Posted March 07, 2025

By Enrique Abeyta

From Cotton King to Charity Prince

Some days, I’ll read a colleague’s piece and it’ll make me smile beyond belief. This happened two weeks ago when I read the column my friend and colleague Enrique Abeyta wrote below.

I have a special connection with Paul Tudor Jones. No, I never met the man personally. I was too timid to introduce myself at his annual Christmas party in Epsom, Surrey, where Tudor Investments’ European operations were located. I vividly remember Bryan Ferry getting up on stage and playing, wondering how much he would’ve cost. I was in my late 20s and was still trying to figure out the world.

And why was I at that party? Because I was one of his algorithmic funds’ futures brokers. I executed, and my bank cleared, that particular fund’s trades. I couldn’t believe the precision with which that fund could ride trends, exiting almost always when the trend fizzled out, taking a bag of money out of the market.

One of my great career regrets is that I couldn’t reverse engineer how he made so much money in the futures markets.

Jones was featured in the Jack Schwager’s seminal book Market Wizards, a must-read for traders. He was short during The Crash of 1987 and made a boatload of cash. He’s a legend among global macro traders.

Enrique’s piece is filled with excellent advice about keeping your head during trading. Enjoy!

Starting Out

There are some great stories in the history of great traders. One is about legendary investor Paul Tudor Jones of Tudor Investment Corporation.

Source: CNBC

Source: CNBC

The story goes that after graduating from the University of Virginia in 1976, Jones asked his cousin William Dunavant, Jr., to introduce him to the trading world. Dunavant was the CEO of one of the largest cotton merchants in the world and connected Jones with the famous commodity broker Eli Tullis in New Orleans.

Tullis hired and taught him to trade cotton futures on the New York Cotton Exchange. While he showed some promise, Tullis eventually fired him for sleeping at his desk after a big night of partying in New Orleans! Eventually, Jones would become the Treasurer and Chairman of the New York Cotton Exchange.

After working for several years at the famous brokerage house E.F. Hutton, Jones established Tudor Investment Corporation in 1980 with Dunavant and Tullis as his first two investors.

Over the years, Tudor has managed billions and established one of the best track records. He focuses on using technical analysis and trading large macroeconomic assets. His trading acumen has earned him a fortune of over $5 billion and made him one of the wealthiest people in the world.

In 1988, he also founded the charity Robin Hood Foundation. Robin Hood distinguishes itself by tying real “return” metrics to the organizations it funds. This distinctive approach has made it one of the most successful charities in history.

Here are some great quotes distilling Jones’ trading wisdom:

“I always believe that prices move first, and fundamentals come second.”

This is a powerful insight that is difficult for newer traders to grasp.

It is human nature to try to ascribe a "reason" for price movements. However, we often don't know what motivates buyers and sellers.

While the reason eventually emerges, rationalizing the price move rather than simply accepting it as a fact is a major trading mistake.

“And then, at the end of the day, the most important thing is how good you are at risk control. Ninety percent of any great trader is going to be the risk control.”

Jones masters controlling his losses and managing his psychology as a trader.

He keenly understands the impact that losses can have on his trading psychology. He focuses first and foremost on managing his losses. This puts him in a winning mindset to make money.

“Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.”

This quote builds on the last one. We like to use the analogy of trading as a dance to the music of the stock market. Even with the best process, sometimes you simply aren’t in tune with the current market environment. You simply don’t have the tune. When this happens, the best path is to step back and trade smaller. Wait until you catch the tune again and begin churning out positive returns to size back up.

“You learn more from your losses than from your gains.”

This is true not only in trading but throughout life. We can learn important lessons from our successes and try to improve them every time. However, understanding and adapting to our losses is an absolute necessity for being a successful trader over time.

“I spend my day trying to make myself as happy and relaxed as possible. If I have positions that go against me, I get right out; if they are going for me, I keep them.”

Again, Jones is a master of understanding and dealing with his psychology.

Remember that a negative stimulus has eight times the biological impact on your body as a positive stimulus. Dealing poorly with your losses can have a spiraling effect on your trading.

This is his most powerful insight: Manage your psychology and keep it positive to improve your chances of winning.

Wrap Up

The best way to learn is from those who have been there. Paul Tudor Jones has undoubtedly been there. At 70 years old, he continues to manage money. He’s had a long and successful career.

Have a wonderful weekend!

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

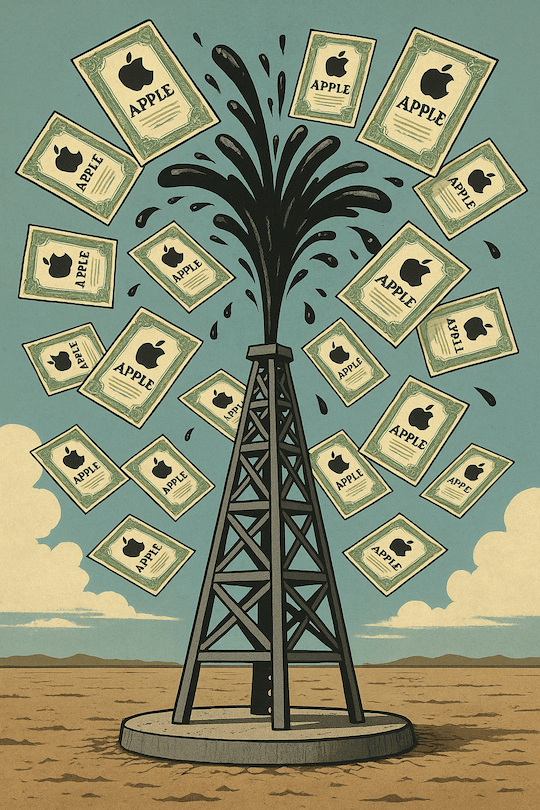

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring