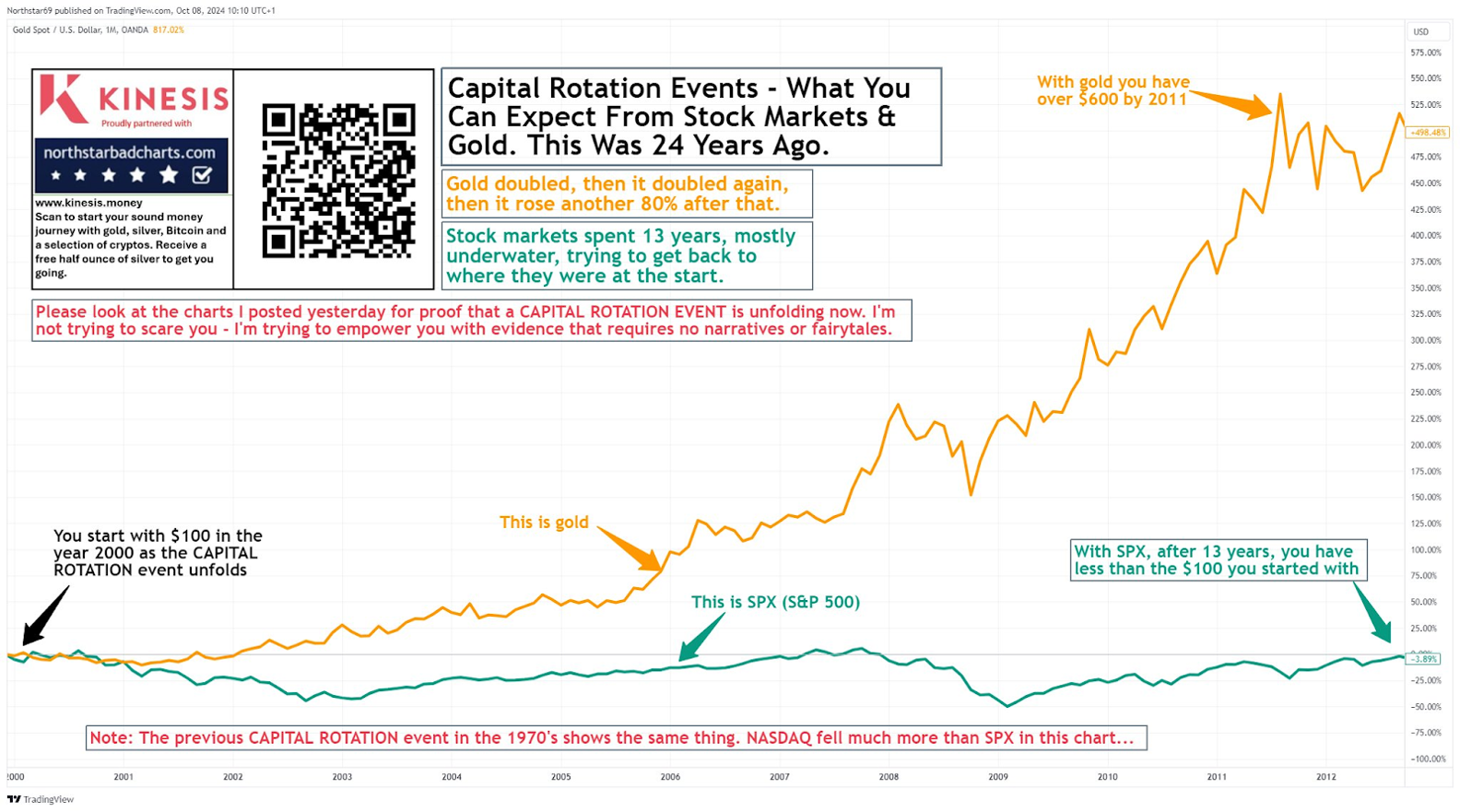

There are just times when when you want to avoid certain things. Tech stocks from 2000 to 2003 were a disaster, and gold from 2000 to 2011 was a dream.

From 1988 to 2000, the Nasdaq was perceived more as a high-yield savings account than a group of risky tech stocks. But from 1929 to 1946, the last thing you wanted to own was equity.

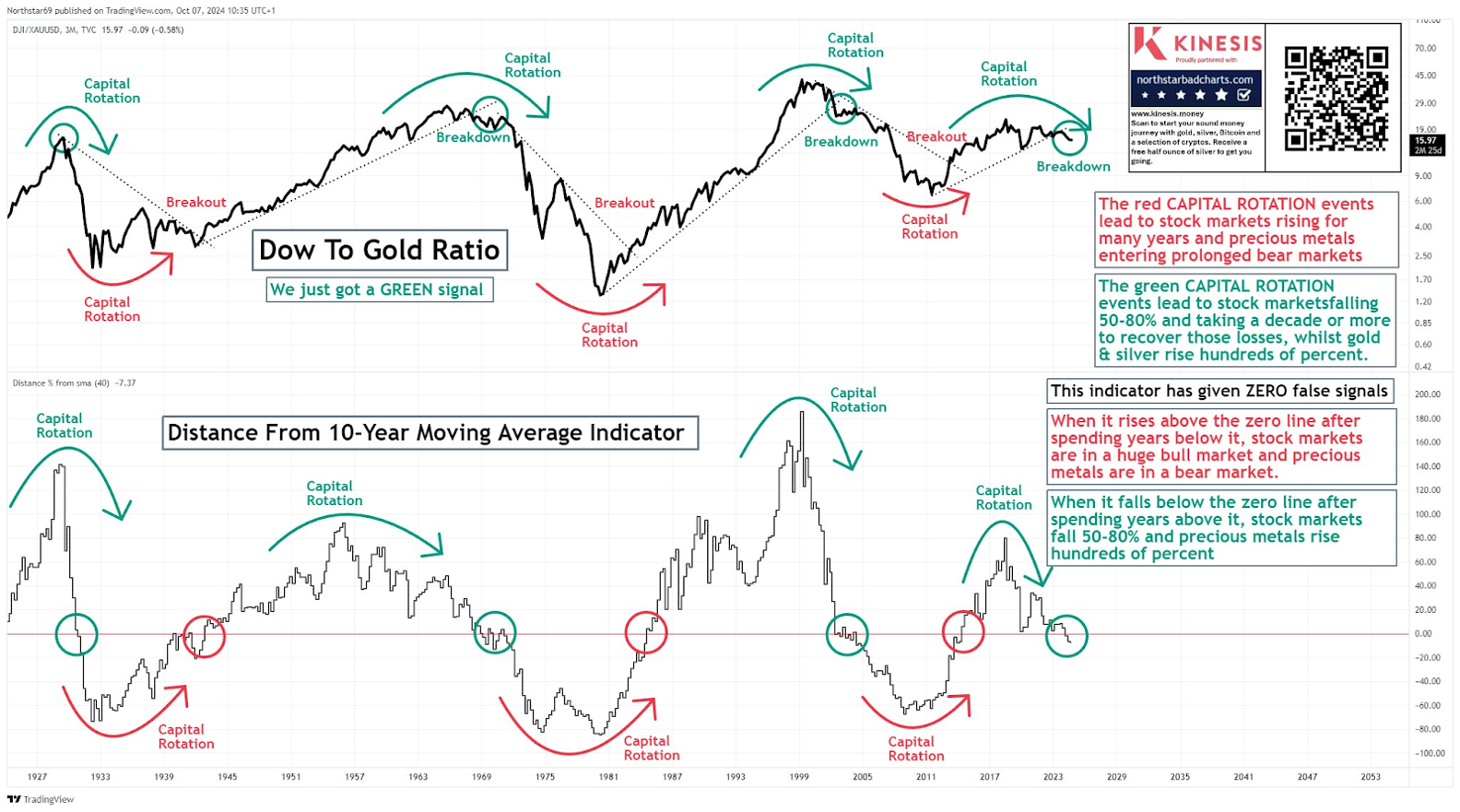

Check out this chart from the fantastic guys over at Northstar Charts.

Credit: @NorthstarCharts

The gents at Northstar expect the stock market to fall 50% to 80% in the coming years, with a major rotation into gold.

Imagine what all that capital flying into gold will do to the price!

And if this is correct, expect an outcome similar to that 2000-2011 gold bull market:

Credit: @NorthstarCharts

It sounds incredible, and I think they’re on the right track. But why hasn’t it happened yet? Aren’t we overdue?

Let me explain.

Delaying Capital Rotation

Must this happen right now? No.

And two things jump out about why capital rotation may take longer.

Ever Lower Interest Rates

I’ve beaten this horse to death in the Rude, so I’ll expound on the point minimally. Did Jay Powell just cut rates by 50 basis points? There you go.

Low interest rates prop up asset prices like a heavy dose of uppers prop up Joke Biden.

But there’s another reason why capital rotation hasn’t had to happen. And that’s a cunning wealth strategy you may not have heard of…

Buy Borrow Die

"Buy, Borrow, Die" is a wealth strategy that, while sounding morbid, is a brilliant way for the ultra-wealthy to build, leverage, and protect their assets. It’s all about accumulating wealth in assets (often stocks, real estate, or businesses), using those assets as collateral for loans, and ultimately passing on those assets tax-efficiently. Here’s how each step plays out:

1. Buy

The first step is simple enough: Buy assets that appreciate over time. Think stocks, real estate, art, or even entire companies. These aren’t just investments; they’re wealth-growing machines. As these assets gain value, they increase the net worth of their owners without triggering any income taxes.

2. Borrow

Instead of selling those assets when they need cash, the wealthy will borrow against them. Banks love to lend to these individuals because the assets are solid collateral. By borrowing, they get liquidity without triggering a taxable event. Better yet, they can often write off the interest on these loans as a tax deduction. So, while you and I might sell stocks to raise cash, they’re tapping into tax-free loans at super-low rates, keeping their assets intact.

3. Die

Here’s where it gets interesting: upon their death, the wealthy pass on these assets to heirs on a “step-up” basis. The new cost basis for these inherited assets is adjusted to their current market value, effectively erasing the capital gains tax liability. This loophole means the heirs can sell those assets without owing taxes on the gains that accrued during the original owner’s lifetime.

Why It Matters

The tax code heavily favors capital over income, and the "Buy, Borrow, Die" approach lets the rich legally avoid the capital gains tax that would typically hit everyday investors.

Incentives shape our investment landscape.

But let’s say Northstar is correct. Why would this be happening now?

The Case for Rotating Out of Tech

In recent years, technology stocks have been the darling of the stock market, delivering insane returns and outpacing most other sectors. However, as economic realities shift, so does the rationale for investing heavily in tech. Here’s why:

Many tech stocks have reached hard-to-justify valuations (see NVDA and TSLA), especially as interest rates have risen. Investors are becoming cautious about paying a premium for growth when future earnings won’t match inflated price tags.

Higher interest rates make borrowing more expensive, dampening the growth prospects of tech companies that rely on cheap capital for expansion. This is particularly impactful for smaller, high-growth tech firms.

Governments worldwide scrutinize Big Tech more closely, with new regulations and fines on the horizon. Google has recently incurred the ire of the EU, while Elon paid heavily to get X reinstated in Brazil. These factors increase uncertainty and depress tech stock performance.

After years of outrageous gains, investors—especially those not into Buy, Borrow, Die—are starting to take profits. This sell-off can trigger a broader retreat from the sector, amplifying the rotation out of tech.

With these factors at play, the appeal of tech is dimmed compared to recent years. As a result, investors are searching for alternative assets to reallocate their capital, and precious metals are catching their attention.

Why Precious Metals are Gaining Appeal

Precious metals like gold and silver have historically served as safe havens during economic and geopolitical turmoil. They offer a hedge against inflation and currency depreciation, making them attractive today.

Gold, in particular, is often seen as a way to preserve purchasing power when inflation erodes the value of paper currency. With inflation concerns persisting, the demand for precious metals is rising. As our good friend and billionaire resource investor Rick Rule reminds us, the average portfolio allocation for precious metals throughout history is 2%. Today, it’s about 0.5%. Even a return to the norm would quadruple the gold price.

Precious metals are viewed as a store of wealth. In market volatility or uncertainty, they attract investors seeking stability.

Central banks worldwide have been increasing their gold reserves, signaling confidence in its value as a hedge against economic instability. Institutional and retail investors have yet to join the game.

Political instability drives investors toward assets that offer protection against potential disruptions in the global economy. Gold and silver are often the go-to choices during such times; just ask Russia’s central bank.

The appeal of precious metals lies in their ability to diversify and provide security when traditional assets, like tech stocks, appear vulnerable. This rotation into precious metals suggests that investors seek refuge from the risks currently facing the tech sector.

Implications of the Rotation for Investors

So, what does this capital rotation mean for investors? Understanding these shifts can help you anticipate changes in portfolio performance and adjust accordingly.

Precious metals tend to be less volatile than tech stocks. As investors rotate out of tech, we could see a reduction in overall market volatility, particularly in portfolios previously dominated by high-growth tech plays.

Adding precious metals increases diversification, smoothing out returns over time. Because they don’t move in tandem with other asset classes, they reduce risk and enhance portfolio resilience.

As inflation persists and economic uncertainty grows, the prices of precious metals will continue to rise. Those who get in early will benefit from appreciation in these assets. Again, as Rick Rule says, invest when “there’s no competition on the bid.”

If the rotation out of tech accelerates, the sector could underperform relative to historical standards. This means investors heavily allocated to tech will see slower growth or declines, depending on how severe the rotation becomes.

This shift signals investors are taking a more defensive stance, balancing their portfolios in anticipation of possible turbulence.

How to Position Your Portfolio for the Rotation

Now that we understand the drivers behind this capital rotation and the potential implications let’s discuss strategies for positioning your portfolio to benefit from the shift toward precious metals.

We’ve discussed this throughout the week, so consider this a summation.

Instead of making drastic changes, consider gradually reallocating some of your tech holdings into precious metals. This could involve selling a percentage of your tech stocks and reinvesting in gold, silver, or related assets.

You can gain exposure to precious metals through physical assets (like bullion or coins) or financial instruments (like ETFs). Physical metals offer a tangible hedge, while ETFs provide liquidity and ease of trading. Decide which suits your investment strategy and risk tolerance.

Investing in mining companies offers leveraged exposure to precious metals. When metal prices rise, mining stocks often experience outsized gains. However, these stocks are more volatile, so weigh the potential rewards against the risks.

If you’re a Strategic Intelligence Pro subscriber, Dan Amoss, the hardest working man in the newsletter business, recommended a dandy of a trade on one of the miners yesterday. Check your inbox to make sure you didn’t miss it!

You don’t need to abandon tech entirely. Maintaining a diversified portfolio is smart, so consider balancing your exposure between growth sectors and defensive assets like precious metals. This way, you can capitalize on tech’s long-term potential while safeguarding against near-term volatility.

Gold and silver act as effective hedges in your portfolio. Even a small allocation (5-10%) will provide some downside protection during market corrections. Reassess your overall asset allocation and make room for these precious metals as a stabilizing component.

Wrap Up

Capital rotation is a natural and essential aspect of market dynamics, driven by shifts in investor sentiment, broader economic conditions, and political intervention. As we rotate from tech to precious metals, understanding the forces behind this shift will help you make informed decisions about your portfolio.

While tech has provided gobsmacking returns in recent years, precious metals now offer a compelling alternative. By diversifying your holdings and adjusting your allocations, you can reduce risk and enhance your portfolio’s resilience.

Remember, the goal isn’t to predict market movements perfectly but to stay informed, remain adaptable, and position yourself to thrive in any market environment.

Now is an excellent time to review your investments, consider the benefits of precious metals, and ensure your portfolio is well-prepared for the next phase of this market.

Have a wonderful weekend!

Empire At Gunpoint

Posted January 05, 2026

By Sean Ring

It's Been a Metals Year... and a Pick!

Posted January 02, 2026

By Sean Ring

The U.S. Equity Indices and What They Mean

Posted December 30, 2025

By Sean Ring

The Shape of Things to Come

Posted December 29, 2025

By Jim Rickards

A Copper Melt-Up in 2026, and “Tech” Meltdown

Posted December 26, 2025

By Byron King