Posted January 20, 2026

By Matt Badiali

From Oil Sheikhs to Mineral Mandarins

In 1975, after OPEC cut oil exports to the West, the U.S. created a strategic petroleum reserve. The oil embargo exposed the economic vulnerability of reliance on imported oil. It sent the U.S. economy into a tailspin for several years.

Fast forward to 2024 and China’s embargo on technologically critical minerals. It didn’t do the same economic damage to the U.S. But it did highlight another economic weakness. These metals are needed for military applications. You can’t fight a modern war without advanced technology. And you can’t build advanced technology without these minerals.

The Response

That’s why, on January 15, 2026, Congress introduced legislation in both the House and Senate to create a strategic metal reserve. The new $2.5 billion stockpile will stabilize the prices of these metals in the U.S.

We learned this response from oil. If you need it, get it.

The U.S., Britain, Canada, Germany, Japan, France, Italy, and the EU account for 60% of global demand for critical minerals. However, China dominates the supply. That gives China far too much economic leverage.

China is the New OPEC

To put that in perspective, at the peak of its dominance, OPEC only controlled about 50% of the world’s oil supply. Today, China refines and processes between 60% and 90% of key energy-transition and defense-related critical minerals. It controls between 47% and 87% of copper, lithium, cobalt, graphite, and rare earths.

And China learned the lessons of OPEC using oil as an economic lever of power. We should too.

In December 2024, China banned the export of gallium, antimony, and germanium to the U.S. They recently suspended that ban until November 2026. However, the market understood the threat. Critical mineral prices skyrocketed. And it exposed the U.S. mining industry's weak underbelly.

The U.S. isn’t the only country creating stockpiles. Australia will create a A$1.2 billion reserve focused on antimony, gallium, and rare earths. Japan, India, and South Korea are all doing the same thing.

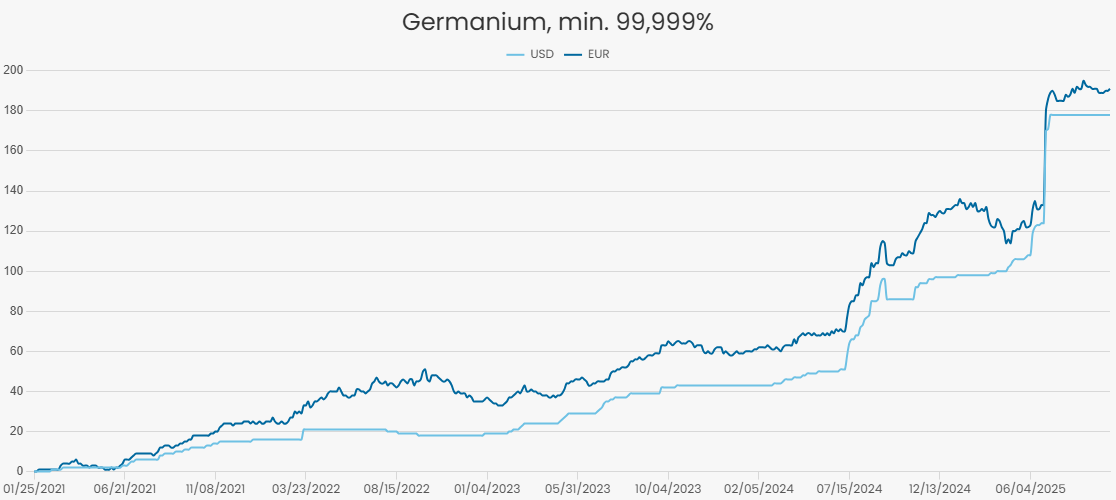

These funds create demand for metals with limited supply. When you have too much demand for scarce resources, it sends prices up. That’s what’s happening now, as you can see in the germanium price chart:

Credit: Strategic Metals Invest

Credit: Strategic Metals Invest

That’s the setup we have right now. If you don’t own critical minerals yet, you need to. It will be the story of 2026 and probably the decade. It’s an unloved sector that few investors participate in.

Don’t believe me? Ask around.

Opportunity Knocks

Last week, I was on a call with about thirty smart, young investors. They own all sorts of stuff like microcap technology companies, Bitcoin, and Ethereum. Nearly all of them bet on sports using online gambling apps. But only two out of thirty own any kind of mining company.

That’s about 7% of the group. That’s it…

These are the folks who will buy these stocks as the bull market gets rolling in 2026. That’s why we want to get in now.

And you don’t have to buy microcaps. Think about oil after the 1970’s. A few companies really exploded out of that period. But the giants did very well. Just look at this chart of ExxonMobil (NYSE: XOM):

That stock went from $2 per share (adjusted) to $129 per share (adjusted). That’s a 63,500% gain. Every $100 you put into ExxonMobil in 1982 is worth $63,500 today. A $10,000 stake in ExxonMobil back then turned into $6.3 million.

That’s going to repeat itself in the mining sector. That’s why you must own miners today.

Consider This

If you don’t know anything about mining, you can simply buy one of the giants like Rio Tinto (NYSE: RIO). Rio Tinto, a $184 billion market-cap miner, is in talks to merge with another giant, Glencore. The company supplies copper to Microsoft for its data centers. It has mines all over the world and produces all sorts of minerals. It currently pays a 4.4% dividend, so you can earn money from this bull market just by owning the stock. If you just own one miner for exposure to critical minerals, Rio Tinto would be the one.

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring