Posted April 01, 2025

By Sean Ring

Gold to the Moon, Crypto to the Morgue

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I show a couple of performance charts so you can see where traditional asset classes and cryptocurrencies trade relative to each other.

If you’re a new subscriber, write to feedback@rudeawakening.info if you have any questions, comments, or issues. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

Donald Trump no longer cares about the stock market.

This is the most important information we’ve got about the Trump Administration. Ultimately, it means stocks aren’t always going to provide positive returns.

Trump and his new Treasury Secretary, Scott Bessent, have clarified that they want the 10-year yield to fall so loans and mortgages are more affordable.

This matters much more to most Americans than an ever-rallying stock market does.

As a result of this policy - and Trump’s tariff tantrums - the SPX, Nasdaq, and Russell 2000 have all wobbled this month below their 200-day moving averages.

Crypto has been decimated, as well.

But gold, silver, and copper are looking mighty good now. All have chunky upside targets and eager buyers. Oil, too, finally joins this bullish set-up.

Let’s get a closer look at the charts.

S&P 500

Last month, I wrote that our new price target was 5,535. We reached that level and recovered to close the month at 5,611.85.

I don’t like that we’re below the 50-day and 200-day moving averages, and the 50-day moving average is pointing sharply downward.

The new downside target is 4,896. But that doesn’t guarantee we’ll reach it. I believe a more likely stopping point is 5,350. If we don’t stop there, we'll head towards the 5,100/5,000 level.

Nasdaq Composite

The Nazzie chart is slightly worse than the SPX’s. We hit our downside target of 17,729 and finished the month at 17,299.29. The next target levels look like the 15,750/15,250 area.

NVDA (a big Nazzie constituent) rolled over, down from 124.92 last month to 108.38. I closed my cheeky April put yesterday for a small profit. However, in the long term, NVDA’s tentative downside target is 87(!).

Russell 2000 (Small caps)

Russell suffered a roughly 7% drop last month, from 214.65 to 199.49. Our original downside target was 192, which will likely be easily hit this month.

But the new downside target is 163.43, which may take longer to hit.

The US 10-Year Yield

Secretary Bessent won’t be denied!

No matter how hard the 10-year yield wants to leap out of that channel, it gets pulled back in.

There’s no definitive downside target at the moment, but I think we’ll soon be looking at a sub-4.00% yield.

That should pressure the dollar downward as well.

Dollar Index

Again, we’ve dropped nearly 3 points this month. President Trump must be thrilled. We’ll see more once he announces his tariff policy tomorrow.

But a weakened dollar is good for USD assets (usually). Hopefully, the metals will benefit.

USG Bonds

We had no follow-through from last month’s ridiculous rally, dropping a point.

Investment Grade Bonds

Again, we dropped a point in the investment grade space. LQD still has a ridiculous upside target, but I think the machine is wrong.

High Yield Bonds

Real Estate

We fell nearly 3.5 points, as I was expecting last month. I reckon we’re looking at 85 first, before we head down to 76.

Energy: West Texas Intermediate (Oil)

Okay, it looks like the 10-year yield and USD have affected oil prices. WTI has rallied to 71.48 from 69.76. It’s not huge—yet—but the new upside target is 83.

Base Metals: Copper

***NEW MONTHLY CLOSING HIGH of 5.03***

I was totally wrong on copper. We hit a new monthly closing high. No new upside target yet.

Precious Metals: Gold

***NEW MONTHLY CLOSING HIGH OF 3,124.22***

Gold took off this month, enjoying a 9.67% rise to 3,124.22. This chart looks healthy and robust. The next target is 3,611.

Precious Metals: Silver

Silver was up 2.50 this month.

This chart is bullish, but not as definitive as gold. Still, we’ll head up from here. Silver’s next target is 39.05.

Cryptos: Bitcoin

Bitcoin’s picture has entirely changed. After getting slammed from mid-90k to barely just above 80,000, Bitcoin’s chart has turned bearish.

BTC’s next target is 75,280.

Cryptos: Ether

Though it’s bouncing today, Ether’s chart is awful. Ether fell 17.8% in March. Its downside target is 1,453 now. I’d still avoid it like the plague.

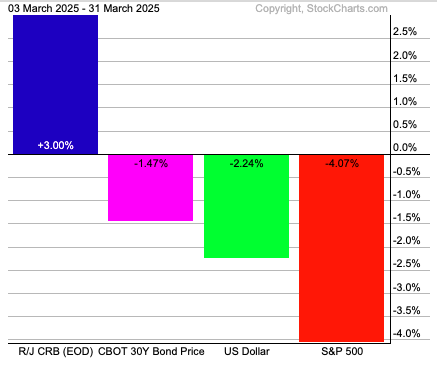

Trad Asset Class Summary

The Almighty Dollar fell another 2.24%, its third consecutive monthly loss. Trump’s plan to weaken the dollar seems to be working. Commodities were the winners, up 3.00% this month. The long bond fell 1.47%.

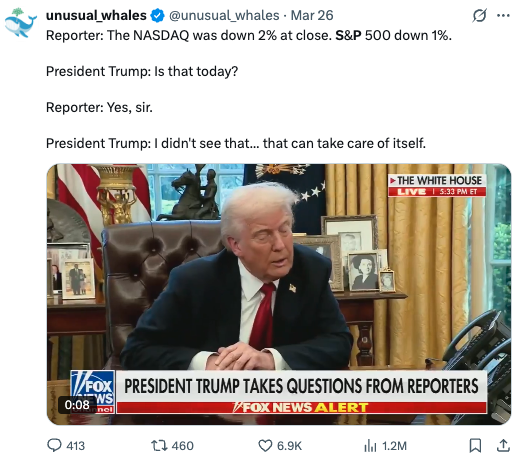

And yet, the SPX fell over 4% this month, its worst showing since April 2024’s -4.16%. Remember, the President is not targeting the SPX anymore; it’s the 10-year yield. He reiterated this last week.

Credit: @unusual_whales

Credit: @unusual_whales

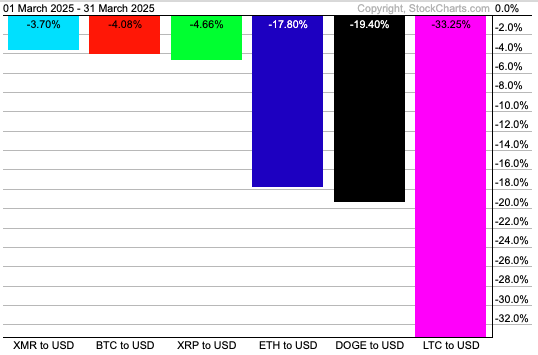

Crypto Class Summary

It was another terrible month for the crypto bros. Litecoin, the only cryptocurrency with a positive return last month, was crushed, losing over a third of its value. Monero, Bitcoin, and Ripple only suffered single-digit losses. Along with Litecoin, Ether and Dogecoin were taken out behind the woodshed, down 17.80% and 19.40%, respectively.

Wrap Up

As the USD weakens, gold, silver, and copper benefit.

Cryptocurrency looks like tech stocks, and follows them into bear market territory. The Nasdaq and Ether look especially weak.

Stick with the metals, as the commodity supercycle looks like it’s kicking off.

Finally, on this April Fool’s Day, here’s a picture of the UK Parliament, courtesy of the X-verse:

Have a wonderful week!

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards

Isn’t Mining Dangerous Enough?

Posted February 11, 2026

By Sean Ring