Posted October 07, 2025

By Sean Ring

Follow the Money Cones!

When most people picture government spending, they envision a gentle rain — a steady stream of dollars trickling evenly over the economy.

Richard Maybury says that’s dead wrong.

In his “Uncle Eric” books — The Clipper Ship Strategy and The Money Mystery — Maybury described government spending as a series of “cones”: sharp, localized bursts of cash that slam into specific sectors while leaving everything else bone dry.

And if you’ve been paying attention to Donald Trump’s second-term industrial strategy, you’re witnessing those cones in full color.

The Donald Turns the Treasury Into His Own Private Equity Fund

The Trump administration’s recent behavior has been unprecedented — not just in tone or rhetoric, but in how the federal government is deploying capital.

Forget bailouts and blanket stimulus. Trump’s team is buying stakes in actual companies — picking winners in sectors they consider “strategic to America’s future.”

Among the beneficiaries:

- Intel Corp. – Received an $8.9 billion federal equity injection to accelerate chip production in Arizona and Ohio.

- Critical Metals Corp. – U.S. equity participation in rare earth projects in Greenland, ensuring the supply chain stays out of Chinese hands.

- Lithium Americas & General Motors JV – Backed by federal financing and direct investment in Thacker Pass, Nevada — the largest known lithium deposit in the U.S.

- USA Rare Earth Inc. and MP Materials Corp. – Both got a piece of the defense supply chain pie.

- Pfizer, Eli Lilly, AstraZeneca, and Johnson & Johnson – Beneficiaries of new strategic stockpile and manufacturing expansion mandates.

- SpaceX and Tesla – “Private” companies orbiting close to the administration’s policy sun, receiving the reflected warmth of federal preference and regulatory forgiveness.

This is not “free-market capitalism.” It’s industrial policy by equity stake.

Maybury’s Cones in Action

Richard Maybury couldn’t have asked for a better real-world example of his theory.

When government spending expands, the new money doesn’t seep equally across the economy like butter on warm toast. It lands in cones — those zones of concentrated political and economic energy.

Each cone radiates wealth to insiders, contractors, and suppliers in that zone. If you’re in the cone, business booms. If you’re not, you get nada.

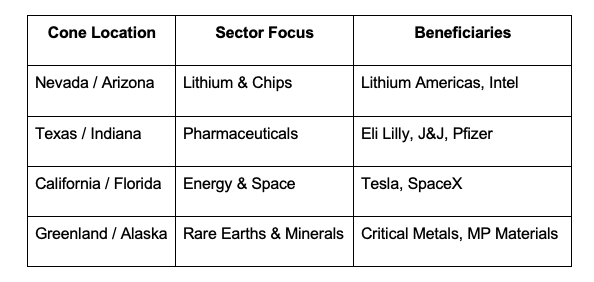

Right now, Trump’s cones are as clear as radar signatures:

These zones have become economic hothouses, attracting private capital eager to bask in the same sunlight. Venture money, hedge funds, and foreign sovereign funds are piling into anything Trump’s team even whispers about as “strategic.”

That’s Maybury’s theory come to life: money doesn’t flow — it detonates.

The Investor’s Playbook: Find the Next Cone

Maybury’s point wasn’t that government spending is evil (though he wasn’t a fan). It was that investors must learn where the cones will fall next.

In the 1990s, that meant defense and telecom.

In the 2000s, it meant mortgages and housing.

Under Biden, it meant “green” subsidies — wind, solar, and EV credits.

Under Trump 2.0, the cones have shifted to hard assets and national security: rare earths, lithium, chips, and domestic pharma.

If you bought into these industries in early 2025, you’ve probably seen double-digit or even triple-digit gains already.

If not, you’re watching others get rich while you’re still reading the policy memo.

Maybury would tell you: don’t chase cones already formed — predict the next one.

Where might those be?

Here’s my guess list:

- Nuclear energy — uranium and SMR (small modular reactor) tech will almost certainly get Trump’s “critical infrastructure” label soon.

- AI hardware — not just software, but the U.S.-made GPUs and silicon used for defense and logistics AI.

- Water systems and desalination — watch for new “strategic water resilience” acts if climate risk headlines keep coming.

- Cyber-defense contractors — Maybury’s cone model thrives on fear; cybersecurity is the next “indispensable” industry.

The cone widens, then shifts.

The Risk: When the Cone Moves

The hardest part about profiting from these “hot zones” is knowing when they’ll cool.

When policy winds change, the cone shifts — and the cash dries up. Investors who bought too late get flattened.

Remember solar in 2012? Defense tech after Iraq? EV startups after 2022?

Those were Maybury cones that went cold.

Right now, rare earths and semiconductors are basking in federal glory. But if Trump’s priorities pivot — say, toward space mining or hypersonic defense — these same companies could find themselves yesterday’s news.

The cone doesn’t apologize. It just moves on.

Wrap Up

Maybury’s “government cones” theory isn’t just economic philosophy. It’s a lens — a way to see how the world actually works.

As I wrote yesterday, The Donald’s America isn’t a free market; it’s a funnelled market. I called it state capitalism, but it’s the same thing.

Money is no longer rain. It’s artillery — and the shells land where DC aims them.

The wise investor doesn’t complain about the craters.

Highway Robbery With a Hot Towel

Posted October 09, 2025

By Sean Ring

As The World Squirms

Posted October 06, 2025

By Sean Ring

A Minor Miner Correction

Posted October 03, 2025

By Sean Ring

$50 Silver: Ceiling or Floor?

Posted October 02, 2025

By Sean Ring

Equities and Metals Soar in a September to Remember

Posted October 01, 2025

By Sean Ring