Posted October 01, 2025

By Sean Ring

Equities and Metals Soar in a September to Remember

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

Last month, I titled this report the “Silver Minings Playbook.” It’s only gotten better for silver hoarders and their mining stock counterparts.

But let’s not ignore the great months the SPX, Nazzie, and Russell 2000 put in, either. And of course, gold also hit a new monthly and quarterly all-time high.

Even bonds, which I dislike at the moment, rallied slightly. It seems like the Everything Rally is back, even if it’s to be short-lived.

Let’s get to the charts.

S&P 500

***NEW MONTHLY AND QUARTERLY CLOSING HIGH OF 6,686.46***

Well, that was one uneventful September! I didn’t think we have a sell-off, and we didn’t. There’s nothing in these charts that screams “Dump me!” In fact, these charts are saying, “If you’re NOT long, you’re wrong.”

The broad market is as lusty as a Nebraska cornhusker. The charts indicate a target of 9,104. Let’s not get silly. But 7,000 is only a whisker away.

Nasdaq Composite

***NEW MONTHLY AND QUARTERLY CLOSING HIGH OF 22,660.01***

The Nasdaq Composite closed up over 5.6%, setting yet another new all-time high on the back of continued strength in tech stocks and positive market sentiment.

The upside target is a crazy 26,285. That target isn’t as far-fetched as it seemed last month.

Russell 2000 (Small caps)

***NEW MONTHLY AND QUARTERLY CLOSING HIGH OF 241.96***

The Russell 2000, the US small-cap stock index, posted a 3.74% return after a blistering August return of over 9%.

The new upside target is 310.

The US 10-Year Yield

Despite JPow’s 25 bp cut, the 10-year yield only came down 8 bps. Oh well.

For the October 29th FOMC meeting, the market is currently assigning a 94.6% probability to another 25-bp rate cut. So I stick to my thesis that we’re getting the kind of inflation that props up asset prices, and that’s good for metals, equities, and bonds.

The Everything Rally seems to be making a comeback.

Dollar Index

The dollar will continue to follow rates down, just as The Donald wants. In fact, the new downside target for the DX is a still woeful 87. With a dollar this weak, it’s easy to see why U.S. dollar-denominated assets are roofing it.

USG Bonds

Investment Grade Bonds

Admittedly, this chart looks excellent, as well. From here, the next target is 116.50, before looking at 128.40. I still won’t buy it, as I don’t buy the story.

High Yield Bonds

From last month:

I'm not sure if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Same as it’s been for a while.

Real Estate

VNQ still appears steady, with the price objective slightly lowered to 100.24.

Energy: West Texas Intermediate (Oil)

This pathetic chart provides the White House with considerable cover to cut rates and weaken the dollar. If oil were more uppity, surely that’d constrain The Donald.

Somehow, we’re eyeing a 73.37 price target. However, I don’t see oil rallying materially until the silver rally reaches at least $50. (Oil usually follows silver up. But that may not even happen this time around.)

Base Metals: Copper

Copper had a good month, closing up 5.9%. But we’ve got a long way to go to reach the tariff-induced highs of earlier in the year.

The charts have a downside target of 3.88, though that may be a while away.

Precious Metals: Gold

***NEW MONTHLY AND QUARTERLY CLOSING HIGH OF 3,859.49***

Let the fun begin! We’ll be heading to $4,000 in no time. We may even get there before the year ends. That bodes well for our mining stocks.

The new upside target is $5,039.

Precious Metals: Silver

***NEW MONTHLY AND QUARTERLY CLOSING HIGH OF 46.64***

The chart above, courtesy of graddhy.com, is one that has been circulating for a while. Now, it’s happened. We’ve completed a full 45-year cup and handle pattern. Though Graddhy is excited, a $370 target isn’t out of the realm of possibility.

This is why I bang the drum about keeping your head and riding this winner. We’ve got a long way to go.

For now, our upside target is $53.12, which is much more sensible in the short term.

Cryptos: Bitcoin

We hit the former downside target of 108,000 last month, albeit briefly, and then had a good rally.

The new upside target is $138,600.

Are we rotating from coins into metals? Doesn’t look like it right now. But it may be happening quietly.

Cryptos: Ether

Ether got down to nearly 3,800 and then bounced back strongly. We’re now looking at 4,775.

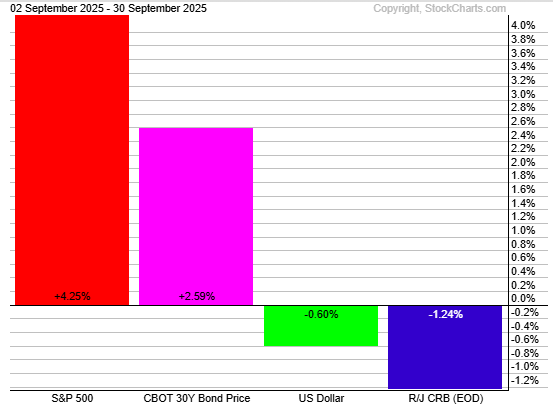

Trad Asset Class Summary

Stocks lead the way overall, posting a 4.25% gain. Bonds followed with a 2.59% gain. The USD fell 60 bps, while commodities lost 1.24%.

Of course, the precious metals (gold, silver, platinum, and palladium) massively outperformed. Agricultural commodities such as cocoa, soybeans, and wheat sold off hard.

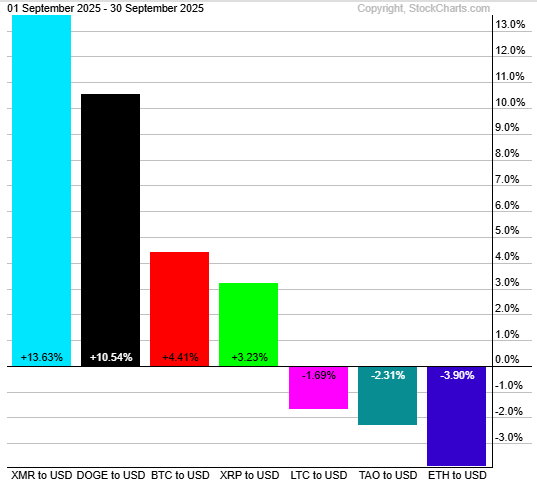

Crypto Class Summary

Monero and Dogecoin led the way this month, each posting double-digit gains. Bitcoin and Ripple finished the month on a positive note, with gains of 4.41% and 3.23%, respectively. Litecoin, Tao, and Ether brought up the rear, all finishing in the small negative numbers.

Wrap Up

What a month for equities, bonds, and the metals. Crypto’s performance was mixed, while agricultural commodities dampened the metals’ shine. So be it, as that will give us more time to pile into the metals and miners before the mainstream catches wind.

Finally, let us laugh (instead of cry), courtesy of the X-verse:

Have a great day!

A Minor Miner Correction

Posted October 03, 2025

By Sean Ring

Keep These Things In Mind When Riding the Wave

Posted September 30, 2025

By Sean Ring

Pennies and Steamrollers

Posted September 29, 2025

By Sean Ring

Blue Orca Hates Aya Gold & Silver

Posted September 26, 2025

By Sean Ring

The Duke, the King, and the Great Auto Loan Con, Part II

Posted September 25, 2025

By Dan Amoss