Posted September 26, 2024

By Byron King

Byron’s Mailbag: Steel and Silver

Let’s review comments from readers on two of my recent articles in the Rude Awakening. These concern the discussion about the proposed merger of Japan’s Nippon Steel with U.S. Steel and an article about silver and silver mining.

I appreciate your taking the time to reply, and I value your feedback. Definitely, it helps me to clarify my own thinking. Here you go:

Re: I’m Not Turning Japanese, Sept. 13, 2024:

Mark in San Diego wrote: “Great article re Nippon-U.S. Steel. Election politics and the political season make the worst time for important business decisions. The outcomes are based on short, dumb sound bites. Note that the Biden administration just deferred making the government call on the steel tie-up until after the election. Maybe there is some sanity in Washington, D.C.”

Anne in Chicago wrote, “I used to work for U.S. Steel, selling sheet coils to appliance companies and automakers. People take for granted that smooth, high-quality surface to their steel, but there’s much advanced metallurgy and engineering involved. Sad to say, my former employer has fallen behind the times. U.S. Steel needs new investment, which Nippon Steel offers. It’s ‘take the deal’ or watch U.S. Steel fade away.”

Thank you Mark and Anne; we could discuss the steel biz all day. But in the Rude Awakening, we try just to offer some word-limited thoughts at sunrise, enough to kick-start the day for our wonderful readers.

Meanwhile, our investment and money-culture is focused on tech-tech-tech, with companies like Google and Nvidia pushing the $3 trillion line, while old stalwarts like steelmakers are lost in the mist. And yet, steel is important, and America’s strategic-level steel saga is nowhere near over.

We must wait and see what happens with U.S. Steel and the proposed Nippon buyout. Per Mark’s note, in the past couple of days the Biden administration booted the steel can down the road, until after the election. I hope it means that sober heads are looking at the big problems, and I’m sure that there’s much politicking behind the scenes.

Meanwhile, Cleveland Cliffs says that it’s willing to buy many U.S. Steel assets if the latter company wants to sell. That would likely raise antitrust issues, based on Cliffs dominating the blast furnace side of steelmaking. But blast furnaces are a fading technology; as in, the future belongs to DRI – “direct reduced iron,” which uses natural gas. (I’ll have much more on that in future articles.) And meanwhile, the U.S. is way behind the rest of the world in just that side of the business, making basic pig iron, despite the country’s ample gas resources.

U.S. Steel blast furnace at Gary, Indiana Works.

U.S. Steel blast furnace at Gary, Indiana Works.

Alas, the American steel sector has been under-invested for many years. Massive levels of foreign dumping haven’t helped.

Magic metallurgy: Chinese steel becomes “Canadian.”

Magic metallurgy: Chinese steel becomes “Canadian.”

Along these lines, I recall a few years back when I visited a port facility near Vancouver, British Columbia. I saw coils of steel being unloaded from a ship that hauled the cargo from China, complete with Chinese characters stenciled on the metal. And along came a Canadian guy in a hardhat, to spray-paint over the Chinese characters. Then, that steel was off on a truck, headed down into the U.S. tariff-free under the old North American Free Trade Agreement (NAFTA).

In other words, per NAFTA, the Canadian unloading crews and spray-paint represented enough so-called “Canadian content” to turn Chinese steel into Canadian steel, and thus beat U.S. import restrictions. Such alchemy! Magic metallurgy, courtesy of a can of spray paint!

Right now in the U.S., it’s more than fair to say that basic industries like steel require immense levels of new capital. But where is the money? Well, there’s always Santa Claus or the Tooth Fairy. More realistically, think in terms of tariffs and tax breaks. But one way or another, a major reorganization is coming to domestic steel, with downstream implications for the country.

Re: America’s Financial Tombstone, Sept 5, 2024:

From Peter in New Jersey: “Nice article. Another chapter in how the West was won. Although the part about all the (Tombstone, Arizona) souvenirs being made in China hurt. A collector of moderate wealth could acquire most of the Morgan Dollars from 1878 to 1904 and 1921 in uncirculated condition. There are only a few key dates and mint marks like 1893 S that are unaffordable except to a very serious collector. However, the dollars minted before the Morgan are very expensive, even the circulated ones. Just goes to show you the volume of silver that came out of the mines in that time period.

“Oh, and about the U.S. debt. It’s not the size that bothers me but its purpose. We are not borrowing money to buy productive assets but squandering it on transfer payments and endless wars. I think that point needs to be emphasized. What happens when we produce nothing, and no one wants to lend us money? Just print it?”

Thank you, Peter. That Tombstone visit was definitely eye-opening. Probably like many others, I long thought of the place in terms of the iconic “Shootout at the O.K. Corral.”

Welcome to Tombstone: “Gunfights Daily.” BWK photo.

Welcome to Tombstone: “Gunfights Daily.” BWK photo.

I didn’t realize the amount and value of silver in the rocks beneath the place, nor the history, particularly how an old Army scout found so much mineralization while chasing and eluding Apache.

As I mentioned in the article, Tombstone was one of the most significant U.S. silver deposits ever discovered and mined. It ranks up there with the silver of the Comstock Lode of Nevada, circa 1860s and onwards; Butte, Montana, circa 1870s and onwards; and Idaho, again 1870s and onwards. (Not to neglect other silver districts such as Colorado and even Missouri.)

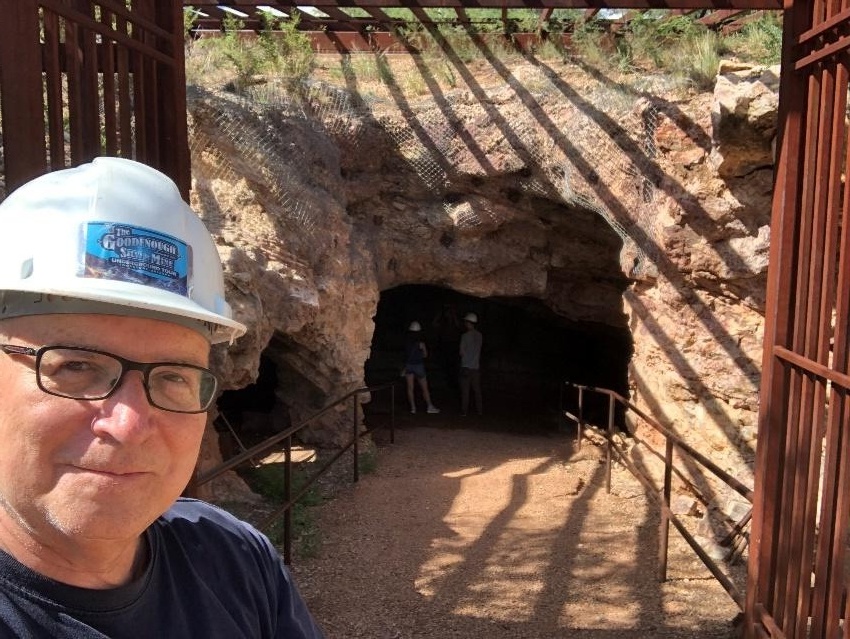

Your editor at the mouth of the Goodenough Mine. BWK photo.

Your editor at the mouth of the Goodenough Mine. BWK photo.

Beyond mining, we could talk all day about the fundamental nature of U.S. money going back to the Whiskey Rebellion of 1791 – 94. It was triggered by a federal tax on the property of people who lacked ability to pay; that is, simple coinage was scarce, especially among settlers out on the western frontier, beyond the Allegheny Mountains. The government sent tax collectors, but the people had nothing with which to pay the levy, and so they rebelled.

That Whiskey Rebellion directly led the new U.S. federal government to establish the country’s first mint at Philadelphia, per the Coinage Act of 1792. Later, in 1835 under populist President Andrew Jackson, the U.S. government set up a mint in Charlotte, North Carolina to produce coins from the output of America’s first gold rush in the western Piedmont.

Then in 1838 came the New Orleans Mint, established to produce currency from silver that flowed into the Big Easy in payment for cotton, pre-Civil War.

As I discussed in the Tombstone article, by the 1880s that same New Orleans Mint had its own freight service on the Texas-Pacific Railroad, for ingots of silver that had been mined out from the 2,000 miles of tunnels beneath Tombstone.

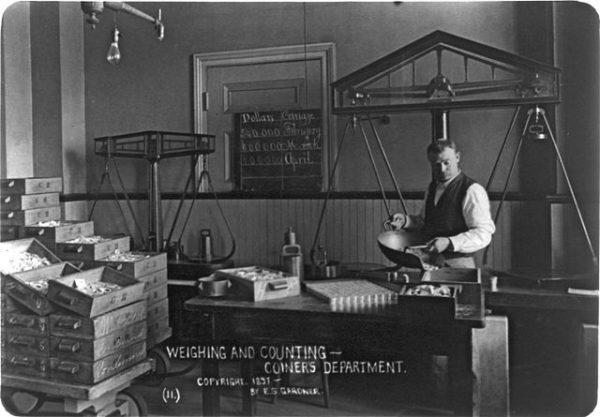

Weighing and counting silver at New Orleans Mint. Courtesy U.S. National Archives.

Weighing and counting silver at New Orleans Mint. Courtesy U.S. National Archives.

As the U.S. economy evolved between the 1870s and early 1900s, the country’s silver industry was the literal and figurative bedrock of the “bimetalism” debate over American monetary policy. Should U.S. currency be only gold-based? Or should the nation’s currency be gold and silver? Recall the old saying, that “gold is the rich man’s money; silver is the peoples’ currency.”

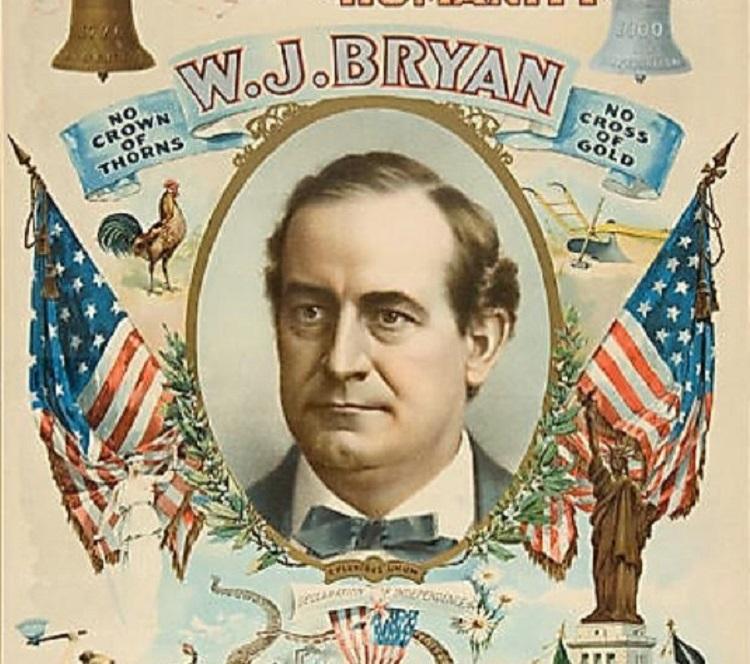

And this long, fascinating tale of exploration, development, industry and national policy brings us to that famous quote from William Jennings Bryan in 1896; that “You shall not crucify mankind upon a cross of gold.” He was talking about U.S. currency and monetary policy, meaning gold versus silver coinage, not making a religious point.

William Jennings Bryan (1860 – 1920). Courtesy Library of Congress.

William Jennings Bryan (1860 – 1920). Courtesy Library of Congress.

Then in 1913, along came the U.S. Federal Reserve, a private bank established by the U.S. government with a mandate to issue a so-called “elastic” currency. And the rest… is history, but not here, not just now.

And yes, Peter, I feel the pain about U.S. debt, and all that money spent down the tubes on transfer payments and wars. For all those trillions of dollars in national debt piled up over the past four decades, where’s the long-term investment in the guts of the country?

Right now, the U.S. monetary outlook appears ruinous. So what shall we do? Invest wisely, of course. And definitely, own gold and silver!

Okay, and with that, I’ll stop here except to thank you for subscribing and reading and to express my appreciation for your kind and thoughtful notes.

Oil Off The Boil

Posted December 24, 2025

By Sean Ring

Gold Bars, Up Bars, and FUBAR

Posted December 23, 2025

By Sean Ring

EX-SQUEEZE ME!

Posted December 22, 2025

By Sean Ring

Swamp, Brains, and the Game

Posted December 19, 2025

By Sean Ring

WTI…WTF?

Posted December 18, 2025

By Sean Ring