Posted June 10, 2022

By Sean Ring

Buckle Up For The Ride Down

- Remember when they told you inflation was transitory?

- It seems like ages ago, and theyre hoping youll forget by the midterms.

- If theres no recovery before then, itll be a Red Tsunami.

Yesterday

Before we got smacked yesterday, I thought we might be in the middle of a mini-accumulation structure (the blue lines).Though Im long-term bearish, I expected the SPX to spring upwards out of that coil.Instead, we had a big down day (blue arrow).

This doesnt mean we cant go up from here.

But the probability of doing so soon is diminished.

JC Parets said you couldnt be short when the SPX is above 4,100.

Its no longer above 4,100.

In fact, its 2% below that level.

Be that as it may, I still point to the fact that recent down days are bigger percentage-wise than up days.

Thats not a good sign.

Worse, the index was green for the morning and then fell off a cliff in the afternoon, with no recovery.

As I write, most Asian and European markets are down pretty hard today. Not a great way to end the week.

Yields and the Dollar

So what happened?

The 10-year yield moved up, remaining above 3.00%.

As Joke Biden gave Powell the political cover he needs to keep increasing rates, Mr. Market may feel Powell will go through with his hawkish hiking far beyond 2.50%.

Right now, the upper bound of the Fed Funds target band is 1.00%.

I like to remind people that moving from 1.00% to 2.5% isnt a 1.5% move.

Powell would be increasing rates 2.5 times.

And that will hurt weak companies used to operating practically interest-free.

This led to the USD surging yesterday.

As USD rates increase, USD deposits are more attractive.

So, foreign investors tend to move their weaker currencies into USD.

As a side note, even though I live in Italy, I keep no savings in EUR.

I move money over when I need to pay for things. Thats all.

Now, think of it this way:

- If your assets are priced in dollars,

- And the dollar increases in value thanks to higher interest rates,

- You need fewer dollars to buy those assets.

- So, dollar-denominated assets fall in price.

Energy Hits Consumers Hard

Let me show you some hard evidence: as the stuff you need (energy) gets more expensive, you spend less on the things you want (consumer discretionary).This is 2022 year-to-date: This is another great chart from the Chart Report:

This is another great chart from the Chart Report: Did you see how well Exxon is doing out of Bidens policies?

Did you see how well Exxon is doing out of Bidens policies? And how about this peach of a headline from the WSJ?

And how about this peach of a headline from the WSJ?Wrap Up

Usually, I like my Friday Rudes to be a bit lighter.But since it couldnt be light, I kept it short.Yesterdays moves made me sit up.My long-term downside target for the SPX remains 3,413.Again, the market may rebound in the coming days, but Im not sure it will.Smarter people than I are looking for a rally here, but Im not optimistic about that.Lets see how the market performs today, and Ill update you on Monday.Until then, grab a lovely glass of something cheerful tonight and enjoy your weekend.You earned it!All the best,Sean

Swamp Thing

Posted December 11, 2025

By Sean Ring

A Sliver of Silver

Posted December 10, 2025

By Sean Ring

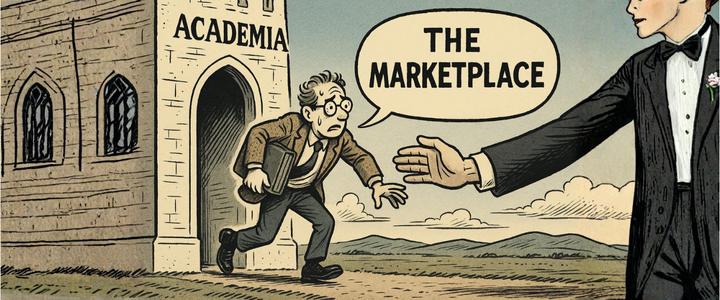

The Public Service of Pushing Brains Into Industry

Posted December 09, 2025

By Sean Ring

Did America Just Lose The Great Game?

Posted December 08, 2025

By Sean Ring

L'oro dell'Italia

Posted December 05, 2025

By Sean Ring