Posted December 10, 2024

By Sean Ring

Gold Glitters on Assad’s Fall

I must admit to being a bit surprised. Sure, gold is a safe haven asset, the price of which should rise on major geopolitical events. Assad’s fall certainly qualifies as that. Therefore, gold acted as it should have, right?

But we must go deeper than that.

Central bank buying has driven the price of gold to new all-time highs. And with Assad’s fall comes Russia’s withdrawal. Iran is severely hurt and isolated. Indeed, Trump has China in his sights, justified or not. And that means more gold buying if these countries want to avoid sanctions that genuinely bite.

Confiscation and Redistribution

After all, only five days ago, outgoing U.S. Secretary of State Anthony Blinken confirmed Ukraine would receive $50 billion in Russian assets the United States and the European Union had confiscated and frozen. Somehow, they feel free to distribute those stolen funds as they see fit. It’s daylight robbery in diplomatic robes and the perfect example of why many countries would happily leave the dollar if they could.

But that won’t happen with The Donald behind the Resolute Desk. On November 30th (U.S. time), he tweeted:

The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy. They can go find another “sucker!” There is no chance that the BRICS will replace the U.S. Dollar in International Trade, and any Country that tries should wave goodbye to America.

Already, BRICS members South Africa and India have rolled over.

South Africa was the first to say it wouldn’t participate in creating a new BRICS currency, following DJT’s threat.

According to Department of International Relations and Co-operation (Dirco) spokesperson Chrispin Phiri (bolds mine):

Recent misreporting has led to the incorrect narrative that BRICS is planning to create a new currency. This is not the case. The discussions within BRICS focus on trading among member countries using their own national currencies. BRICS leaders have called for a reformed international financial system to facilitate trade in local currencies.

However, BRICS is not discussing the creation of a common BRICS currency. Instead, South Africa supports the increased use of national currencies in international trade and financial transactions to mitigate the impact of foreign exchange fluctuations, rather than focusing on de-dollarisation.

Good doggie.

India’s External Affairs Minister (EAM) S Jaishankar said at the recent Doha Forum:

I am not exactly sure what was the trigger for it, but we've always said that India has never been for de-dollarisation. Right now, there is no proposal to have a BRICS currency.

To be fair, these statements were made before the recent unpleasantness in Syria.

What makes no sense to me is that these countries are essentially agreeing to keep a US dollar The Once and Future U.S. President is fully intent on depreciating. It’s a tacit agreement to destroy wealth.

Of course, Trump’s nomination of Scott Bessant as U.S. Treasury Secretary contradicts this, as Bessant sees the Fed as the creator of bubbles and dislikes the current loose monetary environment.

How this all works out is beyond my crystal ball.

With all that said, let’s get out of the politics and into the price action.

Post Election Doldrums

We knew gold would get hit if Trump won and rally if he lost. Since he won by such a landslide, gold got pummeled. But this is par for the historical course.

Gold reached its all-time high on October 31st this year (blue arrow on the chart below).

That’s when the markets started to price in a Trump victory.

Gold fell sharply to about $2,540 before recovering. First, gold needs to retake $2,700 before anything significant happens. I suspect that will come soon. After that, the next target is the intraday high of $2,800. Once that happens, which I think will come before year-end, we’ll be off to the races in 2025. We’ve also got support at $2,650.

The selloff isn’t a surprise. According to Sprott:

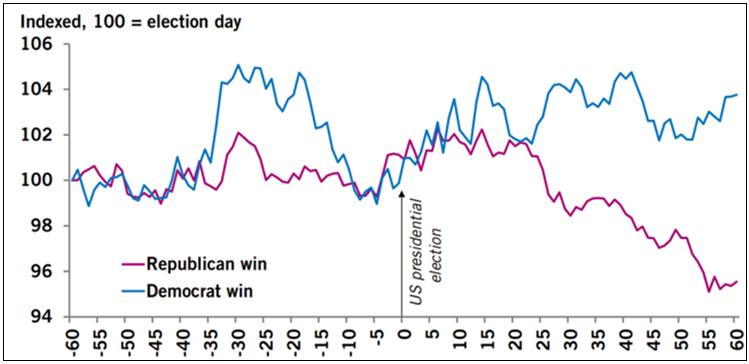

This isn't the first time gold has taken it on the chin post-election. According to Heraeus Group, since 1976, elections of Republican administrations have led to an average 4.54% decline in the gold price within 60 days, compared to an average 3.83% rise in the gold price following Democratic wins. After Trump’s last win in 2016, gold lost 11.64%.

Gold Price Performance Around U.S. Elections (1976-2024)

Credit: SFA (Oxford), Bloomberg, via Kitco

Yesterday’s Action

The chart below shows the price action of Sunday, yesterday, and this morning layered over each other.

Sunday night into Monday morning ET, we saw a sharp rise, thanks to the public announcement of Assad’s downfall (red line).

Credit: Kitco

Following that line, gold rallied from $2,635 to nearly $2,680 before cooling off. The lime green line (today’s price action) shows that gold recovered its losses and is trading at over $2,670.

I expect that trend to continue.

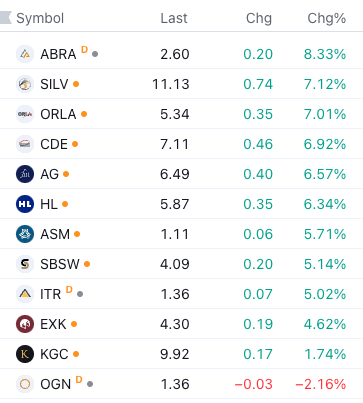

The best part is that many of the gold and silver miners participated in yesterday’s rally:

Many were up double digits before cooling off. Orogen Royalties was the only disappointment. I’m exiting that position today, as the chart looks weak.

Wrap Up

There’s a reason we need to pay attention to politics, especially regarding gold.

This move was entirely precipitated by Assad’s fall in Syria and the expectation of frantic gold buying from central banks of countries unfriendly to the United States. Or, at least, countries worried about American reprisals, whether earned or not.

Still, if you haven’t gotten in yet, there’s time. Gold will recapture $2,800 soon, and then it’ll be $3,000 or bust.

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards

Isn’t Mining Dangerous Enough?

Posted February 11, 2026

By Sean Ring

A Tale of Two Italys

Posted February 10, 2026

By Sean Ring

Take The Money and Rotate

Posted February 09, 2026

By Sean Ring