Posted April 16, 2025

By Sean Ring

BREAKING: Gold Tops $3,300 Overnight

Whenever I get an early WhatsApp message from my good friend and Hong Kong hedge fund manager, H, I know it’s good news.

His message was this:

The US has told other countries to go f*ck themselves with these tariffs. Even countries with a trade deficit with the US.

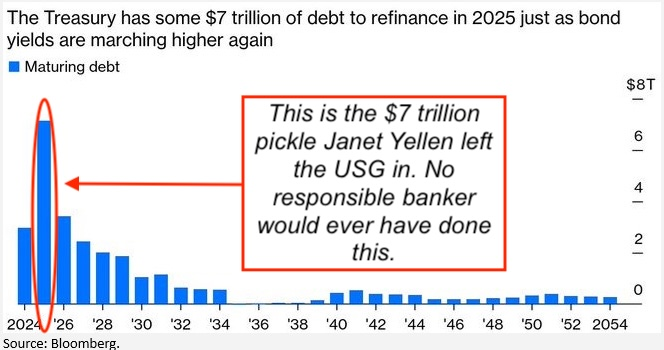

There is $7 trillion in debt that needs to find a buyer this year.

I don’t see how these other countries are going to trip over themselves to buy now.

Gold is smelling this.

I immediately went to my Trading View app and saw this:

Over $3,300! Already! Wow… so much for a respite.

Gold is the one asset flashing a giant red flag about the future of the U.S. economy, fiscal policy, and the dollar itself.

Gold’s steady march upward isn’t just about inflation. It’s about trust—or rather, the lack of it. And this time, the message it’s sending ties directly to a much bigger problem: the U.S. government has to refinance a staggering $7 trillion in Treasury debt this year. (I posted this chart the other day.)

Credit: GoldBroker

That’s not new debt. That’s existing debt, coming due. Uncle Sam has to roll it over. And that’s on top of the new deficits piling up from tax cuts, tariffs, stimulus programs, and good old-fashioned spending.

Typically, the Treasury just auctions off new bonds, and investors snap them up. But this year, things aren’t so simple.

“Can Anyone Spot Me $7 Trillion?”

Let’s start by defining the key players.

Primary dealers are large banks and broker-dealers—Goldman Sachs, JP Morgan, and Barclays—obligated to buy U.S. government debt directly at auction. They’re the first line of demand, mandated by the Federal Reserve Bank of New York. But they’re not altruists. They don’t hold this debt forever. They want to flip it to investors, fast.

But what happens when those investors—both foreign and domestic—start walking away?

Let’s examine who is supposed to buy U.S. debt and what could happen if they don’t.

Primary dealers attend every auction because they must. But if they can’t sell the debt downstream to pensions, insurers, hedge funds, or foreigners, it stays on their balance sheets. That’s a problem. The more inventory they hold, the more risk they bear. And they’ll demand higher yields next time to make it worth their while. That pushes rates up.

U.S. banks and money market funds are next. With T-bills yielding over 5%, short-term debt is attractive. Money market funds, in particular, are shifting from the Fed’s reverse repo facility into Treasuries. But these buyers want short maturities. They’re not interested in locking in today’s rates for 10 or 30 years. That still leaves a significant gap in the long end of the curve.

Pension funds and insurance companies are natural long-duration buyers. They need assets to match their long-term liabilities. But they’re price-sensitive. They won’t buy unless yields on 10- or 30-year Treasuries rise to 4.5% or more. That again implies higher borrowing costs for the U.S.

The Federal Reserve is the backstop nobody wants to talk about. If demand dries up and auctions fail—even quietly—the Fed must step in, not with full-blown QE, but with something that smells like it: stealth monetization. This means expanding the balance sheet again, which means creating new dollars, which means inflation risk, which means gold gets another tailwind.

A growing cohort of retail investors (the "T-bill and chill" crowd) is scooping up short-term Treasuries via brokerage platforms or ETFs. They like the safety and yield. But they’re not stepping in to buy trillions in long-term debt—they’re just a sideshow.

Now layer in the geopolitics.

Foreign buyers are pulling back. China, Japan, and Europe aren’t showing up like they used to—not just because of yields but also because of politics. Trump’s policies have alienated many traditional buyers, and no one wants to hold dollar reserves that can be weaponized.

This brings us back to gold.

Why is Gold Rallying Again?

It’s not just about inflation or dollar weakness. It’s about trust in the system itself. And the fear that if investors don’t show up to fund U.S. deficits, the Fed will have to.

Gold thrives when people fear central banks are printing money to paper over deficits. If the Fed has to start monetizing debt to keep yields down, it’s the ultimate green light for gold.

Trump’s return to the political stage comes with promises of tariffs, spending, and tax cuts. All of these mean bigger deficits. There’s little sign of fiscal discipline. Markets notice. Gold rises.

Issuing massive new debt while cutting taxes and increasing spending is the recipe for currency devaluation. You can’t inflate your way out of debt without weakening the currency, which is bullish for gold.

China and Russia have been buying gold as an alternative to dollars. Central bank gold buying hit record highs last year and is continuing. It’s not speculative; it’s strategic.

If inflation remains sticky and nominal yields can’t rise much further without crashing the economy, real yields (nominal rate minus inflation) may start falling. That’s the sweet spot for gold.

Wrap Up

We’re watching a slow-motion collision between fiscal reality and monetary policy. The U.S. can’t stop borrowing. But investors are demanding higher yields. If the Fed steps in, we get stealth QE. If the Fed steps back, we get a debt spiral.

In both cases, gold wins.

Think of gold as the ultimate get-out-of-jail-free card—not for the government, but for investors. When trust in bonds, currencies, and central banks starts to fray, gold is where capital runs for shelter.

If you're wondering why gold is hitting new highs even without a market panic, this is it. It's not about fear of the moment. It’s about preparing for the policy response to the next crisis.

Because at some point, the math breaks. And when it does, the printing press fires back up. Gold knows that. And it's moving ahead of the herd.

And if it gets too much for Trump, will he revalue gold? Ah, it’s too much to hope for… for now.

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring