Posted February 14, 2023

By Sean Ring

ESG Crushes Energy Investment and Security

- ESG is biased against traditional energy sources.

- Energy affordability and security are compromised.

- And who guards the guardians, as usual?

Happy Tuesday from brisk Asti!

As we’re still waiting for the inflation figures to come in, I thought I’d turn our attention back to energy for a moment.

My friend and colleague Byron King had a good chuckle yesterday when Joke Biden released another 26 million barrels from the Strategic Petroleum Reserve.

This was after Russia cut its output in response to Europe banning seaborne shipments of Russia’s refined oil products.

Of course, the unintended consequence of the sanctions was that the cost of shipping gasoline increased by 405%. That’s four-hundred-five percent. No, it’s not a typo.

And though the EU is stupid, its policies affect worldwide pricing, including the US’s gasoline prices. Hence, Biden’s action.

I shake my head in Brussels’ general direction, to paraphrase Monty Python.

As Byron is the real expert in this stuff, I hope he writes up a piece on all that shortly.

In the meantime, I’ll pivot slightly toward energy policy.

Saudi Aramco’s CEO blasted what he called “biased” ESG policies. It’s worth revisiting ESG because, with all the sanctions and other silliness, ESG policies can worsen things.

What is ESG?

ESG stands for Environmental, Social, and Governance.

ESG policies are sets of standards a company puts in place to address its impact on these three areas, which we’ll explore shortly.

ESG policies are becoming increasingly important to investors and stakeholders as they seek to align their investments with their values and goals. Companies with strong ESG policies and performance may be more attractive to investors, customers, and employees, for the usual virtue-signaling reasons.

There are several ESG implications for energy security, as the energy sector has a significant impact on the environment, society, and governance:

Environmental: Energy companies are under increasing pressure to reduce their carbon footprint and transition to cleaner energy sources. ESG policies influence the environmental impact of energy companies by setting goals for reducing greenhouse gas emissions, promoting energy efficiency, and encouraging the adoption of renewable energy sources.

The “E” in ESG is what Saudi Aramco’s CEO addresses below.

Social: Access to reliable and affordable energy is essential for economic development and social well-being. Therefore, energy security policies need to ensure that the benefits of energy access are distributed equitably, and that vulnerable populations are not disproportionately affected by energy disruptions or price increases.

Ridiculously, the over-regulation of the energy sector causes the undesirable social situations above.

Governance: Energy security policies must ensure that the energy sector is managed transparently and accountable, with effective regulation and oversight. This can help to reduce corruption and promote good governance in the sector.

A sustainable and resilient energy system is essential for long-term energy security, but I’m unsure how ESG gets us over that line.

Who Guards the Guardians?

Various organizations create ESG standards and frameworks to guide companies and investors in assessing and reporting their ESG performance. Some of the most well-known and widely used ESG standards include:

- Global Reporting Initiative (GRI)

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-related Financial Disclosures (TCFD)

- United Nations Sustainable Development Goals (UN SDGs)

- Environmental, Social, and Governance (ESG) criteria of various stock indices, and ratings agencies

These organizations often involve a range of stakeholders in developing their standards. These include investors, companies, NGOs, and academics.

But who are they? And why do they have such a say?

What is Saudi Aramco?

Saudi Aramco is a Saudi Arabian multinational petroleum and natural gas company. It’s one of the largest companies in the world.

The company is headquartered in Dhahran, Saudi Arabia, and is wholly owned by the Saudi Arabian government.

Saudi Aramco has a significant role in the global oil and gas industry, as it is responsible for most of Saudi Arabia's crude oil production and is a major oil supplier to markets around the world.

The company was founded in 1933 as the Arabian American Oil Company (Aramco). It became known as Saudi Aramco after the Saudi Arabian government took complete control of the company in 1980.

Saudi Aramco operates in all aspects of the oil and gas industry, from exploration and production to refining and marketing. The company has diverse assets and interests, including joint ventures and partnerships with other global energy companies.

What Do Saudi Aramco’s CEO and Others Say About It?

Thanks to Tsvetana Paraskova over at oilprice.com, I’ll parse this for you.

President and CEO Amin Nasser said at the Saudi Capital Markets Forum 2023 on Sunday:

As far as the future of capital markets is concerned, ESG is clearly a rising trend. And in my view, an increased emphasis on ESG is a move in the right direction.

However, if ESG-driven policies are implemented with an automatic bias against any and all conventional energy projects, the resulting underinvestment will have serious implications. For the global economy. For energy affordability. And for energy security.

The cost of capital for the oil and gas sector has increased due to higher perceived risks, which in turn are driven by ESG policies.

The primary reason: pressure from multiple directions to discontinue all new investments in oil and gas. Pressure based on what I strongly believe are flawed assumptions and arguments.

Proponents of the popular energy transition narrative paint a picture of a utopian world where alternatives are ready to replace oil and gas almost overnight.

The energy crisis in Europe has shown that alternative energy supply is not ready to shoulder the heavy burden of global demand.

Nasser also mentioned the underinvestment in oil and gas in recent years, citing figures that upstream investment was some $400 billion in 2022, less than 50% of the peak in 2014.

Another prominent voice criticized ESG in 2021.

Terry Smith, the outstanding UK fund manager, said this about ESG:

There are several problems with factoring ESG into stock selection. One is that so many ESG approaches look at many of the most obvious factors, such as carbon footprint, hazardous waste, use of water, use of plastic, sources of energy, etc., but fail to take into account the fundamental and financial viability of the business. We think you should also look at things such as innovation, product development, revenue growth, and return on capital. There is not much point in having a business that scores highly on conventional ESG factors, but that fails financially or in terms of its products or service.

Another problem I would suggest is a mindless box-ticking approach. The mantra of comply or explain too often gets transmuted into just comply. Take Philip Morris (US: PM), for example. We think it is making a major contribution to the welfare of smokers with its Reduced Risk Product, but we daren’t include it in our sustainable fund as it will just be met by people hissing, “It’s a tobacco company.” Yes, it is, but maybe it's also part of the solution to conventional smoking. It would be more productive to have a real debate.

Wrap Up

We don’t want any pollution if we can help it.

We also don’t want to destroy the world economy by insisting on using unproven technologies with questionable results.

The last thing we need is an ESG monster spewing flames when sanctions, price caps, and war has already set the global economy on fire.

Have a great day ahead. And Happy Valentine’s Day!

❤️🔥HOLY SMOKE! An American Pope!

Posted May 09, 2025

By Sean Ring

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

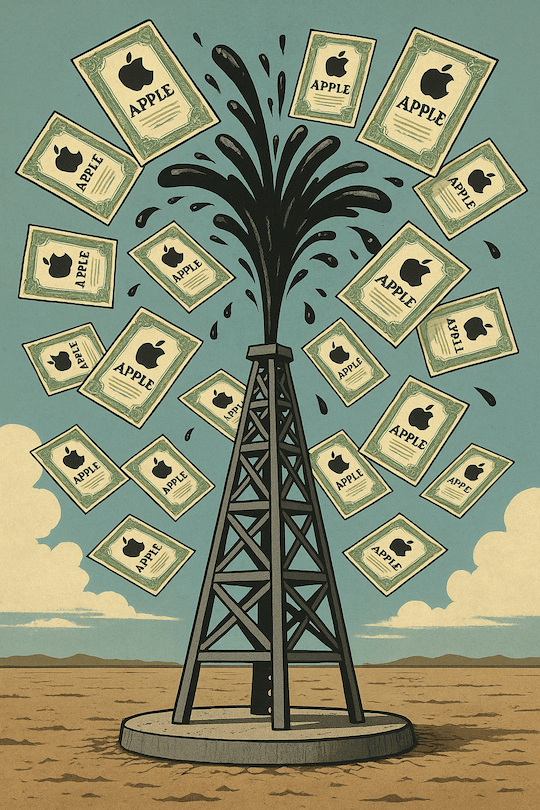

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring