Posted September 12, 2023

By Sean Ring

Checking in on the Small Caps

Good morning from a cooly temperate Northern Italy.

The leaves are turning, and this morning’s temperature is only 20C (68F). It’s simply perfect for this time of year.

While myriad political shenanigans are going on, I thought I’d turn my attention to the stock market. That’s where positions are moving around, and it seems folks are getting a bit bearish.

In this edition of the Rude, I’ll remind you why I said, “Watch the Russell.” I’ll also update you, show you how investors are positioning themselves, and what this may mean for the future.

Why We’re Watching the Russell

I’ll review quickly what I wrote on August 31st via bullet points.

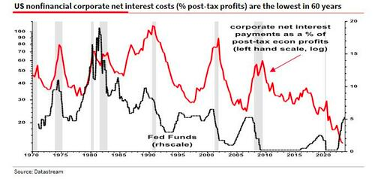

- Societe Generale’s research team noticed corporate net interest costs as a percentage of post-tax profits were at their lowest in 60 years. That’s not supposed to happen when you’re hiking rates like Jay Powell was.

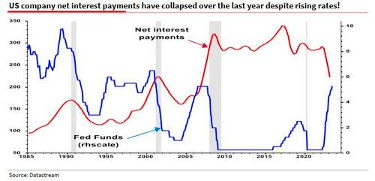

- Double-checking their work, SocGen confirmed corporate net interest payments collapsed despite the quickly and steeply hiked rates.

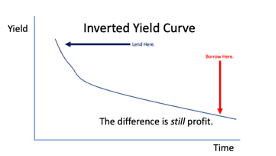

- SocGen theorized large companies with access to the debt capital markets played the inverted yield curve in reverse. That is, they borrowed long (cheaply) and lent short to the money markets (at a much higher rate), creating a profit.

- So, the largest US companies (the S&P 150, as we’ll call them) are immune to interest rate hikes. The remaining 1,350 of the S&P 1,500 are not.

- Therefore, we need to watch the small caps (the Russell 2000) for the first signs of a downturn.

All the above images are courtesy of Zero Hedge.

What’s Happening Right Now

Before I get into the IWM (Russell 2000 ETF) chart itself, this popped up on The Chart Report:

Credit: The Chart Report

The X axis is in years, and the Y axis is in percentage. Right now, the Russell is in the midst of a two-year collapse versus the SPX.

If anything, this looks to continue, though you can argue this may be the bottom. Either way, the Russell looks weak for now.

How Investors Are Positioning Themselves

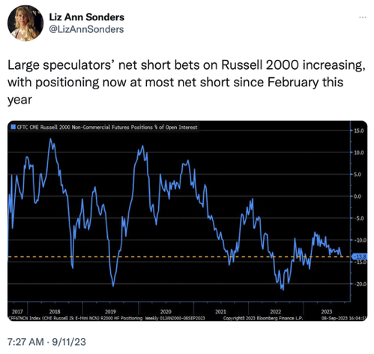

Liz Ann Sonders then posted this:

Credit: The Chart Report

Speculators are shorting the Russell 2000. This is what happened in February, the last time speculators were this short:

Then, the Russell fell from 198 to 170. From the current price of 184, that would imply a fall to 157. We haven’t seen that level since the Covid collapse and recovery. My guess is that we’d get to 162, the two-year low, before either recovering or collapsing further.

What’s Next

Here’s the current weekly IWM chart:

It’s not terrible, to be sure. Nor is there any sign of imminent collapse.

Here’s the daily IWM chart:

Here, we can see a head and shoulders pattern fully formed, but that doesn’t guarantee a further down move.

However, if the IWM price moves below the 200-day moving average (the red line) and the 50-day moving average (the blue line) follows it, we’ll see a big move down.

Right now, the MA lines are reasonably flat, so it’d be no surprise if they rolled over.

Albert Edwards, SocGen’s guru, wrote the following:

In fact, contrary to what the mega-cap valuations suggest, smaller companies remain the beating heart of the US economy – maybe, the SocGen bear notes snarkily if correctly, "the mega-caps are more like vampires sucking the lifeblood out of other companies."

To summarize, while the top 10% of companies are benefiting from higher rates in the form of cash interest income greater than debt interest expense, at the same time, the lights are going out all over the US smaller-cap corporate sector. Unlike their far bigger peers, "they weren’t able to lock into long-term loans at almost zero interest rates and pile it high in the money markets at variable rates."

Ultimately, Edwards concludes, "the pain for US small- and mid-cap companies will trigger the recession most economists are now giving up on, and hey, guess what? I think we’ll soon find out that even the large- and mega-cap stocks might not be immune to the indirect recessionary impact of higher interest rates after all.”

What I’m worried about are the bankruptcies.

In August, commercial Chapter 11 filings increased 54% over last year. Total filings were up 18%.

And those aren’t big companies declaring.

Wrap Up

No, it’s not time to panic.

But reviewing what’s going on in the small caps is good.

The Russell 2000 is the canary in the stock market coal mine.

We’ll continue to watch.

Have a great day!

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring