Posted May 01, 2025

By Sean Ring

Black Gold, Black Death

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

Yes, gold finished at another all-time monthly high. I’m thrilled.

But what in Sam Hill is going on with oil?

I simply don’t understand how we can have two hot wars happening simultaneously, a trade war between the world’s two biggest superpowers, and a weak—and getting weaker—dollar, with oil falling out of bed, staring at a $40 price target.

Something must be wrong. My advice is to follow my colleague, Dan Amoss, who is the hardest-working man in the newsletter business, as featured in StrategicIntelligence, among other publications. Dan’s supply chain research is second to none. One possible explanation for oil crashing is that the “Ghost of Empty Shelves Biden” has returned to haunt us. Dan’s coverage will help you make great trades to profit from this.

In other news, silver is sluggish. If gold doesn’t pull it up, we can see trouble there.

As for equities, stop watching network news. Those clowns were comparing April to the Great Depression. Equities only finished down just over 1%, hardly a cause for alarm.

Bitcoin has recovered somewhat, as well, but Ether is still a leper in the crypto space.

Let’s get a closer look at the charts.

S&P 500

Last month’s downside target was 4,896, and we hit it rather quickly.

But with this recent rally, we may be making our way back to the highs. I think it’s a sucker’s rally, though, and that it’s likelier we’re heading back down soon. If up, then look to returning to the recent highs of 6,100+. If down, the target is 4,700.

It depends on what comes out of the White House on any given day.

Nasdaq Composite

The target levels for last month were in the 15,750/15,250 area. We hit that area quickly.

Our new upside target is 20,830. But if we head down, 12,500. Yikes!

Russell 2000 (Small caps)

Last month’s downside target was 163.43, which we didn’t hit. The new upside target is 222.50.

If we head back down, look for 160.

The US 10-Year Yield

Secretary Bessent almost got his sub-4.00% yield. Up and down, up and down. The market wrestles with the Treasury Secretary.

This should also pressure the dollar downward.

Dollar Index

Though the dollar was routed, commodities didn’t benefit as much as you’d think.

But our new downside target is 86.50. If that gets hit, who knows how high gold and silver will leap?

USG Bonds

After taking a hit in the first week of the month, TLT recovered half of the losses over the following half.

Investment Grade Bonds

Again, we lost a point in the investment-grade space. LQD still has a ridiculous upside target, but I think the machine is wrong.

High Yield Bonds

Ever so slightly rolling over. But no big story, nor targets, here in the junk space.

Real Estate

We fell about a point, but first got below 77. So the 76 target was nearly hit. Now we’ve got an upside target of 98.88. But I’m not sure I trust it. Back down to at least 76 seems much likelier to me.

Energy: West Texas Intermediate (Oil)

There must be something wrong with the global economy if we’ve got a hot war, a dying dollar, and a trade war going on… but oil is trading at $58 a barrel. This must be what’s keeping inflation in check.

Base Metals: Copper

After taking this recent hit, we’re looking at a $3.90 target. The rally seems finished.

Precious Metals: Gold

***NEW MONTHLY CLOSING HIGH OF 3,281.01***

The last two weeks, gold took a breather. But this chart still looks healthy and robust. The next target is 3,611.

Precious Metals: Silver

We need a big move up in silver. It’s been dawdling, thanks to Mr. Slammy coming in and monkeyhammering it at 9 am every New York morning.

Technically, we’ve got a downside target now. But I think gold will pull its stubborn little brother up.

Cryptos: Bitcoin

Bitcoin recovered nicely. It may not hit its all-time highs soon, but I now expect more of a recovery.

BTC’s next target is 101,823.

Cryptos: Ether

Though it’s bouncing today, Ether’s chart is awful. Its downside target is 1,639 now. I’d still avoid it like the plague.

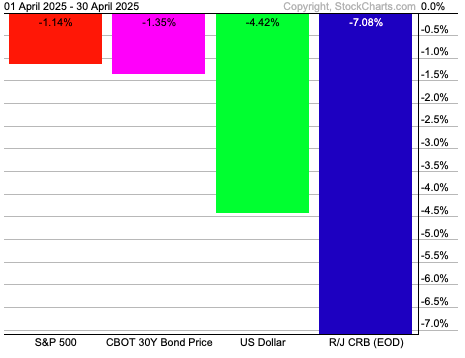

Trad Asset Class Summary

Boy, did we have a wacky month, or what? I can’t remember a time since I’ve printed this report when everything was down.

Commodities were horrendous, down 7.08%. But weirdly, the USD fell 4.42% as well. Usually, we’d see an inverse relationship between the two.

Crypto Class Summary

Monero, the most secretive cryptocurrency, had a great month, increasing by 28.76%. Bitcoin also did well, finishing up over 10%. Ripple was up 2.43%. Dogecoin, Litecoin, and Ethereum were down single digits.

A pretty meh month for the would-be currencies.

Wrap Up

Oil is a disaster, despite a falling dollar. This is the canary in the coal mine for the economy. But an economic downturn will take time to materialize. That means not selling all your equities now, as the market is looking up.

Stay sharp and vigilant, and we’ll be here to help you along the way.

Finally, let us give thanks, courtesy of the X-verse:

Have a great day!

The Massacre of the Innocents

Posted February 02, 2026

By Sean Ring

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring

Trump’s Victory at Sea

Posted January 29, 2026

By Byron King

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring