Posted August 29, 2023

By Sean Ring

China’s Economic Death is Greatly Exaggerated

- Is China’s economy hurting?

- Are China’s demographics dire?

- Is China’s economy about to crash and burn? Stop it.

Good morning from a brisk autumnal Asti!

I love this time of year as it quickly cools down after summer. It makes me want to study more. I feel like I’m going back to school, though I’m nearing 50. What's great about it is that cool air stimulates the intellect and makes you want to analyze things.

Luckily, my good friend, Hong Kong H, sent me an amazing piece of research by Louis-Vincent Gave.

Gave is the head of Gavekal, an excellent analytics company. He opened this article beyond his paywall to show everyone that the death of China’s economy is greatly exaggerated.

I will summarize his excellent research for you in this article and show you the Chinese economy is not in its death throes.

But First, My Assumptions

By printing this, I don’t mean to say China is problem-free.

I believe we won’t know the extent to which the One Child Policy has damaged China for many years yet.

I also believe quasi-famous demographers, who I won’t name, make wild claims to snag highly paid speeches. Their claims are “unfalsifiable,” meaning I can’t prove their models false, but they can’t prove them true, either.

I also believe we don’t know how much Chinese Communist Party (CCP) control of companies damages their innovation. (They are inventing a lot of cool stuff lately.)

We also don’t know precisely how the CCP intervenes in the Chinese markets.

I wanted to get that out of the way before you think I’m cheering for the CCP.

The Banks

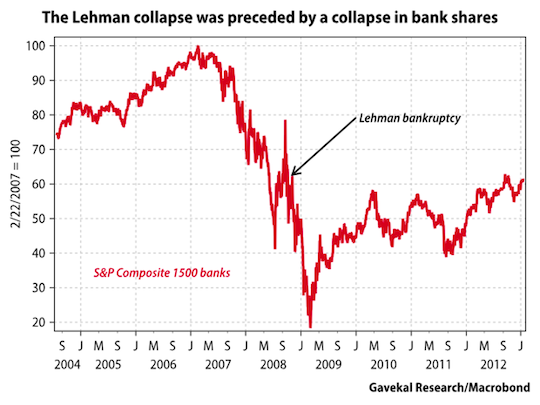

Gave writes, “At Gavekal, we look at bank shares as leading indicators of financial trouble. When we see bank shares break out to new lows, it is usually a signal that investors should head for the exit as quickly as possible.”

Note the S&P Composite 1,500 banks’ performance before and after the Lehman collapse:

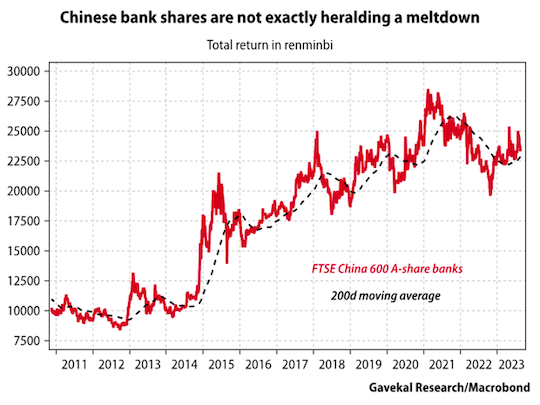

Now look at what Chinese bank shares are doing:

These charts are not the same.

How about over the past year?

Yikes! The SPX banks’ performance is horrific.

Chinese Equities

Let’s look at the Shanghai Composite, China’s big stock index:

Ok, this isn’t the best-looking chart in the world. In fact, I remember moving to Hong Kong in 2015, right at the start of the insane 3,000-point move upward. After that, the deluge.

The Chinese stock market still hasn’t recovered.

But is this, in and of itself, heralding a massive crash? Nope.

Commodities

Here’s one place where I disagree with Monsieur Gave.

He rightly asks, “If China is imploding, why isn’t this reflected in commodity prices?”

Look at this chart:

Since the US Fed has printed so many dollars willy-nilly, the commodity price inflation may have overcome weaker Chinese demand.

I can’t prove that’s the case right now; it’s just a first-glance thought.

FX

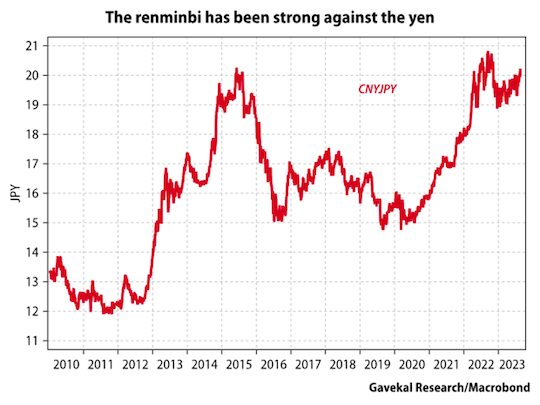

While the Chinese yuan is weaker against the US dollar, it’s performed well against its main competitors, the Japanese yen and the South Korean won.

I checked Gave on the JPY and KRW, and he’s correct.

Since January 2012, the CNY is only slightly up against the KRW. But against the JPY, it’s up nearly 67%.

Chinese Consumption

The Chinese consumer is keeping up.

Gave notes that Macau’s tourism arrivals are nearly back to pre-pandemic levels. He also shows that car sales are relatively strong.

Finally, Alibaba had its strongest first-quarter results on record.

None of those facts suggest an imminent financial crisis or market meltdown.

Chinese Bonds Vs. US Bonds

Ok, fasten your seatbelt for this one:

Are Chinese bonds proving to be safer investments than US Treasury bonds?

As we’ve seen 60/40 portfolios get crushed, we probably assumed everyone else’s bond markets must have also gone down the tubes.

But that’s simply not the case.

Someone somewhere is thrilled to put their money in the hands of the Chinese government.

And why wouldn’t they be?

From Gave:

Staying on the US treasury market, it is also odd how Chinese government bonds have outperformed US treasuries so massively over the past few years. Having gone through a fair number of emerging market crises, I can say with my hand on my heart that I have never before seen the government bonds of an emerging market in crisis outperform US treasuries. Yet since the start of Covid, long-dated Chinese government bonds have outperformed long-dated US treasuries by 35.3%.

That’s just staggering.

Gave sums it up this way:

- There is a sizable problem in the Chinese real estate sector, and companies are going bust.

- Amazingly, however, Chinese banks seem to be weathering the storm, at least for now.

- The Chinese consumer continues to consume, even if not with the same gusto as in the years before Covid.

- Chinese equities have been disappointing, but Chinese equity markets are not in the kind of full-blown meltdown one might expect, given the apocalyptic tone of reporting in the financial media.

- Commodity markets do not seem all that bothered by the implosion in Chinese real estate.

- Government bond yields in China remain stable and have not broken down to new lows.

- US treasuries continue to melt down, even as returns on Chinese government bonds remain steady.

- The Chinese high-yield corporate debt market remains completely dislocated.

So Why the Alarm Bells?

The apocryphal quote “Accuse your enemies of that which you are doing” comes to mind here.

We know the US economy is in trouble, and the Media Industrial Complex has been mobilized to play that down in favor of a Chinese economic catastrophe.

But the numbers just don’t bear out.

I’m not saying the Chinese economy is perfect, and neither is Monsieur Gave, but it’s certainly not going to fall apart tomorrow.

Wrap Up

Gave writes this towards the end of this paper:

This brings me to what should be the big story of the summer: the meltdown in US treasuries. Here is the biggest market in the world, the bedrock of the global financial system, falling by close to double digits in a month. And perhaps most amazing, this meltdown is occurring on limited news. There have been no Federal Reserve policy changes, no hawkish speeches from Jerome Powell. Basically, long-dated US treasuries just fell -9% on no news.

This should be the news. Instead, the news is all about China’s financial meltdown.

My initial reaction to this odd combination of terrible Chinese news with rising US treasury yields was to think: “This is odd. Why are US treasury yields rising when the Chinese news is so bad?”

Then it struck me that perhaps I had things the wrong way around and that I ought to be asking: “Is the Chinese news so bad precisely because US treasuries are melting down?”

Now that’s a good question.

Have a great day.

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring

Dollar Detonation

Posted January 26, 2026

By Sean Ring

Bored of Peace?

Posted January 23, 2026

By Sean Ring

NUUK TRUMP TOWER!

Posted January 22, 2026

By Sean Ring