Posted March 10, 2025

By Sean Ring

Bitcoin’s Wild Weekend!

Boy, has Bitcoin had a rough weekend or what?

From Wall Street’s darling - and the object of The Donald’s sovereign wealth affections - to a mere $80,000 space in a decentralized ledger, Bitcoin exhibits wild price movements at the best of times. But I haven’t seen this kind of volatility since Will Smith slapped Chris Rock at the Oscars.

I know we don’t write much about crypto in the Rude. However, these recent moves are essential tounderstand given the increasing correlation between crypto assets and tech stocks. And whywould that correlation matter? In times of crashes, all correlations go to one.

First, I’ll show you the charts. Next, I’ll explain why this may have happened. Finally, based on the first two, I may suggest a disturbing idea for the rest of the markets.

Let’s get into it.

The Charts

Bitcoin started the year well, after recovering from a December selloff when its price reached $108,244.90. In the new year, BTC rose to a record-breaking intraday high of $109,228.60 on January 20, 2025. We’re now down to $82,308.87, a 24.6% drop from its all-time intraday high.

It’s been downhill from there, culminating this past weekend, when BTC’s price hit $80,048.90. BTC’s new price target is an astonishing $67,261.

Let’s compare Ether next. The market has been bearish since it hit its all-time intraday high of $4,102.92 on December 16, 2024. Now at $2,069.41, that’s a 49.56% drop from its high.

ETH’s new price target is a woeful $1,306.

From a technical perspective, crypto looks lost. What are the underlying reasons for this?

What Gives?

A combination of macroeconomic uncertainty, technical factors, and large-scale transactions led to the sell-off.

Ritchie Valens would be singing “Oh, Donald!” these days. More tariff threats against Mexico, Canada, and China rattled global markets, leading to risk-off sentiment among investors. “Risk-off” means traders take less risk than usual, concentrating more on protecting capital.

They’re as worried about currency wars as my friend and colleague Jim Rickards! This uncertainty spilled over into the crypto markets, prompting profit-taking and more short positions. I’ll discuss this further later.

The “whales” apparently smacked Ether in the mouth. A transaction involving 8,139 ETH ($21.18 million) caused a rapid price drop of 3.2% within 30 minutes. Bitcoin also saw much selling, with $370.52 million in long positions liquidated over the weekend.

Bitcoin's trading volume dropped by 25% from $60 billion in January to $45 billion over the weekend. Similarly, Ethereum's trading volume fell by nearly 27%, from $30 billion to $22 billion. This shows cautious market sentiment.

The crypto market's declines followed those of the S&P 500 and Nasdaq Composite Index, which also fell amid escalating trade tensions. Nearly $1 billion in crypto market cap was wiped out.

Despite this sell-off, some long-term investors saw it as a buying opportunity. This morning (my time), BTC was up over 3% to $83,302.

Now we’ve got the “what,” let’s look at the “why.”

Macroeconomic Uncertainty and Correlation With Other Markets

Let’s discuss economic policy uncertainty in more detail, especially regarding a president with no filter.

Economic policy uncertainty (EPU) often leads to risk-averse investors, as they become concerned about preserving capital. If you’re a fund manager, job number one is the return of capital. Then comes the return on capital.

During heightened EPU, such as The Donald’s trade conflicts or geopolitical tensions like the Russia-Ukraine conflict, investments in high-risk assets like cryptocurrencies decrease. This is counterintuitive, especially for Bitcoin maximalists who see Bitcoin as a safer haven than gold. (This doesn’t appear to be the case.)

Cryptocurrencies are also sensitive to changes in monetary policy. The recent tighter monetary conditions, marked by rising interest rates, have reduced liquidity in financial markets. As a result, investors' appetite for high-risk assets like BTC and ETH, which thrived during periods of loose monetary policy and quantitative easing (QE), has fallen.

With quantitative tightening (QT), we get higher financing costs. For Bitcoin, mining profitability declines due to increased mining rigs and electricity costs. For Ethereum, reduced venture capital - VCs depend on the Fed’s funny money to make more funny money - funding affects the development of decentralized applications on its blockchain.

Rising EPU indirectly spurs concerns about fiat currencies or the broader economy, leading to increased volatility in cryptocurrency markets. During periods of significant uncertainty (e.g., the Scamdemic or geopolitical risks), Bitcoin's volatility increases as investors react unpredictably. Again, theoretically at least, this isn’t supposed to happen.

Macroeconomic uncertainty often triggers liquidity crises in crypto markets. As we saw above, the liquidity of BTC and ETH fell by around 25% each. Investors sold quickly, leading to sharp price declines and further market destabilization.

Here’s the onion: During macroeconomic stress, cryptocurrencies have shown increasing correlation with traditional financial markets, especially tech stocks. The adage “all correlations go to one during crashes” also seems to apply to crypto. Look at this:

Over the last 69 trading days, Bitcoin and the Nasdaq tracked each other nearly one-for-one. This isn’t always the case. But as we’re in turbulent times, it’s certainly worth noting.

Wrap Up

What are the main takeaways from all this? First, crypto is under severe pressure because of Donald Trump's manufacturing trade wars and geopolitical uncertainty, in the name of the art of the deal. Second, far from being a safe haven, crypto has become highly correlated with tech stocks. Third, because of this correlation—remember, it’s not causation—we can look to crypto to see what may be coming ahead.

In short, none of this is good news for equities. This week may get rough again. But on the bright side, gold and silver have held up. Those bets could be coming home safe more than we know.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

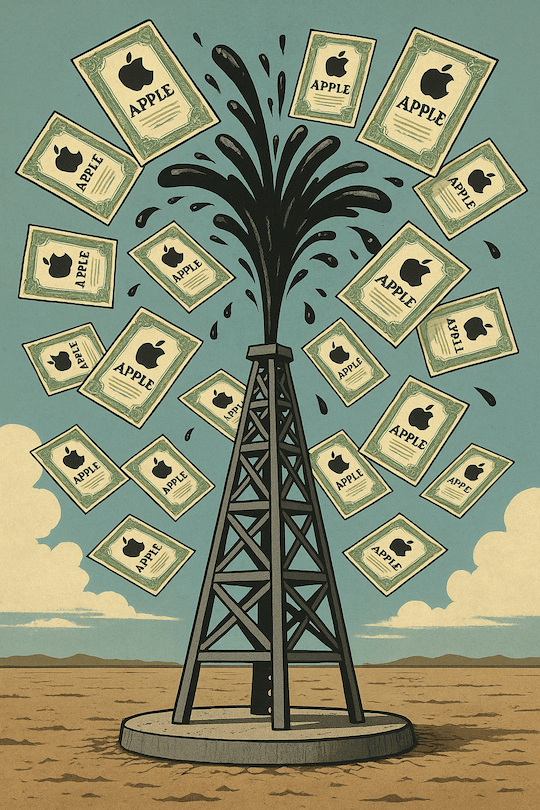

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring