Posted June 04, 2025

By Sean Ring

Gold and Silver Don’t Lie — Politicians Do

Let me tell you a little secret the media won’t: gold and silver don’t care about your political party. They don’t care about your GDP projections, debt-to-GDP ratios, or White House press briefings.

They respond to one thing—truth. And when the truth is that your government just passed - by the hair of its chinny-chin-chin - a $3.8 trillion pork-stuffed monstrosity of a bill called the One Big Beautiful Bill Act (OBBBA)… well, the metals react.

If you’ve been wondering why gold is holding steady above $3,300 and silver is holding above $34.50 despite constant short raids, here’s your answer: fiscal insanity.

In truth, gold and silver are the only opposition party that works.

The $3.8 Trillion Betrayal

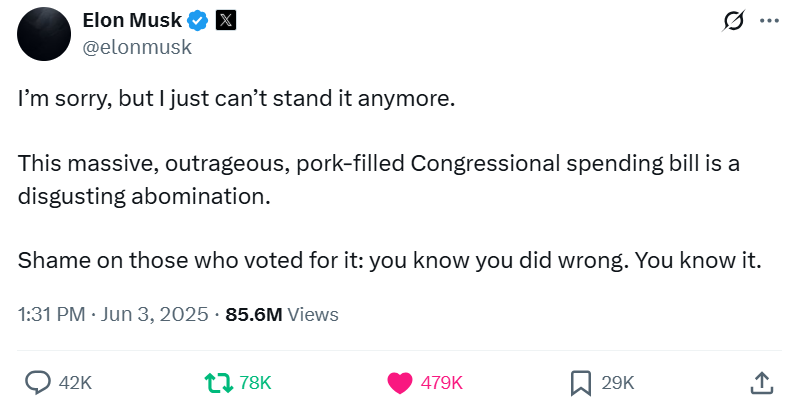

Elon Musk, Trump megadonor and self-proclaimed efficiency czar, is furious—and he’s not wrong.

The OBBBA is projected to increase the federal deficit by nearly $4 trillion over the next decade. That’s not a typo. That’s on top of the $36 trillion national debt we already have. Senator Rand Paul took Elon’s side, as expected.

Of course, the reliable Thomas Massie agreed.

How did Congress manage to get this through by a single vote?

Easy: by raising the debt ceiling again, gutting Medicaid and food stamps, handing out tax breaks to the rich, and lacing the whole thing with good old-fashioned pork.

You know, democracy in action.

Pork Is Back on the Menu

Charlie Kirk called it a "$1.6 trillion pork bomb." Others called it bribery. The Rude will merely call it “business as usual.”

Remember when the GOP pretended to be the party of fiscal restraint?

Neither do I. Neither do they, for that matter.

Despite public outrage and a 215–214 vote margin that barely squeaked through, the bill sailed on the back of "backroom deals and BS" (their words, not mine). No hearings. No scrutiny. Just good old-fashioned swamp politics.

And guess what? That’s bullish for precious metals.

Precious Metals: The Last Honest Asset

As I’ve said and written many times, “You can’t save the world, but you can save yourself.”

Gold and silver don’t need spin doctors. When the government floods the market with debt and pretends $2.7% annual GDP growth will magically cover it all, the metals start whispering:

“Buy me. Protect yourself. These people are nuts.”

And they’re right.

You can see it in the price action. Gold has found a higher floor. After breaking through $34, silver is building a base, fighting every suppression raid with tenacity.

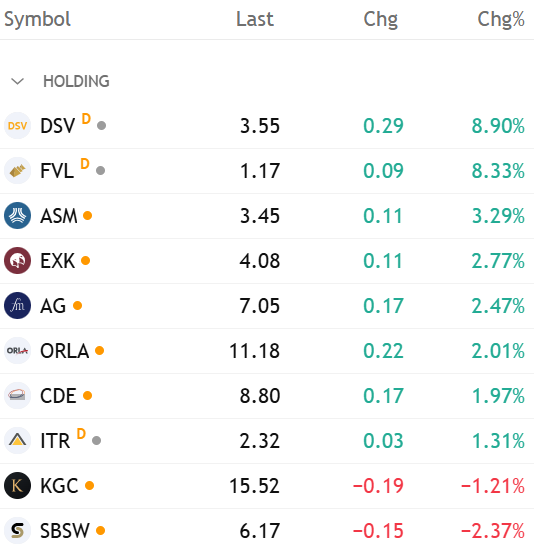

And yesterday, the Rude’s portfolio enjoyed another good day:

These aren’t speculative rallies. These are insurrectionist price moves—the kind that signal structural problems beneath the surface.

Musk and DOGE Can’t Fix This

Musk didn’t just rage-post because he likes attention. He feels betrayed.

This is a guy who threw $300 million behind Trump’s 2024 campaign and now finds himself watching that same administration sign off on the kind of spending blowout that would make FDR blush.

He even helped launch the Department of Government Efficiency (DOGE), an initiative aimed at streamlining federal waste. And what did he get for his trouble?

A bill that blows up the budget, expands the surveillance state, and makes the 2017 tax cuts permanent..

The metals are watching. They’re not impressed.

Social Cuts vs. Silver’s Surge

Think about the human tradeoff here: Medicaid was slashed by $700 billion. SNAP was cut by up to $300 billion. Millions of people kicked off healthcare and food programs.

Hey, I’m all for cutting needless spending. But this move almost invites civil unrest.

Why? So wealthy donors can keep their tax cuts. So, the Coast Guard can purchase $1.9 billion worth of new equipment. So Congress can pat itself on the back for being "tough" on the border.

Meanwhile, silver is on a warpath. The same metal used in solar panels, electric vehicles, missile guidance systems, and semiconductors is becoming increasingly difficult to source, more expensive to mine, and—thanks to monetary madness—more essential than ever.

The Markets Know the Score

Forget the official line. Forget the CBO’s optimistic growth assumptions. Forget Peter Navarro and Stephen Miller telling you that this bill will "pay for itself."

The bond market doesn’t buy it. The gold market doesn’t buy it.

And silver? Silver is the middle finger of the monetary system. It says, "I see what you did. I know what this means."

And so should you.

Wrap Up

This doesn’t end with fiscal discipline.

They just dropped a multi-trillion-dollar stimulus bomb wrapped in lies, pork, and betrayal. And if you think the price of gold and silver won’t react to that, well, it already has.

Elon’s mad because he believed the pitch. He thought the Trump 2.0 administration would behave like a sovereign wealth fund, not a banana republic.

But the metals don’t get mad. They just get more expensive.

Own some.

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali