Posted December 12, 2024

By Sean Ring

Deficits Matter.

Did you hear the great news?

Argentina’s chainsaw-wielding President, Javier Milei, posted a budget surplus for his beloved country. He said:

The deficit was the root of all our evils — without it, there’s no debt, no emission, no inflation. Today, we have a sustained fiscal surplus, free of default, for the first time in 123 years. This historic achievement came from the greatest adjustment in history and reducing monetary emission to zero. A year ago, a degenerate printed 13% of GDP to win an election, fueling inflation. Today, monetary emission is a thing of the past.

What an incredible turnaround!

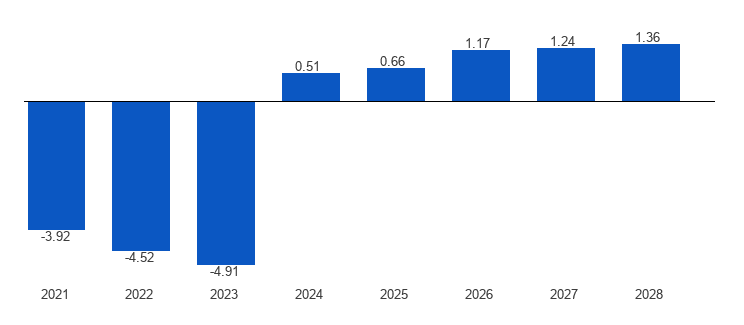

Here’s Argentina’s projected budget surplus over the next few years:

Credit: The Global Economy

Credit: The Global Economy

From Armstrong Economics:

Argentina was forced to stop printing money back in 2022 after inflation surpassed 60% in July of that year, and their currency became utterly worthless. The central bank raised rates to nearly 70% to no avail as government continued borrowing. The problem with socialism is that they eventually run out of other people’s money. The government was spending over $6 million daily on social programs, but the poverty rate continued to rise, and around 57% of the working population could not find jobs.

It took President Javier Milei of Argentina a mere two months to push his nation into a surplus. The Economy Ministry declared that the government posted a $589 million surplus back in April, the first surplus in a decade. Milei referred to the government as “a criminal organization,” and recognized that the public sector needed to shrink as 341,477 people were on the government payroll when he took office.

Referred to as the “gnocchi” after the Italian pasta dish that is commonly served on the 29th of the month, the same day as payday, are the individuals in Argentina on the government payroll who do absolutely nothing. They were installed by politicians in exchange for favors. Critics claim he is firing at random, but the Milei Administration has assured the public that selecting those who will be laid off will be an “extremely surgical task, done so as not to make mistakes.”

Isn’t that nice? No wonder Elon and Vivek will run a DOGE (Department of Government Efficiency) for the incoming Trump administration.

Before that, Americans relied on Dick Cheney’s asinine assertion that “Deficits don’t matter.” Of course, he was wrong. They matter, Dick. They really do.

What’s a Deficit?

First, let me ensure we’re all on the same page. Look at this:

When a government spends less than its tax revenue, it creates a surplus (Argentina). But if, as above, it outspends its tax revenue, it creates a deficit (the U.S. and the rest of the Western world).

The sum of all unpaid deficits is the national debt. In the U.S., we also have state debt and local or municipal debt.

Back to the national level: To cover the deficit, the USG must issue treasury bills, notes, or bonds. The lower the coupon on those bonds, the less interest the government has to pay on them. Treasury bills are government debt issued with a maturity of 365 days or less (short-term). Treasury notes are government debt with a life between 2 and 10 years. Treasury bonds are debt issued with a maturity of 20 to 30 years.

Usually, the longer the maturity, the higher the interest rate. But when the yield curve is inverted, this isn’t the case: short-term yields are higher than long-term yields. If you recall Stanley Druckenmiller criticizing current U.S. Treasury Secretary Janet Yellen for not issuing longer-term T-bonds when interest rates were low (instead of T-bills), this is why.

Now that we’ve covered the terms, you can see why the news from the U.S. is sadly contrary to Argentina’s surplus announcement.

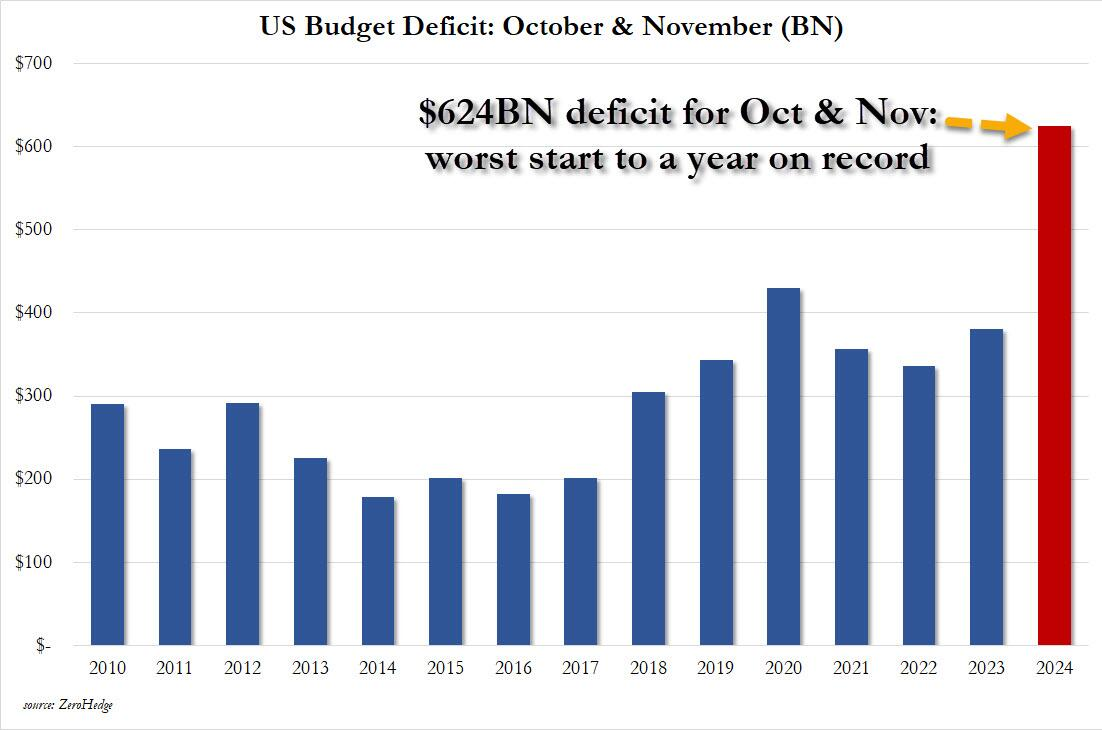

Zero Hedge published this ludicrous chart this morning:

Credit: Zero Hedge

Credit: Zero Hedge

The USG posted a $624 billion deficit for the first two months of the 2025 fiscal year, which turns into a roughly $3.74 trillion deficit for the year. How… the… heck…?

Well, there are all sorts of excuses for this prolifigate spending. But this piece isn’t going to go into some tirade about how unethical, immoral, and unfair it is to steal from the nation’s future to spend on the worst generation.

No, not this time. Today, I congratulate you. Because if you’re long stocks, gold, silver, or crypto, Christmas is coming, and not just because it’s December.

Why Deficits Fuel the Stock Market.

When we talk about gross domestic product (GDP), we define it as the sum of all goods and services produced within a nation’s borders. Lord Keynes mathematically defined GDP through the demand side. His famous formula is this:

GDP = C + I + G + (X - M)

The “C” stands for consumption, which is 70% of this total. That’s higher for America than any other nation. Consumption is simply what consumers like you and me spend. The “I” stands for investment, and that’s what businesses spend. The “G” is government spending. The X minus M is export income minus import spending, or the trade balance, which Trump is hellbent on fixing, as it’s negative.

You may already understand why economists of the Austrian School dislike this GDP definition. It doesn’t measure output; it measures spending. So when a government spends like a drunken sailor in our Clown World, GDP goes up, as if feckless government spending is a good thing.

And when GDP increases, the market feels a false sense of security about economic growth.

Since this is the biggest deficit in history, GDP should fly up, and that spending will make its way into the markets.

My Blunders.

You may recall when the FOMC cut 50 basis points in September, I panicked and sold everything, only to return to the markets a few weeks later.

That was a mistake and a costly one at that.

One of my holdings was Palantir (PLTR), which just took off. I only held 1,000 shares then, but PLTR has rallied $40 since I sold. Yes, your math is correct: It’s a $40,000 error (so far). It’s no wonder traders often call their mistakes “tuition,” as they cost as much as a semester in college.

Good friend and colleague Chris Campbell just wrote this about PLTR for our Mastermind Group:

In short, Palantir isn’t competing.

It’s creating the infrastructure on which the entire future of automated governance, corporate efficiency, and global decision-making might run.

Sure, from the outside looking in, the valuation seems insane.

BUT…

Palantir isn’t just another tech company. It’s the only company solving the problem of data governance at scale.

I still really like the stock, especially in this environment. I made a mistake; I shouldn’t have sold it.

But the good news—and I think it’ll pay off imminently—is that I reinvested those funds into gold and silver miners. I think they’ll take off as gold and silver prices will continue to go up as government spending sets off the next round of inflation.

Let me show you some evidence.

Prepare For The Melt-Up.

I love the gold and silver charts. But it’s not just me. Some excellent market participants adore them, as well.

@NorthstarCharts posted this chart, showing silver’s price action, on X on December 8th:

His target is in the $46 area.

@TaviCosta expands the silver chart to show a 45-year cup and handle formation:

William J. O’Neill, founder of Investor’s Business Daily, loved this pattern. Once the high on the left side of the handle is retaken, usually it’s off to the races.

In short, silver should go far above $50 if it breaks that level, according to this chart.

All-Star Charts’ JC Parets just posted this chart, showing the coming breakout of silver miners:

Summing up those three charts, silver’s price is increasing, but silver mining stock prices are increasing faster.

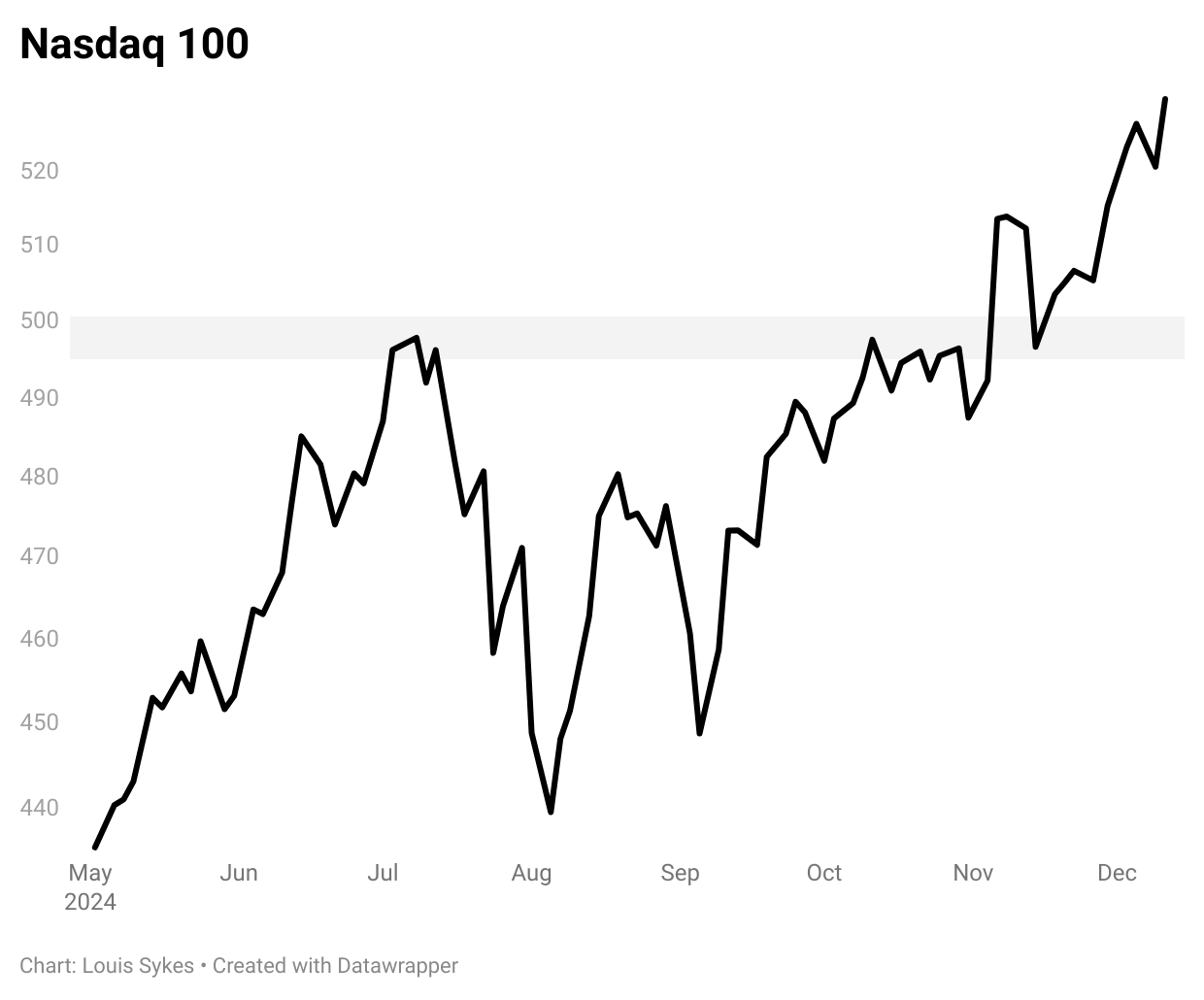

ASC Crypto Daily’s Louis Sykes sent out this chart this morning:

Now, that’s an index in an uptrend if I ever saw one.

Sykes further commented, “If stocks keep working higher in the coming sessions, that could be all the pressure Bitcoin needs to decisively break its 100k resistance zone.”

Here’s Bitcoin’s weekly chart:

If Bitcoin continues to act like a tech play, Sykes will be proven correct.

Wrap Up

Deficits are a disgrace. They rob the young (and poor) and give to the old (and rich). It’s a pox on our way of life.

However, you'd be irresponsible if you didn’t take advantage of it. So get involved, if you haven’t already.

Pick your position: stocks, gold, silver, or crypto. Just stay away from bonds. Bonds and inflation don’t mix so well.

Have a great day!