Posted July 30, 2024

By Sean Ring

Flat As a Pancake

Yesterday was one of those “slow days” the market experiences in the summer every year.

Whether everyone’s on vacation or there’s nothing going on, the markets barely moved yesterday. When I say the markets were flat, I mean they were Bonneville Salt Flats flat.

The S&P 500 was up 0.08%, the Dow was down 0.12%, and the Nasdaq was up 0.07%. It was a total snoozefest.

Why is that?

Well, it’s a combination of summer holidays and the keen anticipation of news. There was nothing significant yesterday, but we’ve got to keep a close watch on the numbers for the rest of the week.

Today’s Releases

We have the Case-Shiller Home Price Index at 9 a.m. As far as immediately moving the markets, that's not a big deal.

But consumer confidence usually matters. However, as we’re right before a FOMC meeting day, this will mean less than usual.

A little background: the Conference Board, a business and research organization, releases its Consumer Confidence Index on the last Tuesday of every month.

The figure is based on the Conference Board's monthly survey of 5,000 households, which asks consumers how confident consumers are about the state of the economy. It tries to gauge how they feel about the current business conditions and the labor market and how they feel about the future.

In case you’re wondering, the University of Michigan publishes a similar measure, the Consumer Sentiment Index, twice a month.

Why should we care about either of these?

Increases in consumer confidence may be associated with increases in stock prices as the increase may suggest that confident consumers will spend more, helping the economy to grow and eventually leading to more robust corporate earnings.

With all that said, Wednesday is the big day this week.

Wednesday is Fed Day

Oh, Jay Powell, if only you’d have listened to me!

You would’ve cut rates by 25 basis points in June, and we wouldn’t be talking about you until after the inauguration. But as central bankers always do, you’ve now waited too long and will have to make a more dramatic move. But first, you will almost certainly sit on your hands for this meeting, waiting for more data to justify your rate cut.

It’s funny because last week, my colleague Simon and I were teaching a bunch of recent graduates about Social Styles. It’s a handy, back-of-the-envelope way of knowing the type of person you’re talking to.

Economic Ph. D.s, quants, and other spreadsheet geeks are almost invariably “analysts.” Their kryptonite is “paralyzed by analysis.”

Jay Powell and his crew are the archetype of the analyst. They simply can’t make decisions quickly because they’re inundated with data. Time and again, we’re left to swing in the wind while the misguided Keynesian nerds in the Eccles Building argue over tenths of a percentage point.

As the Federal Open Market Committee (FOMC) won’t cut this meeting, Jay Powell’s presser is of paramount importance. If he comes out bullish and tells the market it’ll get its rate cut this year, it’ll be party time. If not, we can see more of a sell-off.

Thursday is Jobless Claims and PMI

First, the move—and its volatility—from Wednesday’s FOMC meeting will dwarf any move jobless claims or PMI produce.

But that doesn’t mean they’re irrelevant.

In particular, initial jobless claims are becoming more and more critical. Stay with me here.

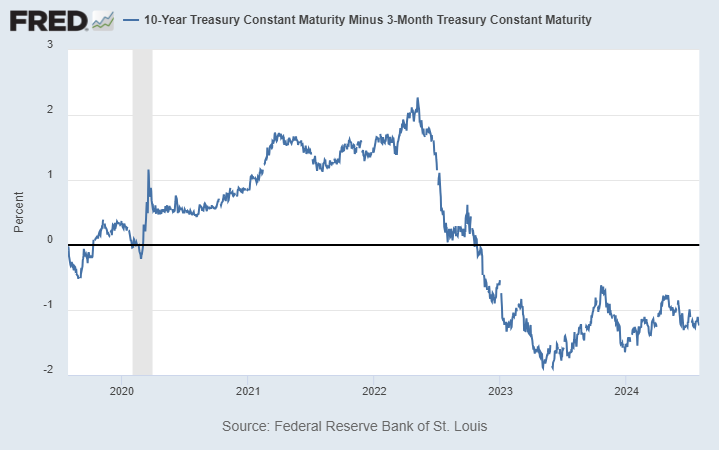

The yield curve has been inverted since October 2022:

Many get this wrong: the curve's inversion doesn’t immediately signal a recession. It’s the re-steepening after the inversion that signals we’re in trouble. As you can see from the above, that hasn't happened yet.

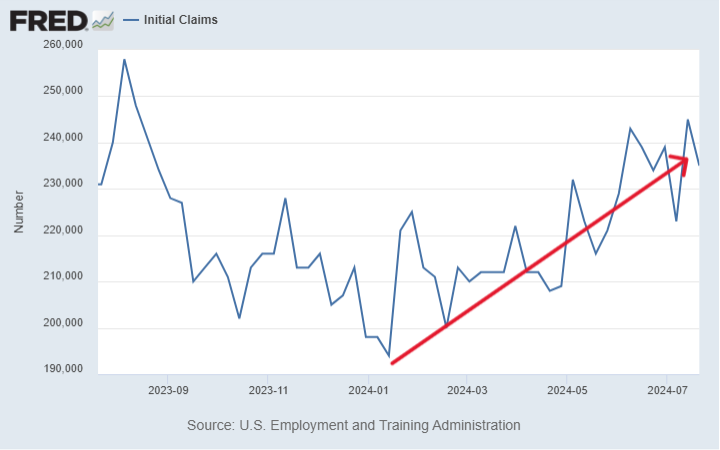

When a recession is about to kick off, the yield curve steepens, and jobless claims pick up. Jobless claims have risen since the beginning of this year:

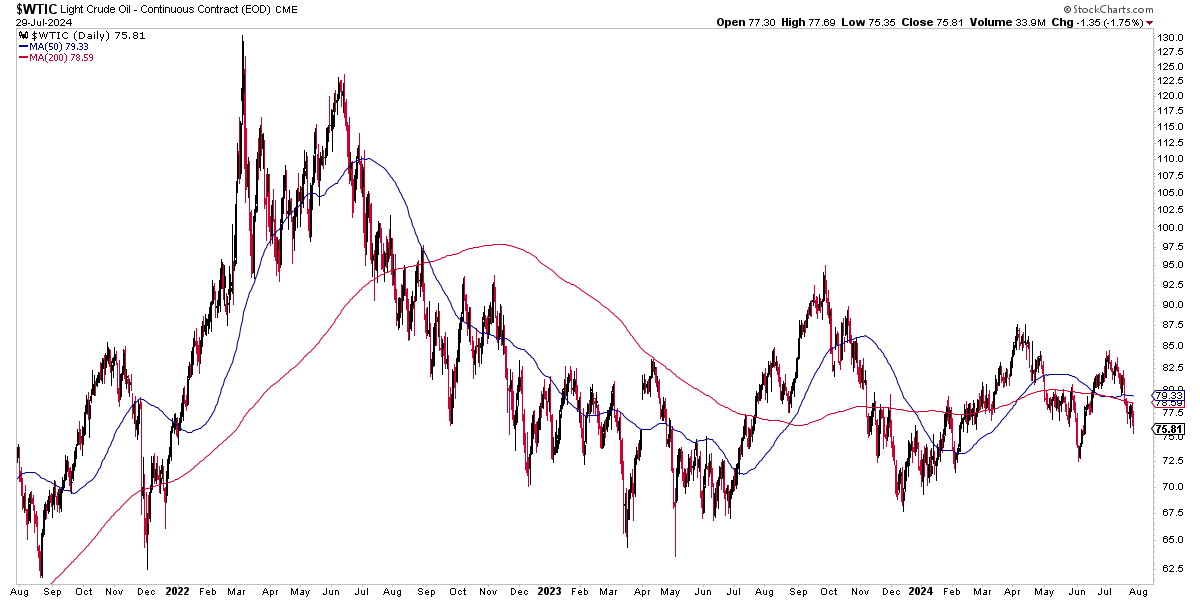

The last ingredient is oil prices. Once the yield curve becomes positive, initial jobless claims pick up, and oil prices rise, that’s the killer. But oil hasn’t gone anywhere.

Oil isn’t trading at $150 despite war and inflation because the world economy is in the toilet. Also, the U.S. dollar is the prettiest currency in the ugly currency parade.

A declining dollar is needed for oil to explode to the upside. But thanks to the yen, sterling, and yuan weakening against the dollar, oil’s rally remains a pipe dream.

As for the euro strengthening against the dollar, even that has cooled off a bit.

So far, only one of the three economic conditions I mentioned above (steepening yield curve, rising jobless claims, and higher oil prices) indicates an imminent recession. This is just another reason to remain confident in your current investment decisions.

The July PMI was a dismal 49.5, signaling a contraction in manufacturing. However, manufacturing is less than 10% of the U.S. GDP, so the market assigns this number less weight.

Finally, we’ve got payrolls on Friday.

Friday is Nonfarm Payrolls

As a broker all those years ago, this was the only economic number that mattered. It carries a similar weight today.

Nonfarm Payrolls measure the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for nearly 70% of economic activity.

The consensus is that the NFP will be 185,000. It’s not a significant number, but it will surely suffice.

Wrap Up

While yesterday was as dull as dishwater, the rest of this week may prove volatile. Watch the numbers to see how the market reacts.

If anything pops up, I’ll write about it later in the week.