Posted October 21, 2025

By Sean Ring

Everything Rally Returns as Markets Go “Comical Ali” On Us…

“There’s nothing to see here!” Comical Ali would spout as a building was falling over behind him.

Muhammad Saeed al-Sahhaf, the Iraqi Information Minister during the invasion of Iraq in 2003, was the living incarnation of Dr. Pangloss, the professor and optimistic philosopher in Voltaire’s Candide. “All is for the best, in the best of all possible worlds,” Pangloss would say, to the infuriation of Candide, who knew the poop had hit the fan (many times).

Voltaire wrote that book as a rebuke to Leibnitz’s optimistic philosophy. After all, how can all be for the best if an Act of God like an earthquake had destroyed Lisbon in 1755? If God is both omnipotent and omniscient, how can bad things happen if this is the best of all possible worlds?

Those are good questions. But today, we have bigger fish to fry.

Because it looks as if Pangloss was right, in this world of financial levitation. But were Voltaire still around today, he’d tell us there’s more to this story.

What Happened?

Everything was up today, save for the VIX and the 10-year yield. The VIX falls because investors aren’t scared. The 10-year yield falls because trouble is on the horizon. It’s now below 4%. Seemingly contradictory? Yes… read on.

The SPX and Nazzie were up over 1%. The Russell 2000 was up nearly 2%. Gold was up almost 2.5%, while silver and copper were up a touch over 1% each. Bitcoin was up 2%. Even the dreaded TLT was up 38 bps, and you know how I hate bonds right now.

And perhaps most hilariously, our miner positions regained close to 50% of what they lost on Friday. I’m happy we had a solid day of recovery, but even I didn’t think it’d be this lusty.

What accounts for this new everything rally?

Coming Down the Pike

My good friend and colleague, Chris Cimorelli, Mr. 10X and Senior Analyst of James Altucher’s Microcap Millionaire, gave us this great rundown yesterday evening:

Right now, there’s a 99% chance the Fed is going to cut rates at the FOMC meeting next week.

There’s a 96% chance of another quarter-point cut in December.

The market loves news like this but it’s important to remember that the Fed doesn’t cut rates out of the goodness of their hearts. They do it because they see underlying weakness in the economy.

So, we need to keep a close eye on major economic reports over the next several weeks.

These are the critical dates to look out for:

Fri, Oct 24: Consumer price index (CPI). This one could go either way. If inflation is heating up, it could soften rate cut expectations slightly, but at the same time it could improve the macroeconomic outlook.

Wed, Oct 29: FOMC meeting decision. There is currently no doubt that the Fed will cut interest rates again by another quarter percent. The market could rise or fall depending on Powell’s comments. At the last meeting the market rose in the first few minutes after the announcement then dropped into the end of the day, only to rally the next day through the end of October.

Thurs, Oct 30: GDP for the third quarter. This is an important one. GDP contracted in the first quarter and rebounded in the second. If this one comes in below expectations it could seriously spook the markets. This is one day after the Fed is cutting so there’s risk of a serious waterfall event, especially if markets rally after the FOMC meeting and the report comes in not-so-great.

Friday, Oct 31: Personal consumption expenditures (PCE): This is the Fed’s preferred inflation reading. This will likely have a bigger impact on the market than CPI.

Fri, Nov 7: October jobs data. Jobs data has been trending lower. This has been one of those “bad news is good news” events for the stock market because lower jobs means lower rates. With lower rates now expected and priced in, bad news could be bad news for stock prices if the jobs data looks, well, bad.

That’s about as good a summary for what’s coming as you can get. But what does historical data tell us?

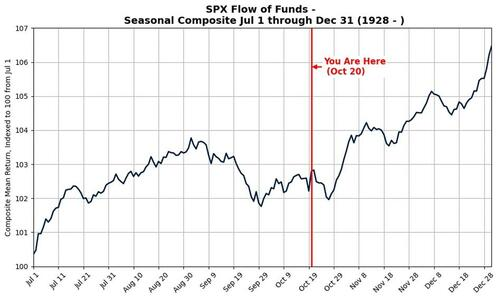

Seasonality in the SPX

You may not know this, but historically, September is usually the stock market’s worst performing month. Most people think it’s October because of 1929, 1987, and 2008.

However, according to Zero Hedge, “October often delivers a volatility shock that shakes out weaker hands and reduces leverage, eventually clearing the way for a ‘Santa Rally’ once event risk passes.”

Credit: Zero Hedge (premium link)

Notice how we tend to flatten out over October. Then we take off into December. That doesn’t mean it happens like that every year. But the odds of that happening are in our favor.

Wrap Up

We don’t have crystal balls. But we have history, data, and our considerable experience behind us. All of this points to a sustained rally for the foreseeable future.

I apologize for sounding like a broken record, but stay calm and carry on!

Have a great day.

The Next Commodity Supercycle Winner

Posted January 09, 2026

By Sean Ring

The Best Stocks, Countries, and Books

Posted January 08, 2026

By Sean Ring

From The Shores of Tripoli to Caracas

Posted January 07, 2026

By Sean Ring

¡Seremos Bienvenidos Como Libertadores!

Posted January 06, 2026

By Sean Ring

Empire At Gunpoint

Posted January 05, 2026

By Sean Ring